Tech, Media & Telecom

LG’s FAST drive to combat TV set market slowdown

The global free ad-supported streaming TV (FAST) market is forecast to double to $12 billion in five years

By Sep 18, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s electronics giant LG Electronics Inc. is upending its TV business strategy by betting even bigger on software and content to offset a slowdown in the global TV set market.

LG Electronics is set to introduce a new TV business plan during its webOS Partner Summit 2023 this week, which will focus on the annual update of the webOS platform on its smart TVs and the expansion of its regular software upgrade to old models by 2025.

Under the new strategy, it will also upgrade its free streaming service LG Channels by broadening its content library and revamping its user interface (UI) and user experience (UX) designs.

ACCELERATING FAST RACE

With the latest move, the Korean electronics giant will accelerate its penetration in the global free ad-supported television (FAST) market to offset a slowdown in global TV set demand.

FAST services allow users to enjoy Netflix-like TV streaming services without a paid subscription. All they have to do is watch some ads, the main revenue source for FAST services.

Global media and technology companies are upping the ante to take the lead in the FAST market race on expectations of its rapid growth.

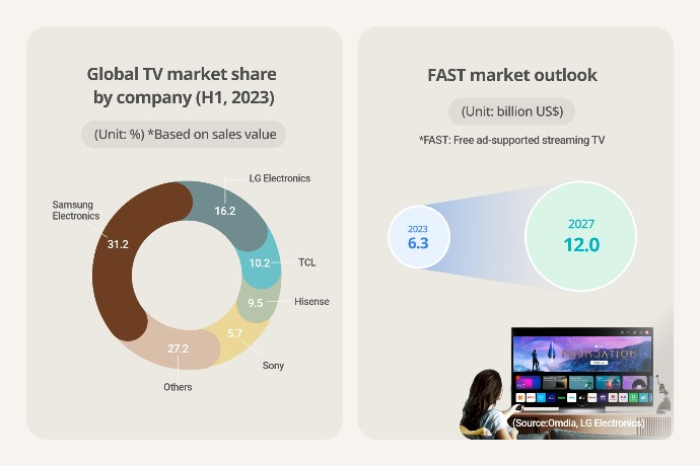

The global FAST market is forecast to grow to $12 billion in 2027 from this year’s $6.3 billion, according to global technology industry tracker Omdia.

LG’s crosstown rival Samsung Electronics Co. operates its own streaming service Samsung TV Plus on its smart TVs. Paramount, Fox and Amazon also own their own FAST services Pluto TV, Tubi and Freevee, respectively.

TO COUNTER TV SET DEMAND SLOWDOWN

While LG Electronics’ regular update of webOS and content could cannibalize its TV sales in the short term, the company expects ad sales through LG Channels to be its next TV business cash cow facing a global slowdown in TV set demand.

Worldwide TV shipments were estimated at 199 million units to date this year, down 1.4% from the same period last year, according to global market intelligence provider TrendForce.

LG Electronics’ global TV market share has been increasingly threatened by the ascent of Chinese rivals with cheaper TV options, while the average TV set replacement demand of seven years is slowing the rate of new TV purchases.

The upcoming overhaul of LG Channels, coupled with the regular webOS update, is expected to boost the number of its worldwide subscribers, which reached 50 million as of March this year, up 78% from June last year, according to the company.

LG Channels was first launched in 2016 in the US and advanced into select European countries in 2019. It is currently available in 27 markets, according to LG Electronics.

In 2021, LG acquired a 56.5% stake in Alphonso for $80 million, which has artificial intelligence-based video analytics capabilities, to accelerate its foray into the TV content platform market.

LG Channels' users can access a wide range of live and on-demand videos including TV shows, movies, news, sports, children’s programs and more regardless of their production companies.

The LG Channels application can be launched on LG TV’s webOS platform.

LG Electronics is hosting the webOS Partner Summit 2023 for two days from Monday to discuss its new TV software strategy with about 300 webOS partners and developers.

The latest move is part of the company's move to transform into a smart life solution company from a traditional appliance company by 2030 with the development of more versatile software and platforms that connect its appliances to operate like smart devices.

To bolster its software development capability, it is operating various software talent grooming programs including Reskilling.

Write to Ik-Hwan Kim at lovepen@hankyung.com

Sookyung Seo edited this article.

More to Read

-

ElectronicsSamsung, LG Electronics top 2 global TV makers in H1

ElectronicsSamsung, LG Electronics top 2 global TV makers in H1Aug 21, 2023 (Gmt+09:00)

2 Min read -

Corporate strategyLG Electronics aims to transform into platform-based tech firm by 2030

Corporate strategyLG Electronics aims to transform into platform-based tech firm by 2030Jul 12, 2023 (Gmt+09:00)

3 Min read -

Tech, Media & TelecomLG to accelerate foray into WebOS TV platform market

Tech, Media & TelecomLG to accelerate foray into WebOS TV platform marketJul 11, 2022 (Gmt+09:00)

3 Min read -

Tech, Media & TelecomLG Electronics enters TV content platform market with its webOS software

Tech, Media & TelecomLG Electronics enters TV content platform market with its webOS softwareFeb 24, 2021 (Gmt+09:00)

2 Min read

Comment 0

LOG IN