Steel

Hyundai Steel sells over 1 mn tons of auto steel to non-captive customers

The steelmaker has been reducing its reliance on affiliates to become a global top three auto steel supplier

By Jan 21, 2025 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

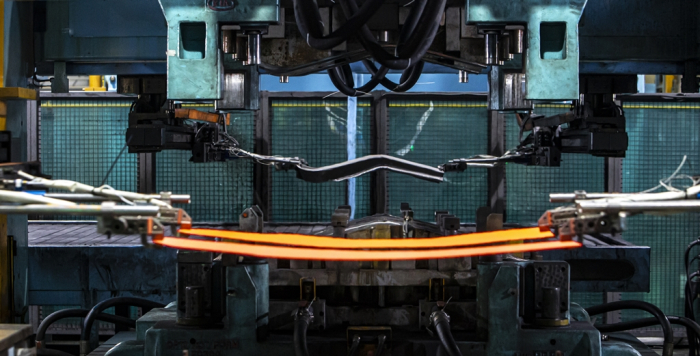

Hyundai Steel Co., South Korea’s second-largest steelmaker, sold more than 1 million tons of automotive steel sheets to overseas automakers other than affiliates Hyundai Motor Co. and Kia Corp. in 2024.

According to industry sources on Tuesday, Hyundai Steel, a unit of Korea’s top automaker Hyundai Motor Group, sold 20% of its 5 million-ton automotive steel production last year to non-captive foreign automakers, surpassing the 1-million-ton auto steel sales mark for the first time.

Hyundai Steel has been selling auto steel sheets since 2017, steadily raising the proportion of its non-Hyundai Group affiliate sales from 16% in 2021 to 17% in 2022 and 18% in 2023.

The steelmaker aims to boost its non-captive auto steel sales to 40% or 2 million tons to become a global top three auto steel supplier. It didn’t provide a timeframe for its goal.

The company supplies auto steel to 25 global automakers, including General Motors Co., Ford Motor Co. and Renault S.A.

TO CUT RELIANCE ON HYUNDAI MOTOR, KIA

Hyundai Steel has vowed to drastically cut its heavy reliance on affiliates Hyundai Motor and Kia as the steelmaker goes global.

Hyundai Steel’s global auto steel market share is estimated at 5.5%, given that about one ton of steel sheets is used to manufacture a vehicle and some 90 million new vehicles are sold annually across the globe.

The Korean steelmaker competes with global majors such as Japan’s Nippon Steel Corp., China’s Baoshan Iron & Steel Co., Germany’s ThyssenKrupp AG, Luxembourg-based multinational steelmaker ArcelorMittal S.A., and Korea’s top steelmaker POSCO.

Hyundai Steel said it plans to build facilities abroad to expand production capacity.

Earlier this month, sources said Hyundai Motor Group is considering building its first overseas steel mill in New Orleans, Louisiana, to shield the automobile giant from Donald Trump’s protectionist policies pledged for his second term.

LOW-CARBON STEEL

Hyundai Steel plans to produce low-carbon automotive steel sheets starting next year through its hybrid electric arc furnace and blast furnace processes.

The technology is aligned with automakers’ need to reduce carbon emissions from the production stage, making low-carbon steel sheets an attractive option.

The company is also upgrading its facilities to begin producing third-generation steel sheets by the end of this year. These sheets are 20% stronger than conventional plates and maintain excellent formability, allowing automakers to easily manufacture vehicles into desired shapes.

Hyundai Steel’s focus on auto steel comes as the domestic steel industry reels from a supply glut triggered by Chinese steelmakers’ aggressive steel exports amid a global economic slowdown.

Write to Hyung-Kyu Kim at khk@hankyung.com

In-Soo Nam edited this article.

More to Read

-

SteelHyundai mulls building 1st overseas steel mill in Louisiana

SteelHyundai mulls building 1st overseas steel mill in LouisianaJan 07, 2025 (Gmt+09:00)

3 Min read -

BatteriesHyundai Steel set to supply iron powder to Korean LFP cathode makers

BatteriesHyundai Steel set to supply iron powder to Korean LFP cathode makersSep 20, 2024 (Gmt+09:00)

3 Min read -

-

-

AutomobilesHyundai Steel supplies high-strength steel for Genesis G80 EV, G90

AutomobilesHyundai Steel supplies high-strength steel for Genesis G80 EV, G90Feb 11, 2022 (Gmt+09:00)

2 Min read -

SteelHyundai Steel, Samsung develop tech to recycle chip waste for steelmaking

SteelHyundai Steel, Samsung develop tech to recycle chip waste for steelmakingSep 27, 2021 (Gmt+09:00)

1 Min read

Comment 0

LOG IN