Steel

Scrap steel price poised to rebound on lower inventories

Scrap inventories at S.Korea’s eight electric furnace steelmakers dip below the psychologically important 900,000-ton level

By Jan 04, 2024 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

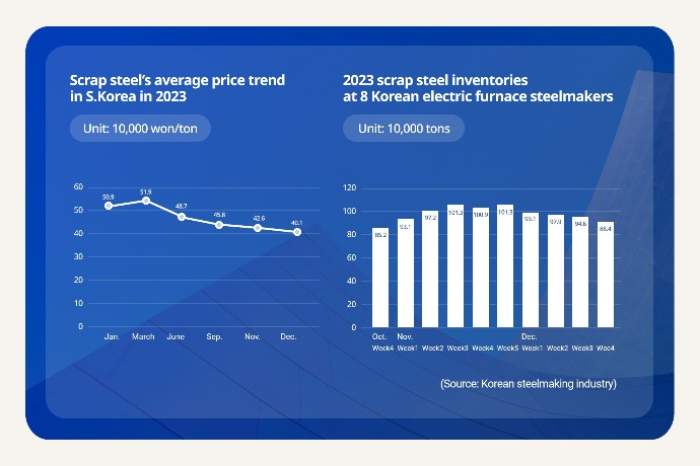

Scrap steel prices in South Korea are poised to bounce back after hitting an annual low in the last month of 2023 amid declining scrap metal inventories at the country’s major steelmakers.

According to the Korean steelmaking industry, the scrap steel inventory level at the country’s eight major electric furnace operators, including POSCO, Hyundai Steel Co. and Dongkuk Steel Mill Co., stood at 884,000 tons as of the fourth week of December, down 12.3% from the month previous.

Local steelmakers consider 900,000 tons a psychologically important level, and they generally take a dip in scrap inventories below the level as a cue to restock scrap steel, said an industry official, adding time is ripe for scrap price hikes.

The 2023 average scrap price also slid to an annual low of about 400,000 won ($305) per ton in December, suggesting it would bottom out soon.

Scrap metals, or recycled steel, are key materials used to produce industrial steel and alloys. Steelmakers are increasingly opting for scrap recycling to reduce their reliance on iron ore as part of global efforts to cut carbon emissions.

PRICES RISE WHILE INVENTORIES FALL

The average scrap price for 2023 skid to the low 400,000-won level per ton in December, last year’s lowest level, from the 500,000-won range at the beginning of the year. The decline has accelerated since it dipped below 450,000 won in August.

December is typically a slow season for scrap demand but steelmakers normally scramble to pile up scrap metal in January and February before March when local construction companies prepare to break ground on various projects.

If steelmakers start restocking their scrap inventories at the beginning of this year, scrap metal prices are expected to rebound.

In January last year, the average scrap steel price jumped 26% to 509,000 won from a month prior.

The tight local scrap supply coupled with high import prices also bodes well for hikes in scrap metal prices in Korea, market analysts forecast.

The local scrap steel industry’s self-sufficiency level is declining from about 80%, and the price of Japanese scrap imports on which Korean steelmakers heavily rely is about 100,000 won more expensive than local scrap steel prices as of December.

Worse yet, as the Japanese and US governments have no immediate plan to lift the bans on their scrap exports, scrap metals will remain scarce, according to the steelmaking industry.

Write to Mi-Sun Kang at misunny@hankyung.com

Sookyung Seo edited this article.

More to Read

-

-

SteelSteel scrap in high demand in steelmakers' push to cut emissions

SteelSteel scrap in high demand in steelmakers' push to cut emissionsNov 07, 2021 (Gmt+09:00)

3 Min read

Comment 0

LOG IN