Steel

Dongkuk eyes $1.7 billion sales from color steel business in 2030

The steelmaker is also looking to newly enter major markets such as the US, Poland, Vietnam and Australia

By Nov 08, 2021 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Dongkuk Steel Mill Co., South Korea’s third-largest steelmaker, said on Monday that it aims to grow its color coated steel business to 2 trillion won ($1.7 billion) in revenue with an annual production capacity of 1 million tons by 2030 from the current 1.4 trillion won sales at 850,000 tons a year.

Dongkuk, the world’s leading manufacturer of color coated steel, said it also plans to aggressively expand its overseas facilities to up to eight factories and sales offices in seven countries by 2030 from the current three plants, each in Mexico, India and Thailand.

“We are considering entering major markets such as the US, Poland, Vietnam and Australia,” Vice Chairman Chang Sae-wook said at the 10th anniversary of the launch of Luxteel, the company’s high-end colored steel brand.

“In the process of expanding our production capacity by 150,000 tons over the years, we will also pursue an M&A as an option.”

Unveiling its DK Color Vision 2030, he said the company will also pursue an eco-friendly steel manufacturing process by introducing a system called Eco Color Coating Line (ECCL), which drastically cuts the use of adhesives.

Dongkuk is Korea’s largest color steelmaker, controlling 35% of the domestic market. Its main plant in Busan has a color steel producing facility with an annual production capacity of 850,000 tons – the world’s largest capacity for a single plant.

BOOMING DEMAND FOR COLOR STEEL

The color steel plate business is booming with increasing demand from a variety of sectors ranging from home electronics companies to construction firms and even chipmakers, as consumers have become more assertive and seek a sense of style in their everyday goods.

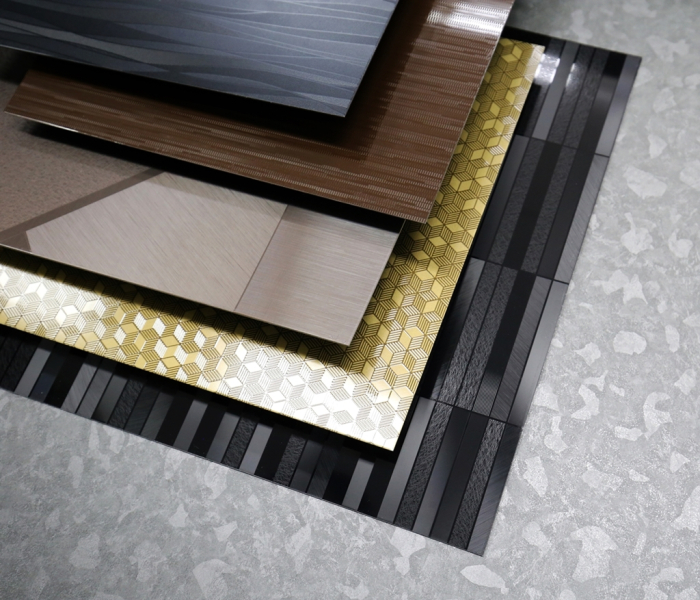

Since the finish of color coated steel recreates the texture of wood grain, the smoothness of marble and the roughness of granite through a wide spectrum of patterns, end products are hard to identify as steel based on appearance alone.

With the growing popularity of color steel plates, steelmakers are now even producing antibacterial color products for use in the operating rooms at hospitals and coronavirus clinics.

In the color steel business, Dongkuk competes against smaller domestic rivals such as KG Dongbu Steel, POSCO Coated & Color Steel, SeAH Coated Metal, and Hyundai Steel Co.

Dongkuk’s main products under the premium Luxteel brand include Luxteel D-FLON, the world’s first weatherproof steel plate specialized for use in the construction industry, and Luxteel Bio, a product with anti-bacterial functions.

The company said it plans to raise the ratio of its color steel products to 30% of all finished products by 2030 from the current 20%.

Dongkuk Steel currently makes more than 10,000 types of colored steel products and has 30 patents.

BRAZILIAN UNIT TURNS PROFITABLE

Boosted by the growing demand for color steel, which has higher margins than general steel products, Dongkuk’s first-half operating profit reached 316.4 billion won, more than the company’s full-year profit in 2020.

The market expects the company to post 750 billion won in operating profit this year.

Dongkuk’s Brazilian unit, Companhia Siderurgica do Pecem steel mill, commonly known as CSP, also turned profitable in the first half of this year after posting years of losses.

Since the Brazilian steel mill, in which Dongkuk holds a 30% stake, began operations in 2016, it has run a deficit almost every year, resulting in an accumulated loss of 2.23 trillion won as of 2020.

CSP is 50% owned by Brazil’s mining giant Vale S.A. and Korea’s top steelmaker POSCO holds the remaining 20% stake.

Write to Jung-Hwan Hwang at jung@hankyung.com

In-Soo Nam edited this article.

More to Read

-

SteelDongkuk Steel adds another production line of color coated steel

SteelDongkuk Steel adds another production line of color coated steelSep 28, 2021 (Gmt+09:00)

2 Min read -

EarningsDongkuk Steel’s Q1 operating profit hits 5-year high as economy recovers

EarningsDongkuk Steel’s Q1 operating profit hits 5-year high as economy recoversMay 17, 2021 (Gmt+09:00)

3 Min read -

Color steelColor coated steel shines in style on Samsung, LG home appliances

Color steelColor coated steel shines in style on Samsung, LG home appliancesMay 09, 2021 (Gmt+09:00)

3 Min read -

Steel industryDongkuk Steel’s Brazil plant: From ugly duckling to golden swan

Steel industryDongkuk Steel’s Brazil plant: From ugly duckling to golden swanApr 09, 2021 (Gmt+09:00)

3 Min read -

SteelmakersKorean steel majors positioned as 2021 market darlings

SteelmakersKorean steel majors positioned as 2021 market darlingsNov 18, 2020 (Gmt+09:00)

3 Min read

Comment 0

LOG IN