Sovereign wealth funds

KIC posts 8.83% return on alternative assets since inception

It achieved an 11.33% return on PE; RE & infrastructure and hedge funds earned 7.76% and 5.64% returns, respectively

By May 26, 2022 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Korea Investment Corporation (KIC), the South Korean sovereign wealth fund, posted a 9.13% annualized return on total assets and $205 billion on assets under management as of end-2021.

The fund announced on Thursday its return on investment amounted to $16.9 billion last year, raising the cumulative returns since 2006, when it started investing, to $87.9 billion.

The exposure to alternative investment increased from 15.3% in 2020 to 17.5% last year, including 7.7% for private equity, 6.5% for real estate and infrastructure and 2.7% for hedge funds. Public equity and bonds made up 40.6% and 34.9% of the AUM, respectively. Others, including inflation-protected securities, raw materials and cash, accounted for 6%.

The fund posted an 8.83% annualized return on alternative investments since inception and a 6.75% return from traditional assets in 2021, respectively. Of the alternative assets, private equity investments achieved an 11.33% return, while real estate & infrastructure and hedge funds earned 7.76% and 5.64% returns, respectively.

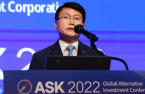

The sovereign wealth fund is aiming to increase alternative assets to 25% of its AUM by 2025, chief executive Jin Seoungho said at ASK 2022, The Korea Economic Daily’s alternative investment forum held on May 18.

The fund will take a conservative approach to private equity due to market volatilities this year, focusing on downside protection of private debts as well as seeking opportunities in multifamily and life science offices, the CEO said.

Founded in 2005, KIC is investing only in overseas assets. It started investment with $1 billion worth of global bonds in 2006, increased the AUM to over $100 billion in 2016 and more than $200 billion last year.

The sovereign wealth fund has been entrusted with $115.1 billion from the Korean government and Bank of Korea (BOK) as of the end-2020.

The new government of Korea is planning to expand KIC’s fund management base, according to the national action plan drafted by the presidential transition committee in April. The plan is to entrust KIC with capital from local small-sized retirement funds and mutual aids, thus expanding the sovereign wealth fund’s management base. Under the current law, KIC can be entrusted capital from the government, BOK and public pension funds.

Updated with the annualized return on alternative investment since inception.

Write to Tae-Ho Lee at thlee@hankyung.com

Jihyun Kim edited this article.

More to Read

-

Sovereign wealth fundsKIC, PE firm WWG to invest $450 mn in equipment maker Duravant

Sovereign wealth fundsKIC, PE firm WWG to invest $450 mn in equipment maker DuravantMay 26, 2022 (Gmt+09:00)

2 Min read -

-

Sovereign wealth fundsYoon admin to expand KIC's fund management base

Sovereign wealth fundsYoon admin to expand KIC's fund management baseMay 12, 2022 (Gmt+09:00)

3 Min read -

Sovereign wealth fundsKIC buys $1.9 mn worth of shares in crypto platform Coinbase

Sovereign wealth fundsKIC buys $1.9 mn worth of shares in crypto platform CoinbaseFeb 11, 2022 (Gmt+09:00)

2 Min read -

Sovereign wealth fundsKIC boosts hedge fund investing with Seoul Guarantee Insurance

Sovereign wealth fundsKIC boosts hedge fund investing with Seoul Guarantee InsuranceFeb 24, 2022 (Gmt+09:00)

1 Min read -

Sovereign wealth fundsKIC eyes tech, healthcare, telecoms via PE and VC

Sovereign wealth fundsKIC eyes tech, healthcare, telecoms via PE and VCJan 05, 2022 (Gmt+09:00)

6 Min read

Comment 0

LOG IN