Sovereign bonds

S.Korean institutional investors inject more capital in MMFs

The balance of local money market funds rose 4.9% to hit a record high of $165 billion on Feb. 2

By Feb 06, 2023 (Gmt+09:00)

1

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korean institutional investors, such as pension funds, mutual aids and corporates, are rushing to money market funds (MMFs) for short-term profits from safer assets as they are reluctant to buy stocks and bonds on worries about a potential economic downturn and sluggish corporate earnings.

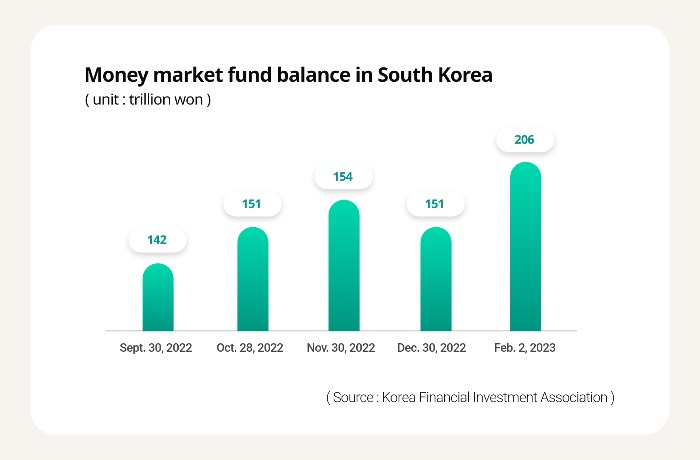

The balance of MMFs, financial products investing in debt securities like treasury bonds, certificate of deposit (CD) and commercial paper (CP) with near terms, rose 4.9% to hit a record high of 206 trillion won ($165.2 billion) on Feb. 2 in the country.

The figure exceeded 200 trillion won on the day for the first time since 2006 when Korea Financial Investment Association (KOFIA) started recording data on the funds. Between Jan. 2 and Feb. 2, it surged 35.9%, or 54.4 trillion won, backed by local institutional investors' injection.

The balance of MMFs, which exceeded 170 trillion won last May, fell to 140 trillion won last October as the local bond market was rattled by Legoland theme park developer’s debt default.

The MMF market has rebounded as the Korean government pledged to inject at least 50 trillion won last October to stabilize short-term money and corporate bond markets. The rescue plan included a bond market stabilization fund of 20 trillion won, purchases of corporate bonds and CPs worth 16 trillion won, and others.

Investors also flock to buy repurchase agreements (repo), short-term contracts to sell securities and buy back in the future at a fixed price – they bet 33.4 trillion won on Bank of Korea’s seven-day repo sales, worth of 17 trillion won, last Wednesday.

Lumpy investments in short-term financial products have stabilized the interest rates. The annual rate for 91-day local CPs with A1 grade closed at 4.37% on Feb. 3, compared with 5.18% closing on Jan. 2. The annual rate for CD, which was over 4% last November, closed at 3.49% last Friday.

Individual investors are moving their capital to savings and bonds, targeting higher interests than MMFs. Their balance of MMFs fell from more than 17 trillion won last October to 13.6 trillion won on Feb. 2.

Write to Hyun-Ju Jang at blacksea@hankyung.com

Jihyun Kim edited this article.

More to Read

-

Corporate bondsKorean life insurer eases bond market woes with buyback

Corporate bondsKorean life insurer eases bond market woes with buybackNov 08, 2022 (Gmt+09:00)

2 Min read -

Alternative investmentsKorean firms eye alternative assets for safer investments, survey finds

Alternative investmentsKorean firms eye alternative assets for safer investments, survey findsJul 11, 2022 (Gmt+09:00)

1 Min read -

MarketsKorea to buy back treasury bonds to curb rising interest rates

MarketsKorea to buy back treasury bonds to curb rising interest ratesNov 03, 2021 (Gmt+09:00)

2 Min read -

Comment 0

LOG IN