Hanwha Ocean, another Korean shipbuilder win $951 million WTIV deals

The contracts will lay the groundwork for Korean shipbuilders to enhance their clout in the wind power market

By Dec 30, 2024 (Gmt+09:00)

Seoul appeal: Korean art captivates Indonesia’s affluent connoisseurs

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

K-pop stocks surge as China set to loosen cultural ban after 9 years

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

Hanwha Ocean Co. and another major South Korean shipbuilder have won deals worth a combined 1.4 trillion won ($951 million) to each build a wind turbine installation vessel (WTIV) for unidentified domestic firms.

A WTIV is a vessel specially designed to install offshore wind turbines. It is priced between 700 billion won and 800 billion won.

Hanwha and the unidentified Korean shipbuilder have agreed to build two WTIVs— one for an energy company and the other for a construction firm, people familiar with the matter said on Monday.

The companies are fine-tuning details of the agreement, including construction conditions, according to sources.

Analysts said the deals are seen as a crucial step in safeguarding Korea’s offshore wind turbine construction market, which is at risk of being dominated by Chinese and European companies.

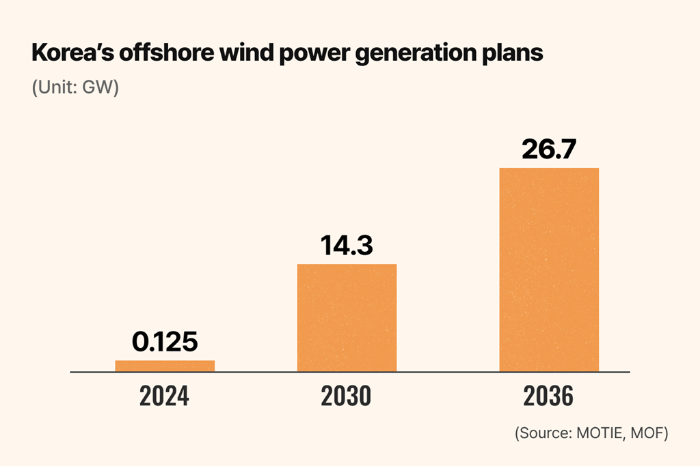

Korea plans to expand its offshore wind power generation capacity to 14.3 GW by 2030 from the current 0.13 GW, requiring the addition of 2 GW capacity annually.

LACK OF LARGE WTIVs

However, a lack of large WTIVs has left the domestic wind turbine market vulnerable to competition from European and Chinese firms.

“Once the two large WTIVs are up and running, Korea will have a competitive edge in the nation’s offshore wind turbine construction market,” said a local shipbuilding industry official.

As global warming draws attention to renewable energy sources like offshore wind power, demand for large offshore WTIVs is steadily increasing.

Korea is a leader in the emerging WTIV market with Hanwha Ocean building four such vessels and Samsung Heavy Industries Co. three, mainly for overseas clients so far.

Korean shipbuilders also compete to lead the global wind farm industry, an emerging game-changer in the renewable energy sector, which generates power through offshore floating facilities.

In Korea, there is only one WTIV used to build smaller turbines with 5 to 10 MW capacity.

With the larger 15 MW turbines becoming the industry standard, however, Korean firms could lose the wind turbine market without sufficient WTIV capabilities, industry officials said.

Korean shipbuilders specialize in building large WTIVs capable of installing 15 MW turbines, bringing their annual installation capacities to 700–800 MW per vessel.

GREATER CLOUT IN WIND POWER MARKET

Industry officials said the latest WTIV contracts would lay the foundation for Korean shipbuilders to expand their clout in the domestic offshore wind power market.

Korea’s wind power market is forecast to grow to 14.3 GW, worth some 100 trillion won by 2030, and to 26.7 GW worth 182 trillion won by 2036, according to government data.

WTIV charter fees from overseas ship owners have increased by 24% over the past year.

Industry officials said installing offshore wind turbines involves surveying seabed conditions, which raises national security concerns.

Write to Yeong-Hyo Jeong, Jung-hwan Hwang and Hyung-Kyu Kim at hugh@hankyung.com

In-Soo Nam edited this article.

-

Shipping & ShipbuildingHanwha Ocean, HD Hyundai reconcile, look to joint overseas warship bids

Shipping & ShipbuildingHanwha Ocean, HD Hyundai reconcile, look to joint overseas warship bidsNov 24, 2024 (Gmt+09:00)

3 Min read -

-

Shipping & ShipbuildingHanwha Ocean wins $1.57 billion deal for LNG carriers, VLCCs

Shipping & ShipbuildingHanwha Ocean wins $1.57 billion deal for LNG carriers, VLCCsJul 01, 2024 (Gmt+09:00)

1 Min read -

Shipping & ShipbuildingHanwha Ocean launches large offshore WTIV

Shipping & ShipbuildingHanwha Ocean launches large offshore WTIVJun 10, 2024 (Gmt+09:00)

1 Min read -

Corporate strategyHanwha Ocean to adopt Kyocera founder Inamori’s amoeba management

Corporate strategyHanwha Ocean to adopt Kyocera founder Inamori’s amoeba managementMay 17, 2024 (Gmt+09:00)

2 Min read -

EnergyKorean companies’ race heats up in $2.8 tn global wind farm markets

EnergyKorean companies’ race heats up in $2.8 tn global wind farm marketsAug 05, 2021 (Gmt+09:00)

2 Min read -

Carbon neutralityDenmark’s Orsted to build world’s biggest wind farm off S.Korean coast

Carbon neutralityDenmark’s Orsted to build world’s biggest wind farm off S.Korean coastNov 24, 2020 (Gmt+09:00)

2 Min read