Korea’s Hanwha Ocean quits money-losing container shipbuilding business

With Chinese firms emerging as the dominant players, Korean shipbuilders are posting heavy losses

By Jan 08, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s Hanwha Ocean Co., the world’s third-largest shipbuilder, has decided to exit the money-losing container shipbuilding business to focus instead on profitable vessels such as liquefied natural gas (LNG) carriers.

Hanwha Ocean, formerly Daewoo Shipbuilding & Marine Engineering Co. (DSME), will no longer receive orders for cheap diesel-powered container ships and relatively highly-priced methanol-powered or LNG-propelled boxships, company officials said on Monday.

However, if a client places an order for container ships along with LNG carriers, Hanwha will likely review whether to build them together, they said.

Established in 1973 as DSME, Hanwha Ocean has been one of the world’s major container shipbuilders. Hanwha is the only Korean company that has built submarines for the country's Navy since 1987.

But just like its domestic peers, the Korean company faced snowballing losses from the boxship business in recent years due to the onslaught by Chinese shipbuilders, which, aided by hefty government subsidies, offered deep discounts to their clients, virtually crowding out rival shipbuilders from other countries.

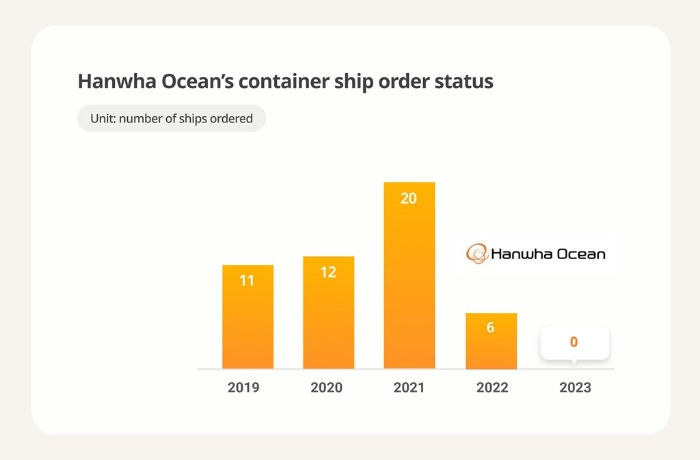

Hanwha, which won orders to build 20 container ships in 2021, saw its new orders drop to six in 2022. Last year, it received no container shipbuilding orders at all.

With dwindling container ship orders, Hanwha has also decided to slash the number of its shipbuilding docks to four from the current five over the next few years.

Hanwha officials said the company may return to the container shipbuilding business if industry conditions improve significantly.

HD KSOE, SAMSUNG HEAVY TO CONTINUE BOXSHIP BUSINESS

HD Korea Shipbuilding & Offshore Engineering Co. (HD KSOE) and Samsung Heavy Industries Co., the world’s No. 1 and No. 2 shipbuilders, respectively, will continue their container shipbuilding businesses for the time being, industry sources said.

However, HD KSOE and Samsung said they are also shifting their business focus toward value-added ships, including LNG carriers.

HD KSOE operates a total of 17 shipbuilding docks, including those at its affiliates such as Hyundai Mipo Dockyard Co. and Hyundai Samho Heavy Industries Co.

Samsung Heavy has eight shipbuilding docks.

“We will continue to build hybrid propulsion ships, which are highly value-added,” said a Samsung official.

When it reports its 2023 business results by the end of March, Hanwha Ocean is widely expected to post losses largely due to its unprofitable container shipbuilding business.

Industry officials said Hanwha likely posted a loss of about 10 billion won ($7.6 million) from every container ship it built last year.

CHINA SWEEPS CONTAINER SHIP ORDERS

In recent years, China has swept the majority of container shipbuilding orders placed worldwide, thanks to their price competitiveness and improved quality of the vessels they built, analysts said.

Last year, Chinese shipbuilders won deals to build 101 container ships, accounting for 57% of 178 newly ordered ships. The figure compared with 51 container ship orders for Korea and 24 vessels for Japan.

With improved shipbuilding technology, the majority of container ships Chinese companies won last year were relatively expensive methanol-powered or LNG-powered ships, industry officials said.

At the end of 2021, the average price of a container ship with 23,000 twenty-foot equivalent units (TEU) was $189 million, about $20 million lower than the price of an LNG carrier of a similar size, 174,000 cubic meters.

The price gap between boxships and LNG carriers has widened further with a 23,000 TEU container ship priced at $235.5 million, $30 million cheaper than an LNG carrier this past December.

“Container ship prices have recovered since last year with growing orders from shipping firms for eco-friendly ships. However, if the current pace of inflation continues, it will be harder to break even in two to three years,” said an official at a local shipbuilding firm.

Write to Jae-Fu Kim and Woo-Sub Kim at hu@hankyung.com

In-Soo Nam edited this article.

-

Shipping & ShipbuildingHanwha Ocean to raise $1.5 bn to boost warship business

Shipping & ShipbuildingHanwha Ocean to raise $1.5 bn to boost warship businessAug 23, 2023 (Gmt+09:00)

3 Min read -

Korean stock marketEcoPro, Hanwha Ocean, JYP among top MSCI inclusion candidates

Korean stock marketEcoPro, Hanwha Ocean, JYP among top MSCI inclusion candidatesJul 18, 2023 (Gmt+09:00)

3 Min read -

Shipping & ShipbuildingSamsung Heavy in $3.1 bn methanol-powered ship deal with Evergreen

Shipping & ShipbuildingSamsung Heavy in $3.1 bn methanol-powered ship deal with EvergreenJul 17, 2023 (Gmt+09:00)

3 Min read -

Shipping & ShipbuildingSecondhand LNG carrier prices hit record high; prospects rosy

Shipping & ShipbuildingSecondhand LNG carrier prices hit record high; prospects rosyJul 12, 2023 (Gmt+09:00)

2 Min read -

Shipping & ShipbuildingKorean shipbuilders outpace Chinese in LNG carrier orders

Shipping & ShipbuildingKorean shipbuilders outpace Chinese in LNG carrier ordersDec 29, 2022 (Gmt+09:00)

3 Min read -

Shipping & ShipbuildingHyundai Heavy’s KSOE wins $2.2 billion order for 10 LNG carriers

Shipping & ShipbuildingHyundai Heavy’s KSOE wins $2.2 billion order for 10 LNG carriersJul 07, 2022 (Gmt+09:00)

1 Min read -

Shipping & ShipbuildingSamsung Heavy wins record $3 billion LNG carrier order; outlook bright

Shipping & ShipbuildingSamsung Heavy wins record $3 billion LNG carrier order; outlook brightJun 23, 2022 (Gmt+09:00)

1 Min read -

Shipping & ShipbuildingKSOE in $1.4 billion deal to build 8 methanol-powered ships for Maersk

Shipping & ShipbuildingKSOE in $1.4 billion deal to build 8 methanol-powered ships for MaerskAug 24, 2021 (Gmt+09:00)

2 Min read