Shipping & Shipbuilding

Korea’s HMM among shippers benefiting from growing Red Sea crisis

Meanwhile, exporters are groaning under rising freight and fuel costs due to the disruptions at the Suez and Panama canals

By Jan 05, 2024 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

The Red Sea crisis, disrupting the passage of ships through the Suez Canal, a central artery for global trade, is a bane for exporters looking for ships and a boon for shipping firms poised to gain from rising freight costs, analysts said.

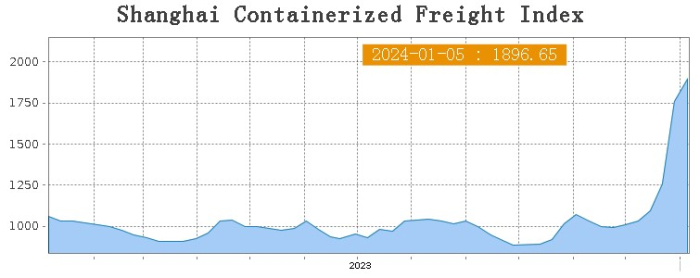

The Shanghai Containerized Freight Index (SCFI), the most widely used index for sea freight rates for imports from China worldwide, is on a rapid ascent trajectory, hitting 1,896.65 on Friday – the highest point since 1,922.95 on Sept. 30, 2022.

The SCFI has risen 7.8% over the past week, when the index was hovering around 800 and 1,100.

The Suez Canal, a shortcut between Asia and Europe, is used by roughly one-third of global container ship cargo.

Since mid-December, Yemen-based Houthi militants have attacked several commercial vessels in the southern Red Sea, including a Maersk ship on Saturday, in support of Hamas in the conflict with Israel.

The attacks are disrupting global trade and sparking fears of a fresh bout of global inflation as shipping rates soar.

Major shipping firms have paused shipments through the Red Sea to avoid attacks by Houthi rebels.

As container ships are diverted around the Cape of Good Hope on the southern tip of Africa, adding thousands of miles to journeys, the disruption is driving up freight costs on the Asia-Europe route.

Rerouting shipments around the southern tip of Africa adds about 6,000 km to journeys connecting Europe with Asia, adding about 10 days to the duration of the trip, signifying extra fuel costs and higher insurance, according to media outlet reports.

PANAMA CANAL SUFFERS FROM DROUGHT

Rising tensions in the Red Sea come as the other major trade shortcut, the Panama Canal, is suffering from drought, further boosting global freight rates.

Analysts said shipping companies are among key beneficiaries of disruptions at the Suez and Panama canals behind the rapid rise in freight rates.

Long-term shipping contracts are usually signed at the beginning of the year and much of the rising freight costs, reflected in the SCFI, will be taken into account when they sign new contracts, they said.

Long-term contracts for routes to the US usually begin in March, and if freight rates continue to rise by then, it will significantly boost shipping firms’ profits.

HMM, MSC, MAERSK HIKE FREIGHT RATES

HMM Co., South Korea’s top containership operator, recently raised its freight rates for routes from India to the eastern part of South America by about $1,500 per twenty-foot equivalent unit (TEU).

A company official said HMM recently conducted its general rate increase (GRI) for routes heading to Europe and plans to raise the rates again as early as next week.

Switzerland’s Mediterranean Shipping Company S.A, better known as MSC, increased cargo rates departing from Asian ports by about 30-40% on the first day of the year.

As exporting companies rush to sign contracts with shipping firms, Maersk, the world’s second-largest container line, has added a “peak season surcharge” to its freight rates since the start of the year, industry officials said.

“In addition to the lengthier shipping times, shipping firms are charging freight rates more than the rise in fuel costs, which is an extra burden on us,” said an official at a Korean exporting company.

Write to Hyung-Kyu Kim at khk@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Mergers & AcquisitionsPoultry processor Harim to buy Korean top sea carrier HMM for $5 bn

Mergers & AcquisitionsPoultry processor Harim to buy Korean top sea carrier HMM for $5 bnDec 18, 2023 (Gmt+09:00)

3 Min read -

Shipping & ShipbuildingS.Korea’s HMM expands bulk carrier fleet for stable profit

Shipping & ShipbuildingS.Korea’s HMM expands bulk carrier fleet for stable profitNov 02, 2023 (Gmt+09:00)

2 Min read -

LogisticsHyundai Glovis to raise car shipping rates amid vehicle carrier shortage

LogisticsHyundai Glovis to raise car shipping rates amid vehicle carrier shortageSep 04, 2023 (Gmt+09:00)

2 Min read -

Shipping & ShipbuildingGlonet: A case of Korea's logistics David vs Japan’s shipping Goliath

Shipping & ShipbuildingGlonet: A case of Korea's logistics David vs Japan’s shipping GoliathJun 07, 2023 (Gmt+09:00)

2 Min read -

Shipping & ShipbuildingKorea, US to work on Busan-Seattle green cargo shipping corridor

Shipping & ShipbuildingKorea, US to work on Busan-Seattle green cargo shipping corridorNov 16, 2022 (Gmt+09:00)

3 Min read

Comment 0

LOG IN