Korean shipbuilders shrug off concerns over lower new ship prices

Prices of crude oil tankers and carriers of LPG, ammonia and methanol are expected to rise, offsetting LNG tanker values' drop

By Dec 12, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korean shipbuilders shrugged off concerns of an industry peak-out boosted by the first fall of new vessel prices in 45 weeks and lower used ship values.

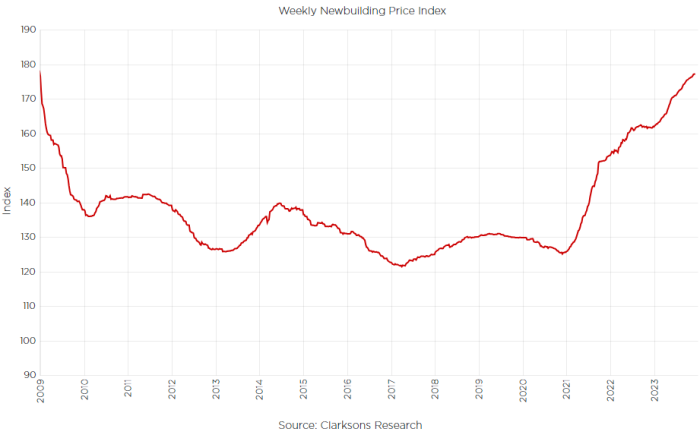

Clarksons Research said its newbuilding price index, a key gauge of the global shipbuilding sector, dipped to 177.08 in the week ending Dec. 8 from 177.14 in the previous seven days, ending 44 straight weeks of increases. The global leading shipping and shipbuilding industry data provider’s secondhand price index, a leading indicator for newbuilding prices, also slid.

The declines in both indices prompted some financial institutions including Nomura Securities Co. to forecast that the South Korean shipbuilding industry had peaked as global shipbuilding orders have been declining since 2021. Shipping companies reduced supplies amid the sustained industry slowdown.

Shipbuilding orders are forecast to fall 17.9% to 1,593 vessels in 2023 from the previous year when the orders already dropped 16.9%, according to Clarksons Research. Orders for liquefied natural gas (LNG) carriers, high value-added vessels mainly manufactured by South Korean shipbuilders, shrank to 65 units this year, about a third of 185 tankers in 2022.

SELLER’S MARKET

Major South Korean shipbuilders – HD Korea Shipbuilding & Offshore Engineering Co., Hanwha Ocean Co. and Samsung Heavy Industries Co. – saw the decline in new vessel prices as temporary, however.

“The rise in new vessel prices may slow. The prices did not enter a downward trend,” said an official at one of the companies.

Those shipbuilders expected suppliers to dominate the market as they have already secured works for the next three years or more, limiting docks available for new orders. The number of yards across the world haven fallen to 164 this year from the peak of 768 in 2007.

Korea Investment & Securities Co. agreed with the shipbuilders' view.

“The newbuilding price index is predicted to resume its rising trend and stay above 180 on average next year,” the brokerage house said.

Local shipbuilders expected prices of crude oil tankers and carriers of liquefied petroleum gas (LPG), ammonia and methanol to rise on healthy demand, offsetting declines in LNG tanker values.

Orders for crude oil tankers more than doubled to 300 units this year from 143 vessels in 2022, while LPG carrier orders jumped 85.5% to 102 units.

Slower growth in new vessel orders is an opportunity for domestic shipbuilders to improve their competitiveness, some industry sources said.

The industry particularly needs time to enhance the skills of foreign workers amid the chronic labor shortage. At an in-house management briefing last month HD Hyundai Heavy Industries Co., a subsidiary of HD Korea Shipbuilding & Offshore Engineering, said shipbuilding may be delayed in the fourth quarter due to the issue.

“Some Chinese shipbuilders suffered problems in production because of similar labor issues,” said another shipbuilder official in Seoul. “We need a strategy to secure sustainable growth through internal improvement rather than blindly increasing orders.”

Write to Hyung-Kyu Kim at khk@hankyung.com

Jongwoo Cheon edited this article.

-

Shipping & ShipbuildingHD KSOE secures $432 mn order for 4 ammonia carriers

Shipping & ShipbuildingHD KSOE secures $432 mn order for 4 ammonia carriersDec 01, 2023 (Gmt+09:00)

1 Min read -

Shipping & ShipbuildingHanwha Ocean wins world's largest ammonia carriers order

Shipping & ShipbuildingHanwha Ocean wins world's largest ammonia carriers orderNov 14, 2023 (Gmt+09:00)

1 Min read -

Shipping & ShipbuildingHD KSOE builds world’s first mid-size ammonia-fueled vessel

Shipping & ShipbuildingHD KSOE builds world’s first mid-size ammonia-fueled vesselOct 16, 2023 (Gmt+09:00)

1 Min read -

Shipping & ShipbuildingHD KSOE to build world's largest ammonia carriers

Shipping & ShipbuildingHD KSOE to build world's largest ammonia carriersSep 07, 2023 (Gmt+09:00)

2 Min read -

Shipping & ShipbuildingKSOE wins order $171 mn for two crude oil carriers

Shipping & ShipbuildingKSOE wins order $171 mn for two crude oil carriersApr 13, 2023 (Gmt+09:00)

1 Min read -

Shipping & ShipbuildingKorea's KSOE lands $240 mn order for LPG carriers

Shipping & ShipbuildingKorea's KSOE lands $240 mn order for LPG carriersMar 21, 2023 (Gmt+09:00)

1 Min read