Dalton Investments raises stake in cosmetics ODM Kolmar

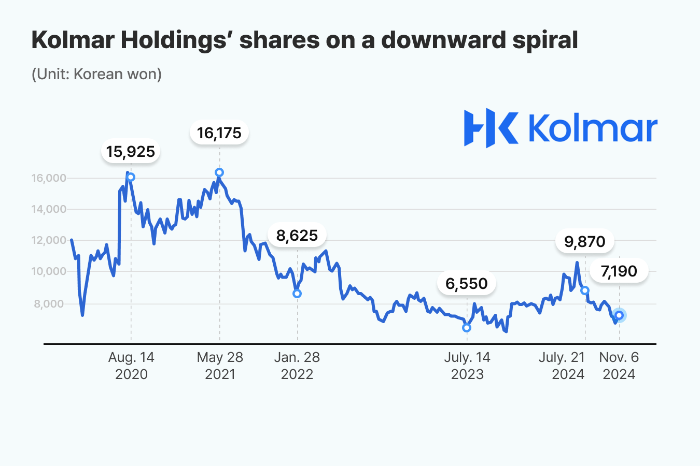

Kolmar Holdings' share price has more than halved since 2021, trading at less than half its book value

By Nov 06, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Dalton Investments Inc., a US-based activist fund, has secured a 5.02% stake in South Korea’s Kolmar Holdings Co., stoking speculation the world’s No. 3 original development manufacturer (ODM) for cosmetic products would become a new shareholder activism target.

Dalton, with $4.3 billion in assets under management as of June 30, has been buying shares in the parent company of Kolmar Korea Co. in the market since early this year.

On Oct. 30, it disclosed its stake in the holding firm as per South Korean laws requiring shareholders with a stake over 5% in a listed domestic company to report its shareholding to financial regulators.

Kolmar Holdings controls Kolmar Korea, Yonwoo Co., a plastic packaging materials producer for cosmetics products and Kolmar BNH Co., a health supplement ODM.

Its revenue comes from dividends and royalty payments from subsidiaries.

INVESTMENT PURPOSES ONLY?

Dalton said in a regulatory filing that its share purchase in Kolmar Holdings was solely for investment purposes.

But stock market analysts expect the US investment firm to pile up pressure on Kolmar to take measures to unlock value as its stock price has been on a downward spiral.

Its share price has tumbled 41% off 12,140 won, this year’s peak touched in July, despite its announcement the same month of share cancellations worth 20 trillion won ($14.3 million).

Its stock is trading at 0.44 of its book value as of Wednesday’s close.

Kolmar Holdings shrugged off concerns about Dalton's possible shareholder activist moves against the company.

“Dalton has not requested anything in particular,” said a Kolmar Holdings official. “We view it as an investment in an undervalued company with a high future value, rather than aimed at putting pressure on our management.”

In May, it sent a letter to Fuji Media Holdings with a recommendation to take the Japanese group private given its shares' underperformance. Dalton held a 6.55% stake in Fuji Media.

Dalton pushed Hyundai Home Shopping Network Corp. and Samyung Trading Co., a chemical materials and products distributor, to implement shareholder-friendly measures in 2019 and 2020, respectively.

In 2022, it urged SK Group, the No. 2 conglomerate in South Korea, to focus more on increasing share buybacks and cancellations than dividend payments.

The move came after it wrote a public letter to the South Korean government and the National Pension Service calling for steps such as lowering taxes on dividends, actively exercising shareholder rights and introducing mandatory electronic voting.

Write to Jun-Ho Cha at chacha@hankyung.com

Yeonhee Kim edited this article.

-

Leadership & ManagementCorporate management disputes spring up in S.Korea

Leadership & ManagementCorporate management disputes spring up in S.KoreaOct 14, 2024 (Gmt+09:00)

4 Min read -

Beauty & CosmeticsKolmar Korea, Sensient Beauty to co-develop pigments

Beauty & CosmeticsKolmar Korea, Sensient Beauty to co-develop pigmentsJul 26, 2024 (Gmt+09:00)

1 Min read -

-

Beauty & CosmeticsKolmar Korea develops AI tech for diagnosing alopecia

Beauty & CosmeticsKolmar Korea develops AI tech for diagnosing alopeciaJun 18, 2024 (Gmt+09:00)

1 Min read -

Bio & PharmaKolmar Global launches hangover reliever Condition in Singapore

Bio & PharmaKolmar Global launches hangover reliever Condition in SingaporeSep 18, 2023 (Gmt+09:00)

1 Min read -

Waste managementKolmar Korea develops eco-friendly paper stick for cosmetic

Waste managementKolmar Korea develops eco-friendly paper stick for cosmeticApr 27, 2023 (Gmt+09:00)

1 Min read -

Food & BeverageKolmar BNH gets approval for health functional food ingredient in US

Food & BeverageKolmar BNH gets approval for health functional food ingredient in USApr 20, 2023 (Gmt+09:00)

1 Min read -

Beauty & CosmeticsKolmar Korea to establish new cosmetics production base in Sejong City

Beauty & CosmeticsKolmar Korea to establish new cosmetics production base in Sejong CityJan 25, 2023 (Gmt+09:00)

1 Min read -

Shareholder activismShareholder activism gathers momentum in South Korea

Shareholder activismShareholder activism gathers momentum in South KoreaSep 19, 2022 (Gmt+09:00)

2 Min read -

Beauty & CosmeticsKolmar Korea to enter $22 billion UAE Halal cosmetics market

Beauty & CosmeticsKolmar Korea to enter $22 billion UAE Halal cosmetics marketSep 08, 2022 (Gmt+09:00)

1 Min read -

Shareholder activismUS hedge fund urges SK to focus on share buybacks

Shareholder activismUS hedge fund urges SK to focus on share buybacksApr 08, 2022 (Gmt+09:00)

1 Min read