KT&G claims sweeping victory against activist funds

The cigarette maker pushes through with its 2022 dividend payout ratio, about half of FCP's demands

By Mar 28, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Activist funds such as Singapore-based Flashlight Capital Partners Pet. (FCP) on Tuesday failed to gain approval on almost all of their proposals made to South Korea’s KT&G Corp., including doubling their dividend payments to 1.2 trillion won ($920 million).

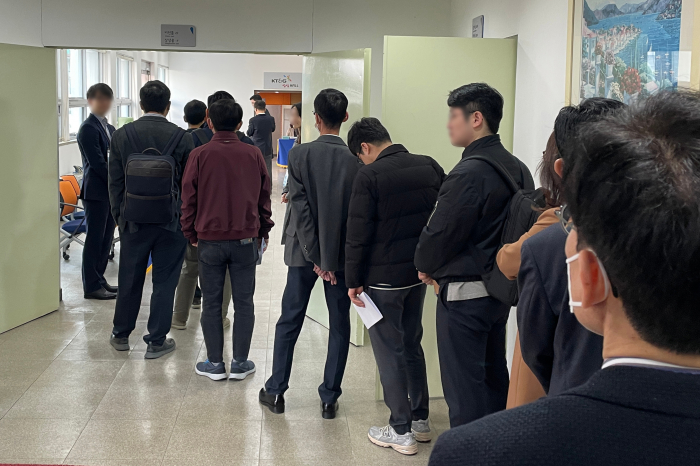

As the world's fifth-largest tobacco maker faced a voting showdown with FCP and Seoul-based Anda Asset Management Co., a total of 34 items were put to the vote during the annual general meeting (AGM).

Among the agenda items, a majority of KT&G’s shareholders vetoed the activist funds' calls for increasing the number of outside board members from six to eight and involving general shareholders in the decision-making process for share buybacks and cancellations.

FCP and Anda Asset led the shareholder activism ahead of the AGM. The two activist shareholders argued that KT&G had enough cash to bump up dividend payments and needed to keep pace with its global peers in that regard.

All agenda items tabled by the two activist funds were rejected, or failed to be put to the vote, except for the introduction of quarterly dividend payouts, which incidentally had already got the nod from KT&G management.

The two funds had been expected to fight an uphill battle against KT&G, after South Korea’s National Pension Service (NPS) last week expressed its support for the cigarette maker.

The NPS has a 7.08% stake in KT&G as of end-2022 as the single largest shareholder. Individual shareholders account for 62.9% of KT&G’s shares outstanding.

The two activist funds’ ownership of the company is estimated to be less than 1% each.

Regarding dividends, KT&G won shareholder approval for its proposed 5,000 won ($3.9) per share, half of FCP’s demand of 10,000 won. Anda Asset had called for 7,867 won.

CEMENTED LEADERSHIP

The AGM results will help KT&G Chief Executive Baek Bok-in cement his leadership at the cigarette maker, which he has been spearheading for eight years.

About 81% of its shareholders with voting rights participated in the AGM, including their proxies and those casting ballots electronically.

The AGM was pushed back by one and a half hours as the company thoroughly reviewed shareholder proxies amid the fierce battle with the activist funds.

KT&G has been the intermittent target of foreign activist funds for some time given its steady stream of cash flow and low dividend payout ratio relative to its global peers.

In the mid-2000s, US billionaire Carl Icahn and hedge fund manager Warren Lichtenstein pushed KT&G to spin off its cash cow ginseng and real estate assets, as well as increase dividend payouts and buy back shares.

In 2022, KT&G earned 1.1 trillion won in operating profit on sales of 3.7 trillion won. Its operating profit has hovered in the 1 trillion won range over the past 10 years.

In November of last year, KT&G bought back 356.8 billion won worth of its own shares in the market.

This year, KT&G plans to spend an additional 300 billion won to buy back its treasury shares and 590 billion won to pay dividends, according to its regulatory filing in January.

CEO Baek pledged to lift its sales to 10 trillion won by 2027, more than double the 2022 revenue.

But KT&G may need to continue to fight a battle with activist shareholders. FCP, led by Lee Sang-hyun, a former head of The Carlyle Group’s South Korean operations, seems unlikely to back down.

Shares in KT&G have extended their decline due to uncertainties ahead of the AGM. On Tuesday, the stock closed 2.4% lower at 85,400 won.

Write to Jiyoon Yang at yang@hankyung.com

Yeonhee Kim edited this article.

-

Shareholder activismKT&G’s hidden saviors in activist fight: In-house funds

Shareholder activismKT&G’s hidden saviors in activist fight: In-house fundsMar 06, 2023 (Gmt+09:00)

2 Min read -

Shareholder activismS.Korea’s KT&G engulfed in lawsuit against activist funds

Shareholder activismS.Korea’s KT&G engulfed in lawsuit against activist fundsFeb 24, 2023 (Gmt+09:00)

2 Min read -

Shareholder activismKT&G potential target of aggressive activist shareholder

Shareholder activismKT&G potential target of aggressive activist shareholderFeb 22, 2023 (Gmt+09:00)

3 Min read