Samsung Group

Samsung Group hires governance expert for unprecedented reorganization

South Korea's top conglomerate aims to strengthen ESG, reinstate heir Jay Y. Lee

By Apr 11, 2022 (Gmt+09:00)

5

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Last month, Samsung recruited Daniel Oh, the former managing director of corporate governance at Morrow Sodali, a global consultancy that offers comprehensive governance and shareholder services to corporate clients. Oh now boasts the second-highest position at Samsung Electronics' investor relations team after Ben Suh, the company’s executive vice president.

Between 2016 and 2019, the 48-year-old led the corporate reorganization of the world’s second-biggest mining company Barrick Gold Corp.

Oh was an executive of multinational investment management firm BlackRock, Inc. from 2014 to 2016. The Massachusetts Institute of Technology (MIT) graduate also worked at Institutional Shareholder Services (ISS) between 2008 and 2013.

Those familiar with Oh told The Korea Economic Daily that he has a full Rolodex of contacts at institutional investors and voting rights advisory firms.

The new hire is responsible for creating the blueprint for Samsung's corporate restructure and drumming up cooperation and support from institutional investors for the shareholder meeting agenda, sources said.

Another task for Oh is to pave the way for co-Vice Chairman of Samsung Electronics Jay Y. Lee’s appointment to the executive director post in the next several months. Lee was released on parole from prison in August 2021.

ACTIVIST FUNDS

Industry insiders are hopeful that Oh will expedite the long-awaited reorganization process as the chaebol has been aiming to eliminate risks related to the current structure.

All eyes are on whether Oh can prepare the Samsung Group against preemptive strikes by activist funds and seek consent from existing shareholders.

The worst-case scenario for Samsung Electronics is for activist shareholders to form an alliance with foreign investors and minority shareholders to put a stop to the governance restructuring plan.

For Samsung to go through with the wanted change, sales, division changes and mergers and acquisitions must be approved at shareholder meetings. And the group is worried about resistance from activist shareholders and their allies.

US investment management firm Elliott Management Corp. vetoed the merger of Samsung C&T Corp. and Cheil Industries back in 2015. Elliott, one of the largest activist funds in the world, was also against the restructuring of Hyundai Mobis and Hyundai Glovis Co. in 2018.

If a similar situation arises, Samsung is counting on Oh and his team to provide analytical research on voting rights by foreign consultancies and more to sway investor sentiment.

RACE AGAINST TIME

Samsung, like other Korean conglomerates, is simply pressed for time.

The Financial Services Commission made it mandatory for companies with more than two trillion won ($1.6 billion) in market capitalization to report their ESG progress from 2025. To meet this requirement, the group embarked on a governance reorganization journey in 2013.

When the Fair Trade Commission ordered it to resolve the issue of cross-shareholding, the group launched a series of M&As and began consolidating shares.

Samsung was able to disconnect what had amounted to more than 80-something cross-shareholding ties as of 2013, bringing that number down to zero in 2018.

Cross-shareholding means that firms possess each other’s shares. Conglomerates use this method to increase subsidiaries.

For instance, company A makes contributions to company B, company B to C, with company C making contributions back to company A.

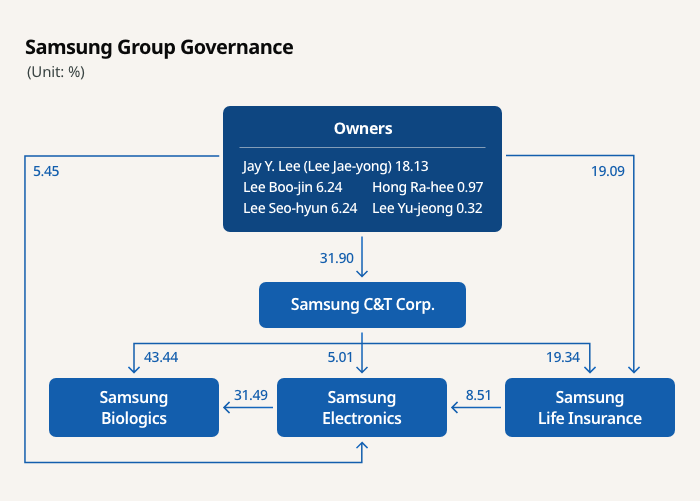

Jay Y. Lee is the grandson of Samsung Group founder Lee Byung-chul. The current leader of Samsung and his extended family members have a combined 31.9% stake in Samsung C&T Corp.

The Lee family’s stake in the acting holding company gets funneled into Samsung Life Insurance and Samsung Electronics, in that order.

Due to this structure, even though Lee has only a 1.63% direct stake in Samsung Electronics, he can exercise power as if he were its largest shareholder.

While the group has been trying to streamline the governance, Lee’s return to prison last year caused a delay in the execution. On Jan. 18, 2021, the Seoul High Court sentenced Lee to two years and six months behind bars after finding him guilty of embezzlement and bribery.

PRESIDENTIAL PARDON

The Samsung leadership appears to be bullish on the possibility of a presidential pardon for the group’s heir.

Once pardoned, industry watchers say Lee’s full return to power at Samsung Group will likely be put to vote at next year’s shareholder meeting.

One of the most important tasks for the new hire Oh will be to make sure that there are no grounds or incentives for institutional investors to oppose the pan-Samsung plan.

Write to Ji-Eun Jeong, Ik-Hwan Kim at jeong@hankyung.com

Jee Abbey Lee edited this article.

More to Read

-

Shipping & ShipbuildingSamsung Heavy set for 2023 turnaround after 8-year losses

Shipping & ShipbuildingSamsung Heavy set for 2023 turnaround after 8-year lossesApr 11, 2022 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsSamsung Asset Mgmt. buys 20% stake in US ETF sponsor Amplify

Mergers & AcquisitionsSamsung Asset Mgmt. buys 20% stake in US ETF sponsor AmplifyApr 01, 2022 (Gmt+09:00)

1 Min read -

Samsung GroupSamsung to work with Western Digital on next-gen storage technology

Samsung GroupSamsung to work with Western Digital on next-gen storage technologyMar 31, 2022 (Gmt+09:00)

1 Min read -

Samsung GroupSamsung heirs sell Samsung Elec shares for $1.1 bn

Samsung GroupSamsung heirs sell Samsung Elec shares for $1.1 bnMar 24, 2022 (Gmt+09:00)

2 Min read -

Samsung GroupSamsung family set to sell $320 mn worth of Samsung SDS shares

Samsung GroupSamsung family set to sell $320 mn worth of Samsung SDS sharesMar 22, 2022 (Gmt+09:00)

1 Min read

Comment 0

LOG IN