Samsung Electronics

Samsung narrows gaps fast with image sensor market leader Sony

Aug 04, 2020 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Samsung Electronics Co. is narrowing gaps fast with Sony Corp., the global leader in image sensors, which are widely used in smartphone cameras and other electronics.

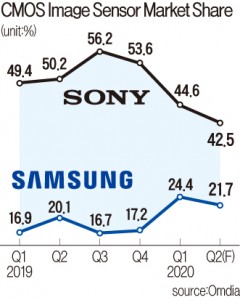

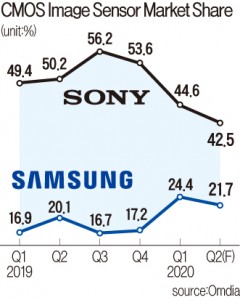

According to market researcher OMDIA, the global market share gap in the CMOS image sensor between Sony and Samsung has narrowed significantly this year.

Sony’s global market share, which rose to as high as 56.2% in the third quarter of 2019, fell to an estimated 42.5% in the second quarter of 2020.

In the same period, the market share of Samsung, the world’s No. 2 image sensor maker, rose to 21.7% from 16.7%, narrowing the gap with the Japanese company to 20.8 percentage points from 39.5 percentage points.

A CMOS (complementary metal-oxide-semiconductor) sensor, also known as an active pixel sensor, is an electronic chip that converts photons to electrons for digital processing. CMOS sensors create images in digital cameras of different kinds. Image sensors have various applications such as fault detection, entertainment, medical application, and others.

RISING DEMAND FOR IMPROVED IMAGING SOLUTIONS

Rising demand for improved imaging solutions and increasing penetration of image sensors are driving the overall image sensor market, with its key applications spreading to other areas, including smartphones, self-driving cars and smart factories.

Analysts attribute Samsung’s advancement in the image sensor market to the increase in shipments of its high-end products and a growing client base such as Chinse electronics firm Xiaomi Corp.

“Image sensors are one of the three key products of Samsung in its system chip product lines that can become the world’s number one,” said Inyup Kang, head of System LSI Business & President at Samsung.

Samsung, the world's largest memory chipmaker, began the mass production of image sensors in 2002, taking advantage of its top-notch chipmaking technology.

In November last year, the South Korean electronics giant released its 108-megapixel ISOCELL bright HMX, the industry’s first mobile image sensor to exceed 100 million pixels.

Samsung’s bigger rival, Sony, features a 64-million-pixel image sensor in its top-line products.

“Samsung’s ISOCELL bright HMX models are high-value products with good quality that fetch big money,” said a local semiconductor industry official.

Samsung supplies the product to such Chinese companies as Xiaomi, Guangdong OPPO Mobile Telecommunications Corp., Vivo Communication Technology Co. and Motorola, a subsidiary of China’s Lenovo Ltd.

COVID-19 PLAYS ROLE IN SAMSUNG'S GREATER MARKET SHARE

The global spread of the Covid-19 coronavirus also played a role in Samsung’s greater market share, as many U.S. consumer electronics companies are delaying the launch of new products, using Sony's image sensors, while Samsung’s major clients in China have raised their order volumes of image sensors.

Multiple companies have brought cutting-edge image sensors to the market recently, including Toshiba, Sony, Samsung and SK Hynix Inc., amid rising demand for improved imaging solutions.

SK Hynix unveiled new CMOS image sensors under the brand “Black Pearl,” targeting a mid-tier market last year. Its market share rose from around 2% in 2019 to 3.4% in the second quarter of this year.

Samsung plans to focus on high-end products to raise its market share as the global market of high-resolution image sensors are estimated to rise at an average annual rate of 87% until 2024.

Sony is building a 100 billion yen (1.127 trillion won) image-sensor production line in Nagasaki Prefecture, with a view to completing it by 2021. The Japanese company aims to raise its global market share to 60% in 2025.

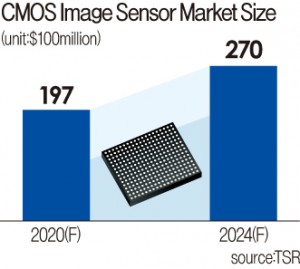

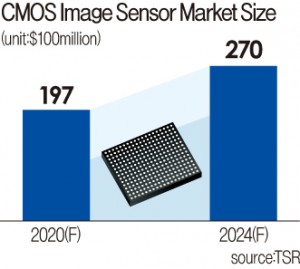

According to market researcher TSR, the CMOS image sensor market is expected to grow to 32.2 trillion won ($27 billion) in 2024 from 22.7 trillion won ($19.7 billion) this year.

By Hwang Jeong-Soo

hjs@hankyung.com

According to market researcher OMDIA, the global market share gap in the CMOS image sensor between Sony and Samsung has narrowed significantly this year.

Sony’s global market share, which rose to as high as 56.2% in the third quarter of 2019, fell to an estimated 42.5% in the second quarter of 2020.

In the same period, the market share of Samsung, the world’s No. 2 image sensor maker, rose to 21.7% from 16.7%, narrowing the gap with the Japanese company to 20.8 percentage points from 39.5 percentage points.

A CMOS (complementary metal-oxide-semiconductor) sensor, also known as an active pixel sensor, is an electronic chip that converts photons to electrons for digital processing. CMOS sensors create images in digital cameras of different kinds. Image sensors have various applications such as fault detection, entertainment, medical application, and others.

RISING DEMAND FOR IMPROVED IMAGING SOLUTIONS

Rising demand for improved imaging solutions and increasing penetration of image sensors are driving the overall image sensor market, with its key applications spreading to other areas, including smartphones, self-driving cars and smart factories.

Analysts attribute Samsung’s advancement in the image sensor market to the increase in shipments of its high-end products and a growing client base such as Chinse electronics firm Xiaomi Corp.

“Image sensors are one of the three key products of Samsung in its system chip product lines that can become the world’s number one,” said Inyup Kang, head of System LSI Business & President at Samsung.

Samsung, the world's largest memory chipmaker, began the mass production of image sensors in 2002, taking advantage of its top-notch chipmaking technology.

In November last year, the South Korean electronics giant released its 108-megapixel ISOCELL bright HMX, the industry’s first mobile image sensor to exceed 100 million pixels.

Samsung’s bigger rival, Sony, features a 64-million-pixel image sensor in its top-line products.

“Samsung’s ISOCELL bright HMX models are high-value products with good quality that fetch big money,” said a local semiconductor industry official.

Samsung supplies the product to such Chinese companies as Xiaomi, Guangdong OPPO Mobile Telecommunications Corp., Vivo Communication Technology Co. and Motorola, a subsidiary of China’s Lenovo Ltd.

COVID-19 PLAYS ROLE IN SAMSUNG'S GREATER MARKET SHARE

The global spread of the Covid-19 coronavirus also played a role in Samsung’s greater market share, as many U.S. consumer electronics companies are delaying the launch of new products, using Sony's image sensors, while Samsung’s major clients in China have raised their order volumes of image sensors.

Multiple companies have brought cutting-edge image sensors to the market recently, including Toshiba, Sony, Samsung and SK Hynix Inc., amid rising demand for improved imaging solutions.

SK Hynix unveiled new CMOS image sensors under the brand “Black Pearl,” targeting a mid-tier market last year. Its market share rose from around 2% in 2019 to 3.4% in the second quarter of this year.

Samsung plans to focus on high-end products to raise its market share as the global market of high-resolution image sensors are estimated to rise at an average annual rate of 87% until 2024.

Sony is building a 100 billion yen (1.127 trillion won) image-sensor production line in Nagasaki Prefecture, with a view to completing it by 2021. The Japanese company aims to raise its global market share to 60% in 2025.

According to market researcher TSR, the CMOS image sensor market is expected to grow to 32.2 trillion won ($27 billion) in 2024 from 22.7 trillion won ($19.7 billion) this year.

By Hwang Jeong-Soo

hjs@hankyung.com

In-Soo Nam edited this article

More to Read

-

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessions

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessionsApr 30, 2025 (Gmt+09:00)

-

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, GoogleApr 30, 2025 (Gmt+09:00)

-

EnergyLS Cable breaks ground on $681 mn underwater cable plant in Chesapeake

EnergyLS Cable breaks ground on $681 mn underwater cable plant in ChesapeakeApr 29, 2025 (Gmt+09:00)

-

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice Obstfeld

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice ObstfeldApr 29, 2025 (Gmt+09:00)

-

Comment 0

LOG IN