Retail

Retailers rely on property redevelopment as earnings sag

Selling or redeveloping big retailers' store buildings becomes a matter of survival to compete with e-commerce rivals

By Jun 24, 2022 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

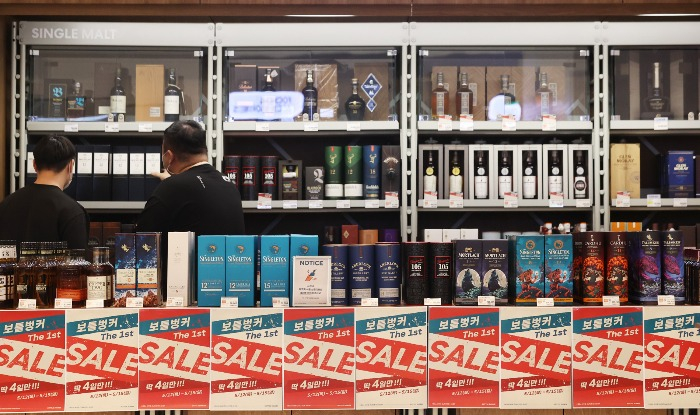

South Korea’s large retailers are keen on redeveloping their decades-old stores into modern residential and commercial complexes as a way out of financial difficulties, after the rise of e-commerce platforms brought their heyday to an end.

Homeplus, owned by private equity firm MBK Partners, is the most aggressive among local retailers in redeveloping the retailer's stores.

It sold the supermarket chain’s two buildings in Ansan, Gyeonggi Province and central Busan, the country’s biggest harbor city, to real estate developers. Homeplus will lease back spaces of the properties once their redevelopment is finished.

Other big retailers such as E-Mart Inc., Lotte Mart and E-Land Group are looking to redevelop their store buildings as well.

E-Mart focuses on increasing its corporate value by redeveloping the properties occupied by E-Mart. It runs the largest number of stores in Seoul as the country’s top retailer and owns nearly 90% of its store buildings. Almost all of them are located in downtown or middle-class neighborhood.

“We’re looking to redevelop E-Mart stores into residential and commercial complexes jointly with Shinsegae Engineering & Construction for medium to long-term plans,” said a Shinsegae Group official.

The Korea Chainstores Association is preparing to submit petitions to the government and parliament to facilitate such industry-wide efforts, an official of the lobby group said on Thursday.

He described big retailers' push to redevelop their stores as a matter of survival following dismal earnings in the first quarter.

GOOD LOCATIONS

E-Land Group is considering redeveloping its retail store building in Jamwon-dong, an upscale neighborhood of southern Seoul. The property houses its popular Newcore outlet and supermarket chain Kim’s Club.

“Redeveloping large retailers’ stores, built two or three decades ago, may be able to revitalize their neighborhood commercial district,” said a real estate developer.

MBK is also tapping real estate developers to sell the Homeplus building in a luxury neighborhood in Busan, in proximity to one of the country’s most beautiful beaches Haeundae.

MBK hopes the Homeplus property in Haeundae, estimated at 300 billion to 400 billion won in value, to be transformed into a high-rise residential and commercial complex.

WAREHOUSES, CHARGING STATIONS

Unlike big-box retail stores in the US and other developed countries, where big-box retail stores are about one-hour drive away from downtowns, large shopping malls in South Korea are situated in downtown or in the areas packed with high-rise apartment buildings.

Retail heavyweights are also converting part of their offline stores into warehouse spaces to store goods for online customers, or charging stations for electric vehicles.

For example, E-Mart’s e-commerce unit SSG.COM uses the offline stores as it warehouses to cut delivery times in the region.

To beef up delivery services, Homeplus is cooperating with Mesh Korea, the operator of deliver app Vroong, to better compete with online competitors, including Coupang Corp., Market Kurly and E-Mart’s SSG.COM.

REGULATIONS

Behind such moves are decade-long regulations that hamper large retail stores’ growth in both online and offline spaces.

Under the current laws aimed at protecting small shops and traditional malls, large supermarkets must close by midnight and shut their doors twice a month. The laws make it difficult for them to handle online orders placed overnight.

The COVID-19 pandemic has accelerated the shift toward e-commerce platforms.

Underscoring such trnds, E-Mart’s first-quarter operating profit plunged 72% to 34.5 billion won ($27 million) from a year earlier on a consolidated basis, despite an 18.8% on-year increase to 7 trillion won in sales.

Write to Dong-Hui Park and Jong-Kwan Park at donghuip@hankyung.com

Yeonhee Kim edited this article

More to Read

-

-

Korean stock marketE-Mart, Lotte Shopping hit by US retailers' earnings shocks

Korean stock marketE-Mart, Lotte Shopping hit by US retailers' earnings shocksMay 20, 2022 (Gmt+09:00)

2 Min read -

Comment 0

LOG IN