Multifamily emerges as Korean LPs’ top real estate pick for 2023

Hotel and retail are the asset types they most want to decrease; senior secured loans are the preferred tranche, given downside protection

By May 03, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

The Korea Economic Daily conducted a survey earlier this year of 22 major Korea institutional investors, including pension funds, mutual aid associations and insurers. Together they manage 2.11 quadrillion won ($1.59 trillion) in assets. Of the 22 investors, 20 manage 411.4 trillion won ($308.9 billion) in alternative assets. The investors were polled before the collapse of Silicon Valley Bank.

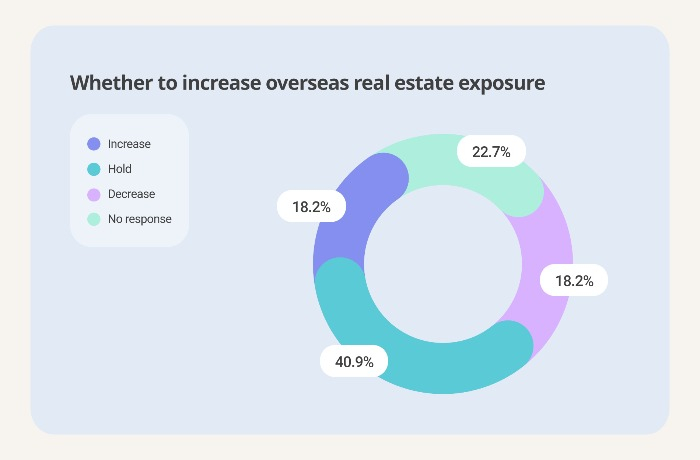

Real estate was the least popular asset class with Korean limited partners (LPs) this year. Only 18.2% will increase exposure to it in 2023, while 40.9% will hold the current proportion. Another 18.2% will decrease it, and the remaining didn’t answer given undecided plans.

The surveyees expect global real estate to experience repricing. Some 59.1% said the asset class is highly or moderately overpriced; 27.3% thought it is fairly valued, while 13.6% didn’t respond. None of the investors said it is undervalued.

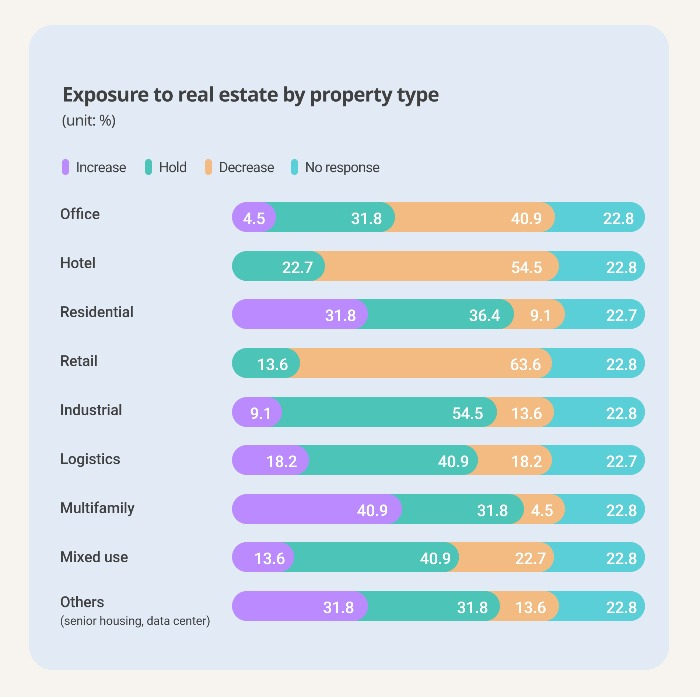

Korean LPs preferred multifamily in hopes that growing populations in major cities will steadily increase demand for living space. Some 40.9% of the surveyed investors plan to increase exposure to the essential living segment; residential, a similar property type, ranked second, winning 31.8% of their votes.

Some oversupply and high rents of global warehouses have soured Korean investors’ appetite for logistics. The property type, the No. 1 choice by Korean LPs in the poll conducted last year, gained only 18.2% of the votes.

Hotel and retail, which were hard hit by the pandemic, saw the lowest demand for the second straight year. None of the surveyed investors plan to increase exposure to these sectors; some 54.5% and 64.6% will decrease their proportion of hotel and retail, respectively.

Other types, such as senior housing and data centers, won 31.8% of the votes thanks to the rapidly increasing elderly population and soaring demand for tech infrastructure.

The surveyees have become more conservative in choosing tranches for real estate investment.

Their favorite tranche was senior secured loans, which have the strongest downside protection, for two consecutive years. Some 40.9% said they will raise exposure to the tranche, up from 30.8% last year. About 36.3% will maintain the current proportion of the tranche, and no investors plan to cut it, the survey found.

Mezzanine and subordinated loans won 27.3% and 13.6% of the LPs’ votes, respectively. Equity, the riskiest tranche, was the least preferred choice with only 4.5%.

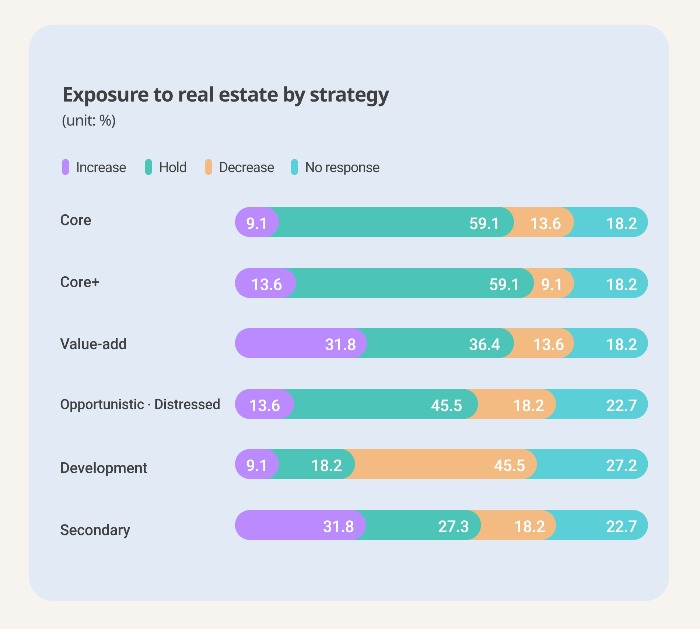

Value-add, which targets significant gains from sales of well-renovated property, and secondary, featured with the potential of sooner exit and less duration risk, together topped real estate strategy with 31.8%. Development was least favored due to rising construction costs and interest rates.

As in the polls on other asset classes, North America was the favorite region for real estate investment. Some 31.8% will increase properties in the region, and 45.5% will maintain the current asset size. Only 4.5% will reduce exposure to the continent; the remaining didn’t respond.

Their second pick was Europe. About 22.7% plan to expand European real estate, while 59.1% will hold the current proportion. None of the surveyees plan to cut real estate assets in the region. Asia was the least favored continent, winning only 18.2%. About 36.4% will hold the current exposure, and 22.7% will reduce it.

In multiple choices allowing up to two picks, 11 LPs selected closed-end funds as the best vehicles for real estate investments. Open-end funds and joint ventures respectively won seven and five votes; direct investment and separately managed accounts each gained three votes.

To view responses of individual institutions on their alternative asset allocation and fund manager selection, please visit Asset Owners Report.

Participants in this survey are as follows:

Public pensions and SWFs

National Pension Service

Korea Investment Corporation

Government Employees Pension Service

Teachers' Pension

Korea Post (Insurance)

Mutual aids & associations

Yellow Umbrella Mutual Aid Fund

Military Mutual Aid Association

Public Officials Benefit Association

Korean Federation of Community Credit Cooperatives

The Korean Teachers' Credit Union

Insurers

Kyobo Life Insurance

Samsung Life Insurance

NongHyup Life Insurance

NongHyup Property and Casualty Insurance

Meritz Fire & Marine Insurance

Samsung Fire & Marine Insurance

Shinhan Life Insurance

Hanwha Life Insurance

Hyundai Marine and Fire Insurance

ABL Life Insurance

KB Insurance

KB Life Insurance

Write to Jihyun Kim at snowy@hankyung.com

Jennifer Nicholson-Breen edited this article.

-

Alternative investmentsClean energy remains top pick for Korean infrastructure investors

Alternative investmentsClean energy remains top pick for Korean infrastructure investorsApr 28, 2023 (Gmt+09:00)

4 Min read -

Private equityMore Korean LPs look to buyouts, special situations for private equity

Private equityMore Korean LPs look to buyouts, special situations for private equityApr 24, 2023 (Gmt+09:00)

4 Min read -

Private debtDirect lending tops private debt strategy again for Korean LPs

Private debtDirect lending tops private debt strategy again for Korean LPsApr 26, 2023 (Gmt+09:00)

4 Min read -

Asset Owners ReportS.Korean LPs to up exposure to private debt, infrastructure in 2023: Survey

Asset Owners ReportS.Korean LPs to up exposure to private debt, infrastructure in 2023: SurveyApr 19, 2023 (Gmt+09:00)

3 Min read