Specialty income by preferred securities, commercial MBS

The two asset types will provide attractive opportunities in 2023, given the spreads over investment grade credit

Apr 17, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

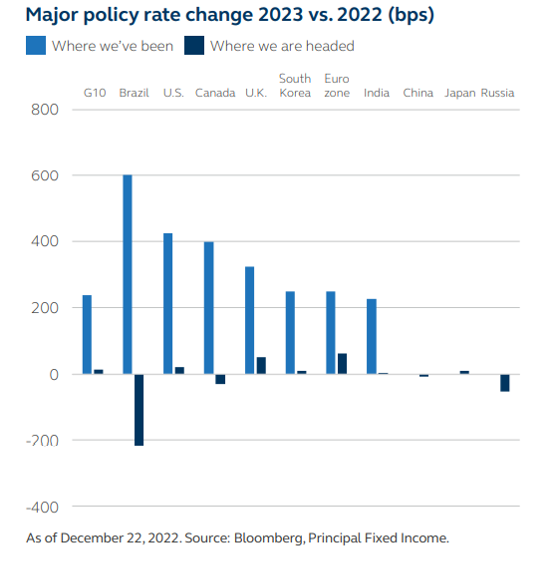

With a hamstrung US Federal Reserve, the global outlook for 2023 is one of cautious optimism for fixed income. As the Fed is unable to readily rescue the economy, global policymakers are factoring in a sharp drop in growth to tone down the pace of policy tightening.

This is despite expectations of moderating, though still elevated, inflationary pressures — a trajectory that could be cushioned by high yield levels in fixed-income markets after this year’s correction. This provides a welcome respite/reset from 2022.

That said, risks remain. Central bank balance sheets have become bloated following a decade of on-and-off quantitative easing and need some release.

The Bank of England already started asset sales in November and the European Central Bank pledged to taper in March of 2023. The Bank of Japan eased up on the yield curve control gas pedal in its most recent major central bank policy action this year, a necessary precursor to a broader reduction of policy accommodation.

The Fed will likely also look for opportunities this year to shrink its balance sheet. Care will be taken to not disrupt markets, although the execution will be extremely challenging.

The combination of elevated inflation, restrictive monetary policy, and slowing global growth present unique challenges for investors. However, select opportunities remain attractive. Given their spreads over investment-grade credit, two asset classes for investors to consider are commercial mortgage-backed securities (CMBS) and preferred securities.

▲ What are preferred and capital securities?

Preferred securities have been an attractive fixed-income sector for investors around the world for many years, but they are still not widely understood. Preferred securities, often known as “preferred” or “hybrids,” are similar but not the same as more traditional preferred or preference shares.

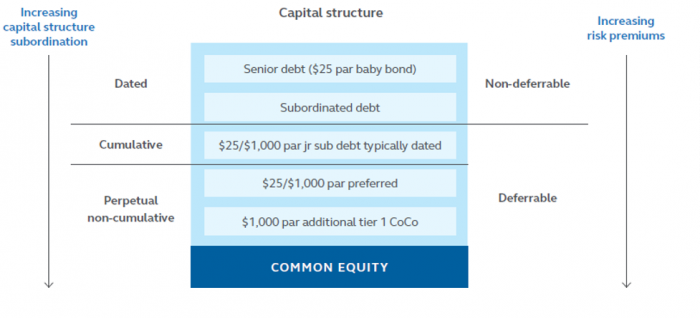

Preferred and capital securities are fixed-income securities that, in the issuer’s capital structure, generally rank junior to senior debt and bank loans, but rank senior to common stock. Preferred securities and other capital securities are deeply subordinated in the capital structure and can typically defer or skip payments without creating a default.

Preferred securities are issued mainly by large banks and insurance companies for regulatory and rating agency capital purposes. Similar to other fixed-income investments, preferred securities' performance can be affected by interest rates and credit risk.

▲ What are the types of preferred and capital securities that investors need to pay attention to?

First, baby bonds. Senior debt is structured and issued as $25 par instruments, meaning that each bond has a stated par value of $25 with a specific, dated maturity. Baby bonds appeal to retail investors who ordinarily cannot participate in the institutionally traded senior debt and $1,000 capital security markets. Baby bonds are usually listed on securities exchanges such as the New York Stock Exchange (NYSE).

Second, subordinated debt. Junior to senior debt frequently plays some role in meeting regulatory capital requirements for insurance companies. Subordinated debt usually has a specific, stated maturity and coupons are typically not deferrable.

Third, cumulative junior-subordinated debt and non-cumulative preferred securities. Comprising the majority of the preferred and capital securities market, these rank junior to baby bonds and subordinated debt and have coupons that can be deferred.

The most senior of these securities are $25 par and $1,000 par junior-subordinated debt instruments (typically bonds with long-dated maturities or perpetuities) having cumulative coupons.

These are generally issued by insurers, utilities and industrial companies. “Cumulative” means that any deferred coupons continue to accrue as a liability to the issuer. Non-cumulative perpetual preferreds are subordinated to cumulative preferreds.

Non-cumulative perpetual preferreds include both $25 par and $1,000 par dividend-paying preferreds, largely additional tier 1 (AT1) securities of US banks.

AT1 contingent convertible (CoCos) capital securities: A recent form of capital issued by non-US, mostly European banks as part of newer regulations following the global financial crisis. CoCos are structured as junior, non-cumulative perpetual securities, the coupons of which can be skipped at any time.

In addition, if the issuer’s regulatory common equity capital drops below certain pre-set levels, the CoCo will either be written down in par value (sometimes with the ability to be written back up later if the issuer’s capital improves), written off completely or converted into common stock, depending on the terms of the structure. US banks do not currently issue CoCos due to different tax laws in the country.

▲ What are commercial mortgage-backed securities (CMBS)?

Generally speaking, CMBS are fixed-rate bonds that represent an investment in a portfolio of first mortgages on a diverse range of commercial properties. This type of CMBS is commonly referred to as “conduit” CMBS. A first mortgage is the primary lien against a property and takes precedence over all other mortgages.

That means that if the property is sold or if the borrower defaults, the first mortgage is paid before any other mortgage lien on the property. CMBS is a hybrid of fixed-income and real estate investments. While a CMBS investment involves the purchase of a bond, the bond is backed by commercial real estate mortgages.

There are different types of CMBS in the market (see below table), conduit CMBS has been the focus of this piece but the asset class has evolved to include other sub-sectors, which offer investors a more diverse set of opportunities that can be accessed to meet a wide variety of investment needs.

| CMBS in a variety of forms | |

| Conduit CMBS | Diversified pools of mortgages on office, retail, industrial, hotel, and apartment properties |

| Single Asset / Single Borrow (SASB) | Collateral consists of a single large "trophy" property or a portfolio of assets owned by the same borrower |

| Agency CMBS | CMBS issued by Fannie Mae or Freddie Mac backed exclusively by mortgages on apartments |

CMBX |

Conduit CMBS index exposure. Credit default swap contracts that reference baskets of 25 underlying bonds. |

▲ Why consider CMBS and preferreds now versus corporates?

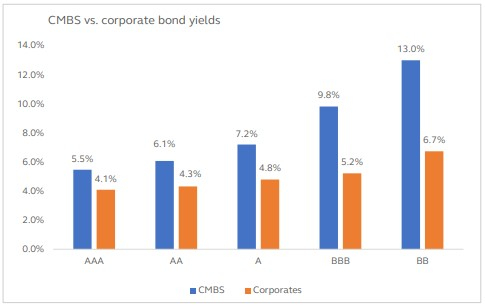

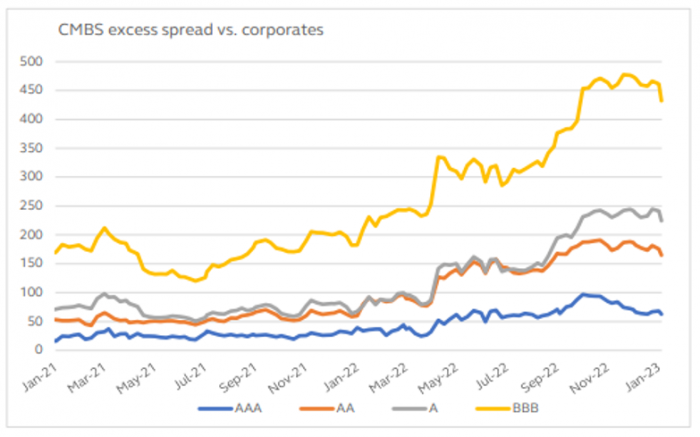

CMBS is an attractive real estate investment to get into in 2023 and one which tends to be overlooked by investors. CMBS market yields have risen materially due to rising treasury rates and widening credit spreads. Debt is “en vogue” again as current yield levels may reach investor targets that previously kept them out of the market. Higher rates and wider spreads have created a potentially attractive relative value landscape for CMBS. Excessive liquidity premiums have resolved, and the credit curve has steepened as fundamental risk takes center stage, warranting a balanced approach.

CMBS spreads have dislocated from historical relationships with corporate bonds as risk premiums remain elevated due to the negative impact that a recession may have on demand for commercial real estate and the longer-term concern on office property fundamentals. A diversified CMBS strategy that considers both recession and office risk potentially offers an attractive risk-return profile for investors.

CMBS BB data is based on indicative market estimates as these securities exhibit a wide trading range based on perceived credit quality

The CMBS market is expected to continue to play an important role in the refinancing of transactions as the market starts to stabilize and recover. These types of assets tend to be very efficient sources of capital as well as good aggregators of capital. Investors can expect CMBS deal activity to pick up again in the second half of this year.

On the preferred side, the outlook is positive for hybrids in 2023. Credit fundamentals are sound, yields are high and prices are low, making a compelling case for high-quality preferred and capital securities for those looking for exposure to credit and duration.

Additionally, hybrids can be capital defensive as predominant fixed-to-refixed types will reset coupons, elevating prices from today’s deep discounts. Increasing fears of missing out should make any credit corrections in 2023 shallower and shorter-lived than those experienced last year.

Preferred and capital securities also offer competitive risk-adjusted yields when viewing yield, credit quality and historical defaults relative to other fixed-income alternatives, such as investment grade, corporate and high yield.

Credit quality is important to consider, especially with defaults on higher-yielding corporate bonds to increase in 2023, while the majority of preferred and capital securities are investment grade. Preferreds offer twice the spread and half the duration of investment-grade corporate bonds.

Compared to high yield, fixed-income investors are not getting paid enough incremental spread to compensate for the extreme default risk differential between preferred securities and high yield. In short, the asset class offers competitive yields relative to duration risk while not sacrificing quality.

By Phil Jacoby, CIO at Spectrum Asset Management, and Marc Peterson, CIO for CMBS at Principal Asset Management

He joined Spectrum in 1995 as a portfolio manager and most recently held the position of managing director and senior portfolio manager until his appointment as CIO on January 1, 2010.

Prior to joining Spectrum, he was a senior investment officer at USL Capital Corp., a subsidiary of Ford Motor Corp., and co-manager of the preferred stock portfolio of its US Corporate Financing Division for six years.

Peterson is chief investment officer, CMBS at Principal Real Estate, the dedicated real estate unit of Principal Asset Management. He is responsible for affiliated and non-affiliated CMBS investment strategies for Principal Asset Management with $6.7 billion assets under management.

He joined the firm in 1992. Prior to his current role, Peterson was an accountant for the Principal Financial Group.

Jennifer Nicholson-Breen edited this article.

-

Real estatePrincipal opens Seoul office to intensify client relationships

Real estatePrincipal opens Seoul office to intensify client relationshipsOct 22, 2022 (Gmt+09:00)

2 Min read -

Real estateDevelopment will outperform in post-COVID era: Principal Real Estate

Real estateDevelopment will outperform in post-COVID era: Principal Real EstateJul 22, 2022 (Gmt+09:00)

long read -

Alternative investmentsData centers in European core cities are promising, Principal head says

Alternative investmentsData centers in European core cities are promising, Principal head saysMar 16, 2022 (Gmt+09:00)

7 Min read -

Korean insurers, Shinhan Alternative commit $130 mn in KKR CMBS fund

Korean insurers, Shinhan Alternative commit $130 mn in KKR CMBS fundOct 23, 2020 (Gmt+09:00)

2 Min read