Real estate

European real estate is well-positioned for attractive relative value: M&G

Property yields will need to expand by less in Europe to restore healthy spread over bonds, says David Jackson, European property fund manager

Dec 19, 2022 (Gmt+09:00)

5

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

The war in Ukraine continues to stoke ongoing uncertainty in Europe, with the impact on energy supplies and prices likely to be felt more intensely throughout winter. Interest rate rises to tackle inflation are slowing economies – though base rates are expected to peak at a lower level than in the UK or US.

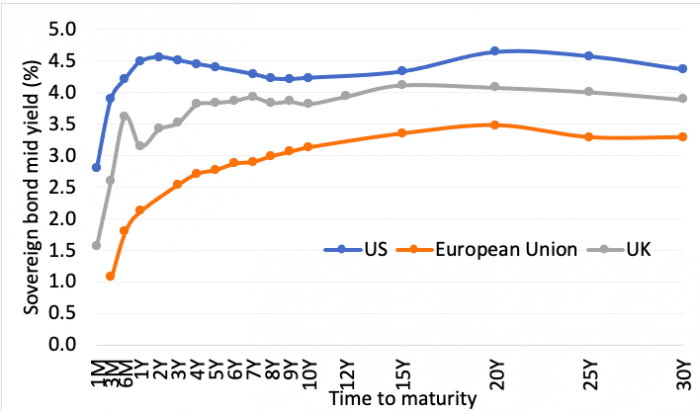

Bond yields have risen with interest rates, narrowing the risk premium of property over bonds. Yet the gap was wide to begin with, given that some European interest rates and bond yields were until recently in negative territory. Therefore, it seems that property yields will need to expand by less in Europe to restore a healthy spread over bonds.

Source: Macrobond yield curve data as of Oct. 24, 2022

Real estate markets globally are facing a price correction; likely to accentuate the divide between prime and lower-quality assets. Increasing occupier requirements mean buildings without green credentials are at risk of lower occupancy, with 'brown' discounts for older property looking set to increase.

Early repricing evidence is starkest for a property that is interest rate sensitive, including bond-like real estate that aims to tap into long-term cash flows. In the longer term, we believe core, inflation-linked property at rebased yields is likely to outperform secondary assets.

Food retail is inherently more defensive during times of economic weakness, given its essential nature. The sector is also more resilient to e-tailing, given a lower level of online food shopping compared to other retail goods.

COMPELLING STRUCTURAL DRIVERS REMAIN

Despite current risk aversion, many parts of the real estate market continue to reflect compelling structural drivers, helping to counter the impact of current upwards pressure on property yields.

The living sectors are a key example, underpinned by a long-term supply and demand imbalance. Helping to bridge the gap could therefore enable investors to tap into attractive income and growth prospects while achieving a positive social impact.

Investment values are not immune to the impact of higher interest rates but the rented market is likely to remain supported by defensive qualities, rental prospects and growing investor allocations. Furthermore, rent controls in many residential markets across Europe could help affordability for renters, while encouraging tenants to remain for longer.

Europe’s student and senior living sectors, similarly, reflect strong growth prospects. Rising numbers of students are studying abroad, seeking professionally managed accommodation, but many gateway cities remain structurally undersupplied.

With aging populations across Europe, high-quality senior housing in affluent areas is also in demand from retirees seeking community living and amenities, with the option of extra support should they need it.

Targeting best-in-class assets could optimize performance

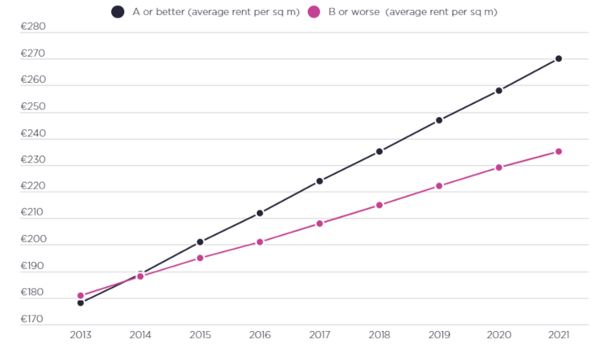

We believe capitalizing on trends that have been accelerated by the pandemic could further optimize performance. With flexible working now ingrained in European corporate culture, businesses are increasingly focused on buildings that offer an inspiring work environment, with high ESG credentials, to help attract and retain talent. This is evident in markets such as Amsterdam, where the divergence of rents is growing between energy label A and B offices, and energy efficiency regulation is becoming more stringent.

Best-in-class office buildings in major European cities are therefore positioned for resilience. Conversely, out-of-town offices and business parks face rising risks of obsolescence.

Source: Savills, June 2022

Parts of the market that are more challenged may offer a cyclical entry point for higher risk/return capital. Upgrading well-located non-core buildings to meet modern occupier requirements, or repurposing assets for residential or mixed-use, for example, could provide access to positive supply and demand drivers at attractive pricing, with the potential to generate attractive risk-adjusted returns, post-recession.

Recapitalising hotel operators with weaker balance sheets could also offer access to a potential recovery in income. Hotel revenues have been impacted by the pandemic and are now facing rising staff and energy costs. Yet the long-term outlook for hotels remains promising, underpinned by the return of international travel.

REPRICED ASSETS ARE LIKELY TO REFLECT A LONG-TERM VALUE OPPORTUNITY

European real estate remains supported by favorable fundamentals, including low vacancy and supply levels. Furthermore, most commercial leases benefit from annual rent reviews linked to the Consumer Price Index, which can provide a hedge against inflation.

A price correction will drive variation in the performance of existing portfolios, depending on the quality of assets. But it is also likely to create new investment opportunities – though investors will need to be mindful of pricing, construction costs and affordability for tenants.

Property revaluations will naturally take time to play out, but as yields reach stabilization, we believe assets are likely to reflect an attractive long-term value opportunity, with improved performance prospects.

With economic headwinds rising, steering through market volatility will require skill and perspective. History shows that it is often in the years after the recession that real estate delivers, with the potential for repricing to create the next best vintage of investments.

The views expressed in this article should not be taken as a recommendation, advice or forecast. With regard to the data and graph above, past performance is not a guide to future performance.

By David Jackson, European property fund manager at M&G

Jennifer Nicholson-Breen edited this article.

More to Read

-

Asset managementSpecialty finance emerging on resiliency, diversification: M&G Investments

Asset managementSpecialty finance emerging on resiliency, diversification: M&G InvestmentsAug 09, 2022 (Gmt+09:00)

long read -

Real estate debtM&G picks logistics, residential property for 2022

Real estate debtM&G picks logistics, residential property for 2022Oct 12, 2021 (Gmt+09:00)

long read -

M&G Real Estate to buy $1 bn Seoul building as KKR backs down

M&G Real Estate to buy $1 bn Seoul building as KKR backs downMay 04, 2018 (Gmt+09:00)

2 Min read

Comment 0

LOG IN