Real estate

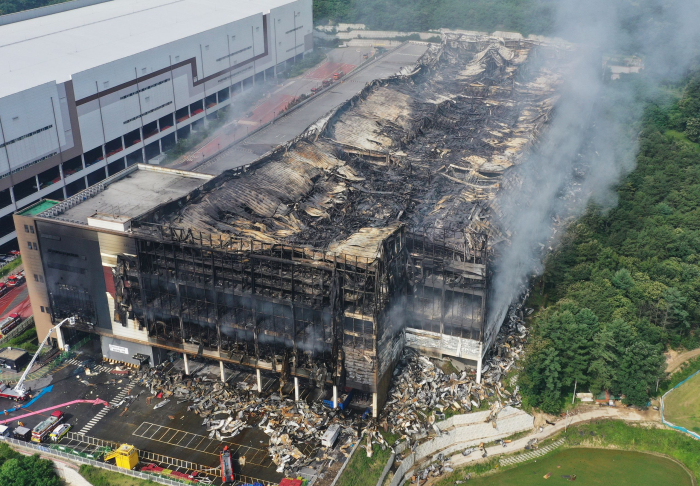

Coupang fire may cut ROI of warehouse assets

The disaster is projected to have a wide impact on Korea's warehouse segment from insurance premium to asset price

By Jun 22, 2021 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Last week’s devastating fire at a Coupang distribution center, which reportedly burned down more than 16 million items for delivery, is expected to cut return on investment (ROI) for warehouses across South Korea.

Investment banking analysts said on June 22 that the deadly fire will result in a drastic increase in premium for fire and property damage insurance in the warehouse segment. With frequent cases of fire in warehouses, the insurance premium in the segment rose by more than double over the last 2-3 years.

“The insurance premium paid by the firms is a cost that they need to bear every year, meaning that it has a direct impact on their operating expenses. The current industry ROI, slightly over 5%, will drop when the insurance firms raise their premiums,” said a representative at a major asset management firm.

Others said that South Korea’s alternative investment industry will be reshuffled with an increased influence of the asset management firms that specialize in warehouse management.

The warehouses have arguably been the country’s most preferred asset in alternative investment due to their skyrocketing demand from the growing e-commerce sector. But now with a series of large-scale fires destroying Korea’s major warehouses over the years, the government is expected to strengthen construction standards and toughen the process for construction authorization.

“After the Coupang fire, safety and ESG standards will also make up key criteria for the industrial and logistics REITs in making investment decisions. The risk of oversupply in the segment will gradually be moderated, while the industry may have a higher entry barrier with the firms that specialize in warehouse management standing out among others,” said Samsung Securities.

But the analysts also said that the demand and investor preference for the warehouses will be sustained, driven by the continued needs from the country’s major retail players including Shinsegae, Lotte as well as Coupang.

“Unless the retail industry finds a good substitute for warehouses for distribution and logistics, the demand for these buildings will continue to go up. As the warehouses are expected to keep generating stable rental income, the investors will maintain their high preference for them,” said Daishin Securities.

Some analysts added that the old warehouses that lack sufficient fire prevention facilities are likely to face a certain level of price adjustments in the market. Previously, if a warehouse was built at a good location, the trading price was maintained at a high level. But now it has become important for the warehouses to have the latest fire prevention facilities in place.

“The old and new warehouses had little price difference, as the market had been overheated. Now the market price is expected to normalize amid the growing importance of the fire control facilities,” said an investment banking official.

Write to A-young Yoon at youngmoney@hankyung.com

Daniel Cho edited this article.

More to Read

-

Alternative investmentsShinhan REITs poised to buy Amazon logistics center

Alternative investmentsShinhan REITs poised to buy Amazon logistics centerJun 04, 2021 (Gmt+09:00)

2 Min read -

ASK 2021 Panel talksKorean pension funds eye non-core global real estate

ASK 2021 Panel talksKorean pension funds eye non-core global real estateMay 14, 2021 (Gmt+09:00)

long read -

Seoul real estateDowntown Seoul office building prices rise to record high

Seoul real estateDowntown Seoul office building prices rise to record highMay 18, 2021 (Gmt+09:00)

5 Min read

Comment 0

LOG IN