KKR sells 9.5% stake in HD Hyundai Marine, recoups $450 million

The latest sale is KKR’s third significant stake sell-down following a share sale during the 2024 IPO and sales this February

By 9 HOURS AGO

South Korea’s Rznomics inks $1.3 bn out-licensing deal with Eli Lilly

Korea’s aesthetic medicine enjoys golden era with surge in foreign spending

In China’s waterway city Hangzhou, K-beauty redefines ‘shuiguang'

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Kumho Tire shuts Gwangju plant after fire, derailing record sales run

Global private equity firm KKR & Co. Inc., formerly known as Kohlberg Kravis Roberts & Co., has sold a 9.5% stake in HD Hyundai Marine Solution Co. in a block trade, recouping $450 million, or 620 billion won, from its investment in the South Korean ship repair company.

According to industry sources on Thursday, the transaction took place after market close, with KKR offloading 4.26 million shares at 145,500 won ($106) apiece, a 9.5% discount to the day’s closing price of 160,800 won.

The deal exceeded initial expectations, with proceeds surpassing the 500 billion won mark previously targeted.

The sale underscores the strong investor appetite for shares in HD Hyundai Marine, which has benefited from a global resurgence in demand for marine engineering and sustainable ship retrofitting services.

HD Hyundai Marine has seen its valuation multiply since its market debut, attracting interest from institutional investors worldwide.

KKR’S THIRD SIGNIFICANT SELL-DOWN

The sale marks the third significant sell-down by KKR since HD Hyundai Marine's initial public offering (IPO) on the Kospi main bourse in April 2024.

KKR invested 653.4 billion won in HD Hyundai Marine to acquire a 38% stake, paying 43,000 won per share, in 2021, when the ship repair firm was split off from HD Hyundai Co. With the stake, KKR was the second-largest shareholder of the company.

Following a partial exit during the IPO and a further 4.49% stake sale in February this year for 295 billion won, KKR recouped more than its original investment, amassing total proceeds of over 666.1 billion won even before the latest transaction.

Post-sale, KKR’s ownership has fallen to around 10% from 19.52% earlier.

Sources said the proceeds from the latest sale will be booked as profit, given that the original stake has already been fully monetized.

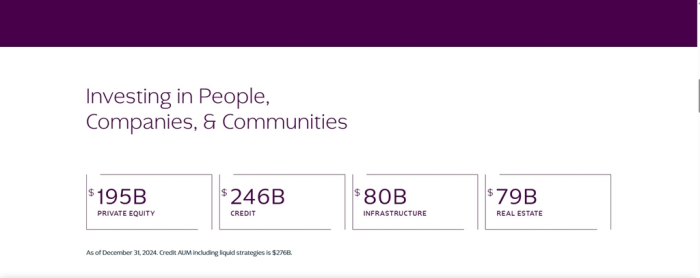

With $600 billion in assets under management at the end of 2024, New York-based KKR has been expanding its real estate and infrastructure portfolio in Korea, Asia’s fourth-largest economy.

In early Friday, shares of HD Hyundai Marine were down 3.1% at 155,900 won, versus the Kospi index’s 0.2% rise.

Over the past few months, Korea’s shipbuilding and related stocks have rallied on growing expectations of a rise in potential deals from the US under the second Donald Trump administration, which has been actively seeking ways to revamp the world’s No. 1 economy’s naval fleet to countermeasure China’s dominancy in shipbuilding sector and maritime forces.

Trump has called for Korea’s cooperation, especially in vessel maintenance, repair and overhaul (MRO).

Write to Jun-Ho Cha at chacha@hankyung.com

In-Soo Nam edited this article.

-

Private equityGeopolitics rewrite investment playbook – and that’s an opportunity: KKR

Private equityGeopolitics rewrite investment playbook – and that’s an opportunity: KKRApr 10, 2025 (Gmt+09:00)

7 Min read -

StocksKKR recoups $206 mn in block sale of HD Hyundai Marine shares

StocksKKR recoups $206 mn in block sale of HD Hyundai Marine sharesFeb 21, 2025 (Gmt+09:00)

2 Min read -

Shipping & ShipbuildingHD Hyundai Marine sets sights on LNG vessel retrofitting in Trump era

Shipping & ShipbuildingHD Hyundai Marine sets sights on LNG vessel retrofitting in Trump eraFeb 05, 2025 (Gmt+09:00)

3 Min read -

Shipping & ShipbuildingKorean shipbuilding shares surge on supercycle hope, Trump Trade

Shipping & ShipbuildingKorean shipbuilding shares surge on supercycle hope, Trump TradeJul 28, 2024 (Gmt+09:00)

3 Min read -

Shipping & ShipbuildingHD Hyundai Marine Solution aims for top spot in global ship repair market

Shipping & ShipbuildingHD Hyundai Marine Solution aims for top spot in global ship repair marketApr 03, 2024 (Gmt+09:00)

2 Min read