Private equity

Young Poong Precision to increase control over Korea Zinc

The pump and valve maker will buy additional shares in the zinc smelter worth $28 million over one year starting Dec. 28, 2022

By Dec 28, 2022 (Gmt+09:00)

1

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

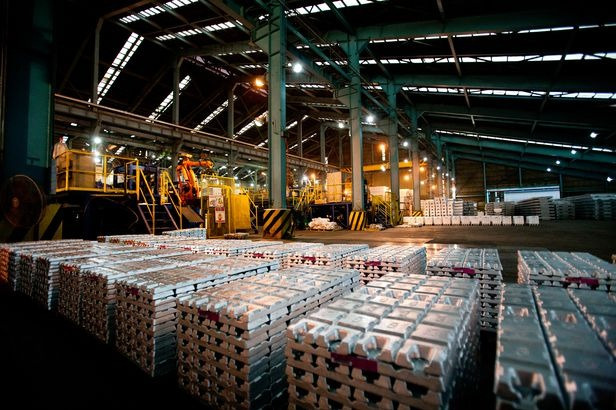

Young Poong Precision Corp., an industrial pump and chemical plant valve maker under South Korea's Young Poong Group, is aggressively increasing control over group affiliate Korea Zinc Co.

According to a disclosure on Dec. 27, Young Poong Precision will acquire 35 billion won ($27.6 million) worth of Korea Zinc shares over a year's time from Dec. 28 in order to "strengthen control of the company." The value of the shares is equivalent to 9.25% of Young Poong Precision's total assets.

The pump and valve maker has recently bought 17,611 shares of Korea Zinc from Nov. 25 to Dec. 13, increasing its holding rate to 1.57%. Once the 35 billion won transaction is complete, Young Poong Precision will own a 1.92% stake in Korea Zinc on a basis of the zinc smelter stock's closing price of 565,000 won on Tuesday.

Young Poong Group's major affiliates have been run by two owner families, Chang and Choi. Young Poong Corp., chaired by Chang Hyung-jin, controls the group's electronics and bookselling businesses. Korea Zinc Chairman Choi Yun-birm and his family control the zinc smelter and the group's non-ferrous metal affiliates.

Young Poong Precision is understood to be aggressively increasing its stake in Korea Zinc as the smelter is prepared to be spun off from the group, market speculators said.

Last month, Korea Zinc exchanged part of its treasury shares with those of LG Chem Ltd. and Hanwha Corp.

The smelter swapped a 1.97% stake (391,547 shares) for LG Chem's 0.47% (367,529 shares) in a block deal, with each stake worth 257.6 billion won. Korea Zinc also exchanged a 1.2% stake (238,358 shares) worth 156.8 billion won for Hanwha's 7.3% (5.4 million shares).

The transaction is Korea Zinc’s move to increase shareholders who will support the smelter’s future decisions, such as separating from Young Poong Group, market observers said.

Earlier this year, the gap between the Chang and Choi families' Korea Zinc shareholding rates was more than 1000 basis points. It has since shrunk to less than 400 bps due to the stock swap and Korea Zinc’s buyback of its own shares.

Write to Ik-Hwan Kim at lovepen@hankyung.com

Jihyun Kim edited this article.

More to Read

-

Leadership & ManagementYoung Poong Precision emerges as key to Korea Zinc control; shares surge

Leadership & ManagementYoung Poong Precision emerges as key to Korea Zinc control; shares surgeNov 27, 2022 (Gmt+09:00)

1 Min read -

Corporate investmentKorea Zinc exchanges treasury shares with LG Chem, Hanwha Corp.

Corporate investmentKorea Zinc exchanges treasury shares with LG Chem, Hanwha Corp.Nov 24, 2022 (Gmt+09:00)

1 Min read -

Corporate investmentKorea Zinc to invest $7.5 billion in green hydrogen, battery materials

Corporate investmentKorea Zinc to invest $7.5 billion in green hydrogen, battery materialsAug 09, 2022 (Gmt+09:00)

2 Min read

Comment 0

LOG IN