Private equity

SEMA jointly acquires stakes in US telecom tower operator

The retirement pension invests $500 million to become a Vertical Bridge shareholder

By Nov 12, 2021 (Gmt+09:00)

1

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s Korea Scientists and Engineers Mutual-Aid Association (SEMA) said on Nov. 12 that it has invested $500 million in a joint acquisition of Vertical Bridge Holdings, LLC, a major operator of wireless communication infrastructure in the US.

The joint acquisition was led by DigitalBridge Group Inc., a global real estate investment trust (REIT). The REIT in October announced that through funds affiliated with its fund management platform DigitalBridge Investment Management it completed the acquisition of a controlling stake in Vertical Bridge.

According to SEMA, DigitalBridge led the joint acquisition of a 58% stake in Vertical Bridge. A blind fund of Digital Colony Management LLC, DigitalBridge’s digital infrastructure investment firm, acquired a 10% stake, while global limited partners including SEMA jointly acquired 48% and Canada-headquartered pension fund Caisse de dépôt et placement du Québec (CDPQ) secured 30%.

Founded in 2014, Vertical Bridge has rapidly expanded its portfolio to include more than 308,000 owned or master-leased sites, including over 8,000 telecommunication towers in the US. “We expect to earn stable revenues as the entry barriers for the telecommunication tower business in the US are high and customer churn rates are low due to long-term contracts,” an official from SEMA said. “The assets have great potential in line with the growth of 5G and autonomous cars.”

DigitalBridge has invested in digital infrastructure such as cell towers, data centers, fiber and small cells. Its assets under management are $40 billion.

With an AUM of 8.9 trillion won ($7.5 billion), SEMA allocates about 60% of its total assets to alternative investment. "In addition to solar and wind energy facilities, we are looking closely at hydrogen, energy storage facilities such as batteries and infrastructure related to energy transportation and distribution, as well as the relevant technologies," SEMA’s Chief Investment Officer Huh Sung-moo said in a panel session at ASK 2021, The Korea Economic Daily's alternative investment forum held in Seoul last month.

Write to Jong-woo Kim at jongwoo@hankyung.com

Jihyun Kim edited this article.

More to Read

-

ASK 2021 Panel talksKorea scientists fund sees US-China conflict create infra investments

ASK 2021 Panel talksKorea scientists fund sees US-China conflict create infra investmentsOct 28, 2021 (Gmt+09:00)

1 Min read -

SEMA to favor PEF and PDF investments over real estate

SEMA to favor PEF and PDF investments over real estateOct 14, 2020 (Gmt+09:00)

7 Min read -

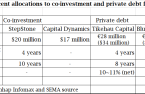

Korea scientists fund to commit $37 mn to co-investment funds; $34 mn to PDF

Korea scientists fund to commit $37 mn to co-investment funds; $34 mn to PDFMar 11, 2018 (Gmt+09:00)

1 Min read

Comment 0

LOG IN