Real estate debt outshines corporate credit: Savills IM

Many US companies relying on private credit are not generating enough free cash flow to cover their debts

Jan 14, 2025 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Private credit has been among the top picks for alternative investors over the past few years. During the period of high interest rates, corporate lending has generated higher-than-expected returns with rising corporate profit margins and high valuations.

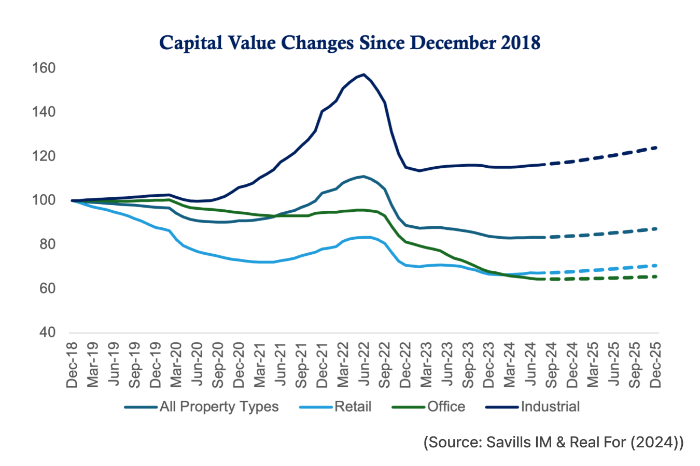

With the real estate market recovering from elevated borrowing rates and office vacancies, real estate debt is now expected to outperform other private credit strategies such as corporate and infrastructure loans.

"Now, with property values stabilizing, real estate debt presents a compelling opportunity. New loans secured against assets that have rebased lower in value give lenders a favorable position," said Cyrus Korat, co-founding partner of DRC Savills Investment Management.

Historically, real estate and corporate credit performance have been highly correlated and closely tied to the business cycle. However, their performance diverged in the high interest rate environment, he said.

Real estate debt currently offers high returns with an improving credit profile, compared to corporate credit, which faces rising defaults and stretched valuations. This makes real estate debt the more compelling option in today's market.

"Our strategy is weighted to the residential and industrial/logistic sectors because of their longer term outlook." Korat added.

"Compared with them, the retail and office sectors carry more risks, but there is also much less competition for these sectors and thus there are a greater number of 'mispriced' opportunities for their providers of capital."

SENIOR DEBT VS MEZZANINE DEBT

"We believe the most compelling opportunity right now is the provision of senior whole loans that are generally backing a property improvement loans," he noted.

In these types of loans high returns can be generated for senior risk with spreads of 4-5% over the risk free rate.

"Excess returns versus traditional senior lending are high, and compared with mezzanine, you are achieving only a fractionally lower return for a much lower risk."

Corporate credit is the largest and most accessible of the three private credit strategies, favored by large funds capable of deploying significant capital.

However, warning signs for corporate credit are starting to emerge.

The speculative grade default rate is rising and many US corporates in the private credit market are not generating enough free cash flow to cover their debts. In Europe, bankruptcies are increasing while new business formation is stagnant.

"These trends suggest weaker corporate performance may be on the horizon as the effects of the slowing economy and higher rates finally take hold. High current valuations leave room for significant price corrections," said Korat.

INFRASTRUCTURE DEBT

Infrastructure debt is still high on the list of alternative investors thanks to its resilience to economic cycles.

"Despite compressed pricing, its defensive nature and the ongoing need for global infrastructure projects make it an attractive strategy for investors seeking longer-term exposure," Korat explained.

Real estate and infrastructure debt strategies provide hard asset security and extensive loan covenants typically providing more stable and higher recovery rates through the lending cycle.

"Investors should closely monitor these trends when making portfolio decisions, keeping in mind this adage: past performance is no guarantee of future results."

(This article was contributed by Cyrus Korat, co-founding partner of DRC Savills Investment Management.)

-

Alternative investmentsKorean pension funds raise bets on infrastructure, global stocks

Alternative investmentsKorean pension funds raise bets on infrastructure, global stocksJan 01, 2025 (Gmt+09:00)

4 Min read -

Real estateKorean funds offer rescue financing for global offices

Real estateKorean funds offer rescue financing for global officesNov 20, 2024 (Gmt+09:00)

2 Min read -

ASK 2024Private debt remains attractive; NPLs rekindle interest

ASK 2024Private debt remains attractive; NPLs rekindle interestOct 17, 2024 (Gmt+09:00)

2 Min read -

Asset managementKorean investors turn to private credit, secondaries: CIOs

Asset managementKorean investors turn to private credit, secondaries: CIOsMay 22, 2024 (Gmt+09:00)

3 Min read -

Private debtKorean LPs stick to private debt amid market uncertainties

Private debtKorean LPs stick to private debt amid market uncertaintiesFeb 01, 2024 (Gmt+09:00)

3 Min read