Petrochemicals

GS Caltex seeks balanced growth with $2 billion new olefin complex

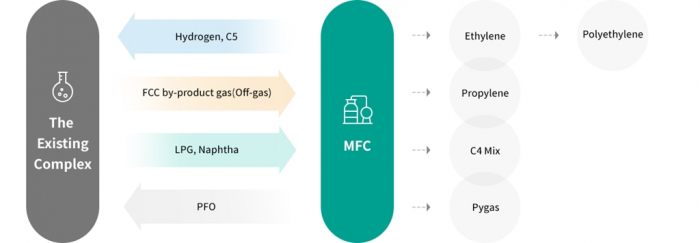

The new facility, MFC, features a flexible design to handle various feedstock, meaning enhanced profitability

By Nov 11, 2022 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

GS Caltex Corp., South Korea’s second-largest oil refiner, said on Friday it has completed the construction of a 2.7 trillion won ($2 billion) olefin production facility – a key milestone for the company’s non-refining business as it seeks balanced growth.

GS Caltex – a 50-50 joint venture between US energy company Chevron Corp. and Korea’s GS Energy Corp., a GS Holdings subsidiary, – said the investment represents its single largest spending on an olefin plant, known as a mixed feed cracker (MFC), aimed at securing a future growth driver.

The project is a key part of GS Caltex’s strategy to bolster its position as a global leader not just in oil refinery but also in the petrochemical industry, it said.

With the completion of the MFC, GS will have an annual production capacity of 750,000 tons of ethylene, 500,000 tons of polyethylene, 410,000 tons of propylene, 240,000 tons of mixed C4 raffinate, which is produced through the cracking of hydrocarbons, and 410,000 tons of pyrolysis gasoline, a naphtha-range product.

“The MFC will expand our petrochemical lineup from aromatics to olefins to create a more balanced business portfolio. It will also enhance our presence in the global market,” the company said.

Among major olefin products is ethylene, a feedstock that goes into making a vast range of everyday chemical products, such as plastics, synthetic rubber, building materials, adhesives and paint.

GS held a ceremony for the construction of the MFC facility located near its second refinery plant in Yeosu, South Jeolla Province, attended by Chief Executive Hur Sae-hong, Honorary Chairman Hur Dong-soo, GS Group Chairman Huh Tae-soo, provincial Governor Kim Young-rok and Park Il-jun, second vice minister of trade, industry and energy.

ADVANCED FACILITY TO CUT CARBON EMISSIONS

GS Caltex said the new plant is more advanced than existing naphtha cracking facilities, called NCC. The MFC can process various raw materials such as liquefied petroleum gas (LPG) as well as naphtha.

The company said it has installed five heating furnaces with an annual capacity of 150,000 tons each, at the MFC to convert raw materials into olefin products through thermal decomposition.

To handle large quantities of ethylene produced at the plant, GS Caltex has established a new high-density polyethylene (HDPE) processing facility.

The advanced MFC plant will help reduce energy use by 10% compared with existing petrochemical facilities, GS said, adding that the company expects to slash carbon emissions by about 760,000 tons annually.

“The completion of the MFC facility is an important turning point in terms of our growth potential and diversification into the non-refining business,” said CEO Hur.

In an interview with The Korea Economic Daily last month, the CEO said he expects global oil prices to remain elevated for a protracted period due to geopolitical tensions, hurting its petrochemical business.

Korea’s four major oil refiners – SK Innovation Co., GS Caltex, S-Oil Corp. and Hyundai Oilbank Co. – collectively posted record operating profits in the first half, largely driven by higher crude prices.

In the first six months of this year, GS Caltex posted 3.21 trillion won ($2.23 billion) in operating profit, an all-time high. But its second-half outlook is grim, weighed down by its petrochemical business, which posted a 28.7 billion won loss in the first half.

Write to Ik-Hwan Kim at lovepen@hankyung.com

In-Soo Nam edited this article.

More to Read

-

EnergyOil prices to remain high, petrochem a concern: GS Caltex CEO

EnergyOil prices to remain high, petrochem a concern: GS Caltex CEOOct 17, 2022 (Gmt+09:00)

3 Min read -

Carbon neutralityLG Chem, GS Caltex to produce biodegradable plastic material

Carbon neutralityLG Chem, GS Caltex to produce biodegradable plastic materialNov 19, 2021 (Gmt+09:00)

3 Min read -

ESGGS Caltex marks Korea’s first company to buy carbon-neutral crude oil

ESGGS Caltex marks Korea’s first company to buy carbon-neutral crude oilJun 17, 2021 (Gmt+09:00)

1 Min read -

Future mobilityGS Caltex to showcase drone delivery, future gas stations at CES 2021

Future mobilityGS Caltex to showcase drone delivery, future gas stations at CES 2021Jan 07, 2021 (Gmt+09:00)

1 Min read

Comment 0

LOG IN