[Interview] Pension funds

SEMA to increase Asia-based infra assets, CIO says

The Korean scientists' retirement pension will up investment in infra, real estate and pre-listed firms to 68% of AUM

By Nov 25, 2021 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

SEMA is a mutual aid association for experts in science and engineering-related areas, such as scientific research institutes and software businesses. Its assets under management are 10.6 trillion won ($8.9 billion), which is backed by monthly payments from around 98,000 members as of November 2021.

While investing 33% of its AUM in stocks and bonds, SEMA plans to increase the investment proportion of infrastructure, real estate and pre-listed companies from the current 65% to 68%. Huh said the retirement pension sees an increase of around 1.5 trillion won in total AUM every year, supported by operating profits and new member registrations.

“Our new investments will focus on high tech-based infrastructure and overseas companies related to the asset class, for example, hydrogen fueling infrastructure and wastewater treatment,” Huh said.

"We expect that demand for facilities to produce, transport, store and manage hydrogen will rapidly increase as it becomes more and more important as a global energy source."

This is in line with what he said in a CIO panel session of the ASK 2021 forum in October. At the time, Huh said SEMA is looking closely at hydrogen energy storage facilities such as batteries and infrastructure related to energy transportation and distribution.

He added demand for waste treatment infrastructure will also increase as global climate change is a critical issue and people are paying more attention to the environment as their incomes increase.

"Our investment philosophy is to seize opportunities and lead investment before other investors,” he explained.

SEMA will increase venture capital investment from the current 4% to 5% next year, bringing the combined proportion of venture and private equity investment up to 20% of its AUM. Huh said the mutual aid association will select VC firms from time to time as well as PE firms next year and will be more active in additional venture investments.

Huh said SEMA will focus more on blind pool funds than project funds as blind pools normally have better investment opportunities. He added most project funds that global asset managers pitch to Korean investors haven’t been able to attract investment from their own countries, another reason why SEMA prefers blind pools.

Regarding environmental, social and governance investment, Huh said it is hard to understand companies' ESG activities when SEMA plans for investment. "I believe disclosure of ESG-related activities will bring a better investment environment," he added.

Write to Jae-fu Kim and Jong-woo Kim at hu@hankyung.com

Jihyun Kim edited this article.

More to Read

-

-

Private equitySEMA jointly acquires stakes in US telecom tower operator

Private equitySEMA jointly acquires stakes in US telecom tower operatorNov 12, 2021 (Gmt+09:00)

1 Min read -

ASK 2021 Panel talksKorea scientists fund sees US-China conflict create infra investments

ASK 2021 Panel talksKorea scientists fund sees US-China conflict create infra investmentsOct 28, 2021 (Gmt+09:00)

1 Min read -

Korea scientists fund appoints new CIO for two-year term

Korea scientists fund appoints new CIO for two-year termMay 03, 2019 (Gmt+09:00)

1 Min read -

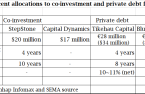

Korea scientists fund to commit $37 mn to co-investment funds; $34 mn to PDF

Korea scientists fund to commit $37 mn to co-investment funds; $34 mn to PDFMar 11, 2018 (Gmt+09:00)

1 Min read

Comment 0

LOG IN