NPS’ investment return at all-time high in 2019; alternatives lag

Feb 28, 2020 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

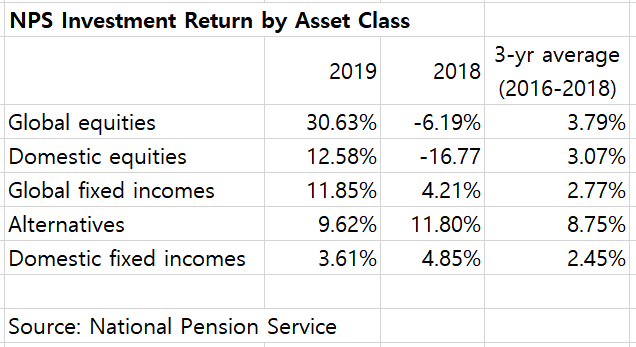

The National Pension Service (NPS) achieved its strongest investment return of 11.31% in 2019, led by hefty gains from equities and overseas fixed-income securities, while gains from alternatives slowed to a single-digit rate.

The 2019 result is the highest since the $610 billion pension scheme set up the Investment Management department in 1999 and compares with a negative 0.92% return in 2018.

Global equities returned 30.63%, powered by stock market rallies and as the weaker won boosted foreign-currency translation gains, NPS said in a statement on Feb. 27.

In comparison, returns from alternative investments dipped to 9.62%, from 11.81% a year earlier.

The share of alternatives both at home and abroad was little changed at 11.5% of total assets which grew by 15% to 736.7 trillion won ($610 billion) by the end of 2019.

It gave no breakdown between domestic and overseas alternative portfolios.

NPS is aiming to increase the proportion of alternatives to 15% by 2024 to 150 trillion won in value.

“We are expecting assets under management to reach 1,000 trillion won by 2024 and 1,700 trillion won by 2041. Given that, we will likely have a ‘golden time’ over the next 10 years during which we can make active asset management without liquidity concerns,” NPS said in the statement.

“Against this background, we are preparing a comprehensive plan for global investments in order to maximize returns by facilitating investment abroad.”

The comprehensive investment plan includes buying equity interests in global asset managers to make strategic cooperation which would lead to co-investment, or dispatch of NPS employees to the global investment houses for training, Korean news outlet edaily said on Feb. 26.

“NPS has been suffering from a chronic problem of continual outflows of investment staff because of its geographical location and low pay and performance bonus,” edaily quoted an unnamed investment banking source as saying. “It may be able to solve the problem with the dispatch program."

NPS was not immediately reached for comment.

This week, it announced a plan to hire 13 investment staff to bolster global and alternative investments.

The world's third-largest pension fund runs three foreign offices in New York, London and Singapore with 28 employees, below the quota of 40, Yonhap Infomax reported on Feb. 20.

By Jung-hwan Hwang

jung@hankyung.com

Yeonhee Kim edited this article

-

Real estateMirae Asset to be named Korea Post’s core real estate fund operator

Real estateMirae Asset to be named Korea Post’s core real estate fund operatorApr 29, 2025 (Gmt+09:00)

-

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concern

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concernApr 27, 2025 (Gmt+09:00)

-

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fund

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fundApr 23, 2025 (Gmt+09:00)

-

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark project

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark projectApr 22, 2025 (Gmt+09:00)

-

Real estateS.Korean gaming giant Netmarble eyes headquarters building sale

Real estateS.Korean gaming giant Netmarble eyes headquarters building saleApr 18, 2025 (Gmt+09:00)