With domestic dockyards fully booked, Korean shipbuilders turn overseas

HD Hyundai, Hanwha and Samsung are looking to overseas yards to meet surging demand amid the Washington-Beijing conflict

By Apr 14, 2025 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

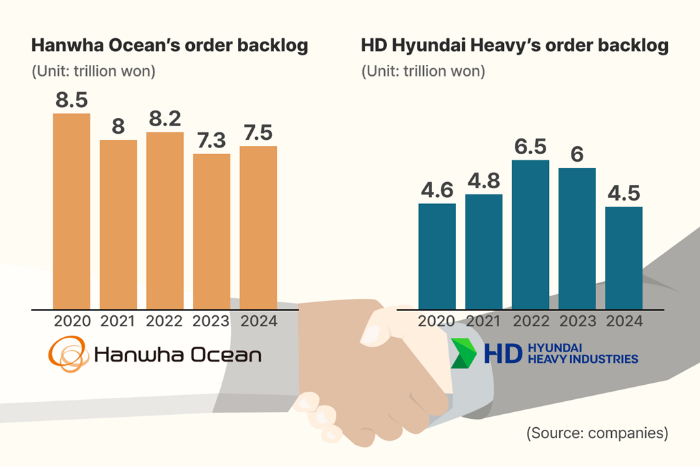

As order books swell amid green shipping mandates, LNG demand and military naval modernization, South Korean shipbuilders are extending their global reach by tapping overseas dockyards.

The offshore pivot reflects a new phase for Korea’s three shipbuilding champions, the world’s three largest: HD Korea Shipbuilding & Offshore Engineering Co. (HD KSOE), Hanwha Ocean Co. and Samsung Heavy Industries Co.

Analysts said the Korean Big Three stand to benefit from the emerging industry supercycle and the so-called Trump Trade — investor hopes that the second Donald Trump presidency spells good news for the shipbuilding market.

The strategic decoupling of the US from China amid an escalating trade war between Washington and Beijing is also a boon for Korean shipbuilders as the US Navy is seeking to build up its defense capabilities against China in partnership with its allies.

Alongside South Korea, China and Japan are also global shipbuilding powerhouses, but China-made ships are not an option for the US.

SUBIC SHIPYARD IN THE PHILIPPINES

Korean shipbuilders are turning abroad as domestic dockyards reach full capacity. Increasingly, companies are building vessels in Southeast Asia and the Middle East in a strategic push to stay ahead of their Chinese rivals and respond to geopolitical shifts in global trade.

According to industry sources on Monday, HD KSOE has secured an order for four 115,000 deadweight tonnage (DWT) crude oil tankers from Hong Kong-based Cido Shipping.

The ships will be built not in Korea but at the revived Subic Shipyard in the Philippines, with delivery scheduled for 2028, sources said.

Four bulk carriers of the same class, ordered by Japan’s Nissen Kaiun, have also begun construction at the Subic Shipyard.

Subic Shipyard, located 110 km northwest of Manila, was developed by Hanjin Heavy Industries Co. in 2006 but ceased operations in 2019 amid financial difficulties. It was later acquired by Cerberus Capital Management L.P., a US alternative investment firm.

HD KSOE began leasing part of the facility last year and now operates one of its dry docks, using it to build ship blocks and offshore wind platforms while also servicing Philippine Navy vessels through maintenance, repair and overhaul (MRO) work.

HD Hyundai Heavy Industries Co. (HHI), a unit of HD KSOE, has chosen the Philippines as its Asian base for warship construction and global sales.

HD KSOE, the intermediate holding company of HD Hyundai Co., a shipbuilding, oil refining and machinery conglomerate, has three shipbuilding affiliates under its wing: HD HHI, Hyundai Mipo Dockyard Co. and Hyundai Samho Heavy Industries Co.

HYUNDAI MIPO IN VIETNAM

Elsewhere in Southeast Asia, HD Hyundai Mipo’s Vietnamese subsidiary is undergoing a major expansion.

HD Hyundai Vietnam Shipbuilding Co., located in Khanh Hoa province, plans to boost its annual production capacity by 50% to 23 vessels by 2030. The yard mainly builds Aframax-class tankers and currently delivers about 15 ships a year.

HD Hyundai Mipo is experiencing a surge in tanker orders from European and African shipowners.

In response, the company is investing over 100 billion won ($70.4 million) to build an additional dock in Vietnam.

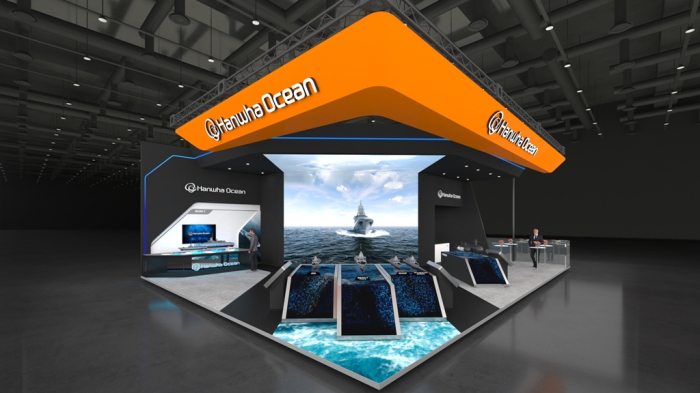

HANWHA OCEAN FOCUSES ON THE US, SINGAPORE

Hanwha Ocean, formerly Daewoo Shipbuilding & Marine Engineering (DSME), is also aggressively expanding its offshore footprint.

Last June, it acquired a 100% stake in Philly Shipyard Inc., becoming the first Korean company to enter the US shipbuilding industry.

In September, Hanwha launched a public tender offer for Singapore’s offshore equipment manufacturer Dyna-Mac Holdings Ltd. to fully own the company.

For now, Hanwha Ocean plans to build seven vessels at Philly Shipyard and has a shipbuilding backlog of 29 topside modules at Dyna-Mac, signaling a deeper push into offshore platforms and energy-related infrastructure.

SAMSUNG HEAVY ACTIVE IN CHINA

Meanwhile, Samsung Heavy Industries is active in China.

The company recently subcontracted construction of four newly ordered crude oil carriers from Greek shipowner Centrofin Management Inc. to China’s PaxOcean, sources said.

The latest move follows a similar arrangement last November, when Samsung delegated work on four Suezmax tankers ordered by Dynacom Tankers Management Ltd. of Greece to a yard in Zhoushan, Zhejiang province, in China.

Samsung has also sourced ship blocks from a Chinese affiliate, Samsung Heavy Industries Rong Cheng Co., transporting the components to Korea for final assembly. This model allows it to meet tight delivery deadlines without stretching domestic resources.

Samsung is now exploring further partnerships in Southeast Asia as it seeks to diversify beyond China amid rising geopolitical and cost pressures.

Write to Sang-Hoon Sung and Jin-Won Kim at uphoon@hankyung.com

In-Soo Nam edited this article.

-

Shipping & ShipbuildingS.Korean shipbuilders rally as Trump hints at buying foreign ships

Shipping & ShipbuildingS.Korean shipbuilders rally as Trump hints at buying foreign shipsApr 11, 2025 (Gmt+09:00)

2 Min read -

Shipping & ShipbuildingKorea’s Hanwha Ocean sends USNS Wally Schirra back to theater after MRO

Shipping & ShipbuildingKorea’s Hanwha Ocean sends USNS Wally Schirra back to theater after MROMar 14, 2025 (Gmt+09:00)

5 Min read -

Shipping & ShipbuildingHD Hyundai, Hanwha Ocean to jointly bid for high-stakes warship deals

Shipping & ShipbuildingHD Hyundai, Hanwha Ocean to jointly bid for high-stakes warship dealsFeb 26, 2025 (Gmt+09:00)

4 Min read -

EarningsHanwha Ocean swings to profit, seeks 6 US Navy MRO projects

EarningsHanwha Ocean swings to profit, seeks 6 US Navy MRO projectsJan 24, 2025 (Gmt+09:00)

3 Min read -

Shipping & ShipbuildingHanwha Ocean, HD Hyundai reconcile, look to joint overseas warship bids

Shipping & ShipbuildingHanwha Ocean, HD Hyundai reconcile, look to joint overseas warship bidsNov 24, 2024 (Gmt+09:00)

3 Min read -

Shipping & ShipbuildingHanwha to take full control of S’pore Dyna-Mac with tender offer

Shipping & ShipbuildingHanwha to take full control of S’pore Dyna-Mac with tender offerSep 12, 2024 (Gmt+09:00)

1 Min read -

Shipping & ShipbuildingKorean shipbuilding shares surge on supercycle hope, Trump Trade

Shipping & ShipbuildingKorean shipbuilding shares surge on supercycle hope, Trump TradeJul 28, 2024 (Gmt+09:00)

3 Min read -

Shipping & ShipbuildingHanwha acquires $100 million Philly Shipyard for US market debut

Shipping & ShipbuildingHanwha acquires $100 million Philly Shipyard for US market debutJun 21, 2024 (Gmt+09:00)

3 Min read -

Shipping & ShipbuildingHD Hyundai Heavy picks Philippines as Asian base for warship sales

Shipping & ShipbuildingHD Hyundai Heavy picks Philippines as Asian base for warship salesMar 07, 2024 (Gmt+09:00)

1 Min read