Travel & Leisure

S.Korea’s foreigners-only casinos bask in return of Chinese high rollers

Major casino players, including Paradise, GLK and Lotte Tour, posted stronger-than-expected first-quarter earnings

By Apr 10, 2025 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s foreigners-only casinos are witnessing a significant rise in their sales revenue with the return of high rollers from China and Japan, who shunned their neighboring country amid heightened political tensions following the failed martial-law declaration in December.

The rebound has sparked renewed investor optimism, with analysts now predicting a stronger-than-expected outlook for the sector, particularly in light of Seoul’s plans to ease visa restrictions for Chinese group tourists as early as the third quarter.

According to industry sources on Thursday, Paradise Co., Korea’s largest foreigners-only casino operator, posted 80.9 billion won ($60.5 million) in casino revenue in March, a 51.6% increase from March last year.

The performance marked a dramatic reversal from earlier in the first quarter; revenues in January and February saw year-on-year contractions.

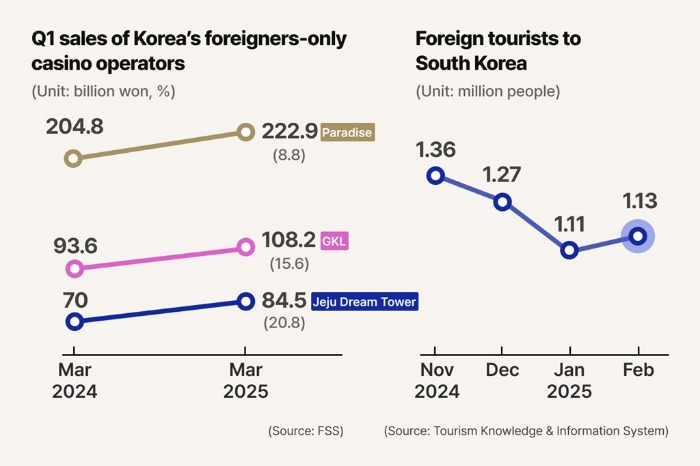

For the first three months of this year, Paradise posted an 8.8% sales increase from the year-earlier period.

Grand Korea Leisure Co. (GKL), which operates three foreigners-only casinos under the name Seven Luck in Seoul and Busan, and Lotte Tour Development Co., which runs Jeju Dream Tower Casino on Korea's top tourist island of Jeju, also reported double-digit percentage growth in first-quarter sales.

According to Seoul-based Hana Securities, Paradise’s first-quarter sales are estimated at a record 286.7 billion, including those from its hotel and resort businesses, and 52.1 billion won in operating profit, about 10 billion won higher than the latest market consensus.

GKL and Lotte Tour are also expected to beat market expectations.

“March was a major inflection point,” said an industry official. “Not only have Chinese and Japanese VIPs returned, but favorable exchange rates and a rebound in general tourist traffic are also fueling momentum.”

WEAK WON VS YEN, YUAN

Korea’s foreign visitor numbers began to recover in February after dipping for two consecutive months following the martial-law declaration.

From a recent low of 1.11 million arrivals in January, tourist numbers ticked up to 1.13 million in February and are projected to rise more sharply in the coming months.

A weak won relative to the Japanese yen and the Chinese yuan has also made Korea a more affordable destination for prolific gamblers traveling from China and Japan.

“There has been a steady increase in VIPs from Greater China and Japan. We’re also witnessing more visits from foreign high rollers already residing in Korea,” said a Jeju Dream Tower official.

Improved hold rates have also buoyed casino performance.

Paradise’s hold percentage stood at 12.4% in the first quarter, up 1.3 percentage points from a year earlier, suggesting a broader customer mix and a stronger showing from casual gamblers.

The hold percentage is the amount a casino earns from a game and is often used to determine the average earnings from a table. A hold rate of 10% means that a player loses 10% of their bet per game to the casino. The higher the hold percentage, the larger the casino’s profit.

TAILWINDS FROM IMPROVING SEOUL-BEIJING RELATIONS

Korea’s casino sector is looking to build on its recent gains amid broader geopolitical shifts and improving ties between South Korea and China.

While Japanese visitors dominate the VIP customer base, Korean casino operators are eyeing a potential resurgence in Chinese traffic as Beijing tightens its grip on Macau’s casino industry.

Many of Macau’s casinos, including properties owned by US firms such as Sands, Wynn and MGM, are facing heightened regulatory scrutiny from Chinese authorities as tensions persist in US-China trade relations.

As a result, Chinese VIPs may increasingly seek out alternative destinations, with Korea, Singapore and the Philippines among the key beneficiaries, analysts said.

South Korea’s move to permit visa-free entry for Chinese tour groups as early as the third quarter has added further optimism to the outlook. The policy is part of a broader initiative to attract 18.5 million foreign visitors this year.

Industry watchers said the visa waiver program is unlikely to be reversed if there is a change in Korea’s government leadership following the presidential election on June 3.

On its part, China resumed its visa-free policy for South Koreans in November last year.

Write to Jae-Kwang Ahn at ahnjk@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Travel & LeisureS. Korea’s foreigner-only casinos suffer poor profit

Travel & LeisureS. Korea’s foreigner-only casinos suffer poor profitAug 19, 2024 (Gmt+09:00)

3 Min read -

Travel & LeisureParadise opens VIP-only casino at Walkerhill Hotel

Travel & LeisureParadise opens VIP-only casino at Walkerhill HotelSep 20, 2024 (Gmt+09:00)

1 Min read -

Travel & LeisureJeju casinos, hotels bask in return of Chinese tourists; luxury shops fall

Travel & LeisureJeju casinos, hotels bask in return of Chinese tourists; luxury shops fallJun 18, 2024 (Gmt+09:00)

2 Min read -

Travel & LeisureLotte Tour's Jeju Island casino triples revenue

Travel & LeisureLotte Tour's Jeju Island casino triples revenueMay 03, 2024 (Gmt+09:00)

1 Min read -

Travel & LeisureKangwon Land aims to revive casino business with $1.9 billion in spending

Travel & LeisureKangwon Land aims to revive casino business with $1.9 billion in spendingMar 29, 2024 (Gmt+09:00)

2 Min read -

Travel & LeisureMohegan fuels casino, resort market rivalry in Korea

Travel & LeisureMohegan fuels casino, resort market rivalry in KoreaFeb 27, 2024 (Gmt+09:00)

2 Min read

Comment 0

LOG IN