HD Hyundai Heavy, HII team up for naval shipbuilding

Their partnership should pave the way for the S.Korean shipbuilder’s advance into the US warship building sector

By Apr 09, 2025 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

HD Hyundai Heavy Industries Co. (HD HHI) and US naval shipbuilding leader Huntington Ingalls Industries Inc. (HII) have agreed to join hands to build battle force ships, a move expected to open up new markets for South Korea’s largest shipbuilder in the US.

On Monday, HD HHI and HII signed a memorandum of understanding (MOU) to work together to build warships and commercial ships and develop next-generation shipbuilding technologies, the two shipbuilding giants announced on Tuesday.

They hope that their collaboration can enhance their maritime industrial base in both the US and Korea.

Especially, their strategic partnership is expected to allow HD HHI to unlock new opportunities for defense shipbuilding for the US Navy, which is seeking to significantly expand its fleet to keep pace with China in fleet size.

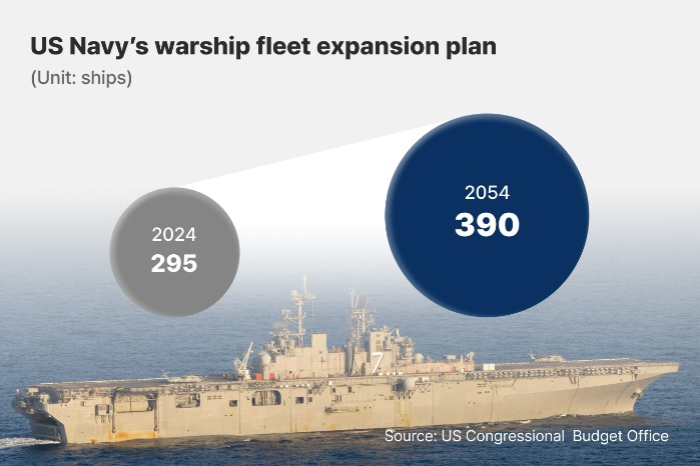

According to the US Congressional Budget Office, the US Navy plans to expand its fleet to 390 ships by 2054, requiring the addition of 364 new warships over the next three decades due to the retirement of old ships in phases.

The US Navy’s fleet stood at 295 ships in 2024.

In January, the budget office estimated the total cost of acquiring the new ships to be about $1 trillion over 30 years.

LARGEST US WARSHIP BUILDER

HII is a global, all-domain defense provider, delivering combat ships and a wide range of defense solutions ranging from unmanned systems to electronic warfare to autonomy and synthetic training.

Headquartered in Virginia, HII is the largest military shipbuilder in the US, with a more than 135-year history.

Its shipbuilding division, Ingalls Shipbuilding, operates a shipyard in Pascagoula, Mississippi, employing more than 11,000 people. It builds various classes of ships, including Arleigh Burke-class destroyers, San Antonio-class amphibious assault ships and National Security Cutters.

Last year, the company was commissioned by the US Navy to build six Aegis destroyers out of the Navy's total fleet of nine ships for the year.

Its operating profit for 2024 stood at $535 million on sales of $11.5 billion. Its order backlog is estimated at $48.7 billion.

The two shipbuilding giants will share their shipbuilding know-how to create synergy.

As the world’s No. 1 shipbuilder, HD HHI will share its extensive expertise in general shipbuilding technologies with HII, which in return, will share its battleship technologies with the Korean partner.

The two discussed the Korean shipbuilder's participation in the training of local employees at the US shipbuilder’s dockyard and HII’s supply chain for the US Navy combat ship construction.

WIN-WIN FOR THE US NAVY AND KOREAN SHIPBUILDERS

The US Navy is actively seeking to expand its fleet in response to China’s aggressive naval buildup over the past decade.

In 2000, China's People’s Liberation Army Navy had 110 combat ships while its US counterpart operated 318 units.

But China’s fleet in 2024 jumped to 370, outpacing the US Navy’s 295 and boasting the world’s largest fleet. By 2035, China aims to add more warships to expand its fleet to 475 units versus the US Navy’s 317.

The US Navy has failed to keep pace with China, largely due to limited shipyard space capacity and an insufficient number of workers in the US.

The US plans to build five units of the Arleigh Burke class destroyers for its navy every year, but the country's current building capabilities are fewer than two destroyers a year.

Korea, however, can churn out more than three Aegis destroyers a year, and the cost of building each unit in the country is estimated at 1 trillion won ($677.1 million), about half the cost of building the same class destroyer in the US.

This is why analysts have long called for the US to collaborate with allies like Korea and Japan on naval shipbuilding to keep China in check.

President Trump has already called on Korean shipbuilders to partner with their US counterparts on naval shipbuilding.

In February, Mike Lee and John Curtis, Republican senators from Utah, introduced the Ensuring Naval Readiness Act and the Ensuring Coast Guard Readiness Act, designed to allow foreign countries in the Asia Pacific region and India that have mutual defense treaties with the US to build battleships and related vessel parts for its Navy.

The US Congress is also discussing an amendment to the Burns-Tollefson Act, which currently restricts foreign-built warships from being constructed or maintained in the US.

Once the bill is changed, HD HHI could form a consortium with HII to win combat vessel orders from the US Navy.

“Today’s agreement (with HD HHI) reflects our commitment to explore all opportunities to expand US shipbuilding capacity in support of national security,” HII Executive Vice President and President of Ingalls Shipbuilding Brian Blanchette said in a statement.

“By working with our shipbuilding allies and sharing best practices, we believe this MOU offers real potential to help accelerate delivery of quality ships.”

Joo Won-ho, chief executive of the naval & special ship business unit at HHI, also said, “This partnership marks a new milestone for both of our companies and provides us with the unique opportunity to expand our expertise in shipbuilding.”

HD HHI operates the world’s largest shipyard in Ulsan, Korea.

Write to Jin-Won Kim at jin1@hankyung.com

Sookyung Seo edited this article.

-

Shipping & ShipbuildingHD Hyundai on course for $1.55 bn order amid US-China trade war

Shipping & ShipbuildingHD Hyundai on course for $1.55 bn order amid US-China trade warApr 06, 2025 (Gmt+09:00)

2 Min read -

Shipping & ShipbuildingHD Hyundai, Palantir chiefs discuss AI shipyard, defense technology

Shipping & ShipbuildingHD Hyundai, Palantir chiefs discuss AI shipyard, defense technologyMar 09, 2025 (Gmt+09:00)

2 Min read -

Shipping & ShipbuildingHD Hyundai, Hanwha Ocean to jointly bid for high-stakes warship deals

Shipping & ShipbuildingHD Hyundai, Hanwha Ocean to jointly bid for high-stakes warship dealsFeb 26, 2025 (Gmt+09:00)

4 Min read -

Shipping & ShipbuildingHD Hyundai, Hanwha to tap into $242 billion US Navy warship market

Shipping & ShipbuildingHD Hyundai, Hanwha to tap into $242 billion US Navy warship marketFeb 12, 2025 (Gmt+09:00)

4 Min read -

Shipping & ShipbuildingHD Hyundai eyes foray into US navy ship repair market in June

Shipping & ShipbuildingHD Hyundai eyes foray into US navy ship repair market in JuneJan 14, 2025 (Gmt+09:00)

2 Min read -

Shipping & ShipbuildingHD Hyundai Heavy delivers Aegis destroyer to S.Korean Navy

Shipping & ShipbuildingHD Hyundai Heavy delivers Aegis destroyer to S.Korean NavyNov 27, 2024 (Gmt+09:00)

1 Min read -

Shipping & ShipbuildingHanwha Ocean, HD Hyundai reconcile, look to joint overseas warship bids

Shipping & ShipbuildingHanwha Ocean, HD Hyundai reconcile, look to joint overseas warship bidsNov 24, 2024 (Gmt+09:00)

3 Min read