Economy

Political crisis ups downside risk to S.Korea’s economy: S&P, Moody’s

Growing concerns about pledged universal tariffs on imports by the US also pose a great risk to Asia’s No. 4 economy

By Jan 10, 2025 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

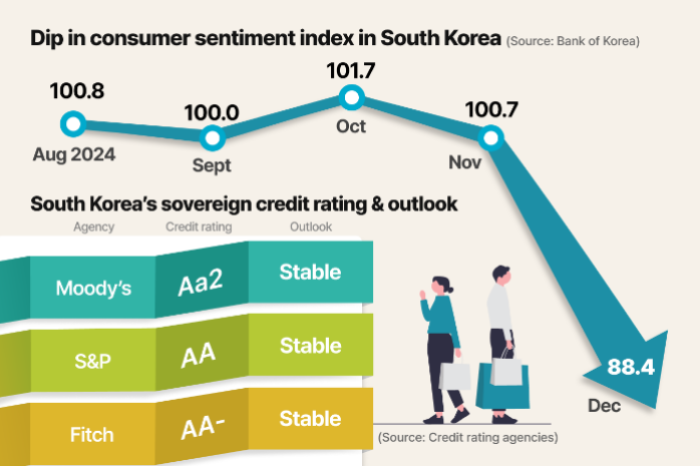

Global credit rating agencies are warning of looming downward pressure on South Korea’s sovereign credit rating about a month after Asia’s fourth-largest economy was abruptly marred by political chaos following its president’s ill-fated martial law decree.

Political turmoil triggered by President Yoon Suk Yeol’s six-hour imposition of martial law, followed by his impeachment by the National Assembly, has increased uncertainty in the Korean economy, said senior analysts at S&P Global Ratings and Moody’s Ratings.

“As it drags on, the political crisis is weighing on (Korea's) growth outlook,” Louis Kuijs, APAC chief economist at S&P Global Ratings, said in an email interview with the Korea Economic Daily this week. “It is hurting business and consumer confidence and there are signs inbound tourism is affected.”

Anushka Shah, vice president at Moody’s Sovereign Risk Group, echoed his concerns, warning of a potential cut in Korea’s rating.

Sovereign credit rating measures the ability of a government to repay debt. The lower the rating, the higher corporate borrowing costs in the country, causing a fall in company stocks in a vicious circle.

Once it is lowered, it takes several years to return to higher ratings.

Shah picked the ongoing political debacle as the greatest risk to the Korean economy.

“The unfolding political events in Korea have created an environment of heightened political uncertainty, with legislature having little capacity for substantive policy matters until such time as a judicial decision on the impeachment is reached,” Shah said.

To ease concerns about the Korean economy, the Korean government under the leadership of acting President Choi Sang-mok, also the finance minister and deputy prime minister, is going all-out to prevent a cut in Asia’s No. 4 economy’s sovereign rating.

On Thursday, Choi held marathon meetings with the global or regional heads of Moody’s Ratings, S&P Global Ratings and Fitch Ratings to discuss the Korean economic condition – just a month after he met with them immediately following President Yoon’s short-lived martial law declaration.

At the meetings, Choi told them the Korean economy has stabilized somewhat, and the government and financial authorities have been working closely to stabilize the market.

EXPORT MATTERS

However, S&P’s Kujis sees the incoming US administration under Donald Trump as a bigger immediate threat to the Korean economy than the political turmoil, citing “US economy and financial policy, directly and indirectly, including via its impact on China and other large economies” as the most significant risk factor for South Korea’s economy.

US President-elect Trump has threatened universal tariffs on imports, up to 20% as his campaign pledge.

S&P projected further US trade tariff actions on China would hurt the growth of the world’s No. 2 economy as well as Korea’s exports.

Korea heavily relies on exports for its economic growth, and the US and China, the world’s top two economies, are its major trading partners.

“In all, we expect (Korea’s) export growth to slow this year but not drastically,” said the S&P’s APAC chief economist.

GROWTH SLOWDOWN

In November, the credit rating agency forecast Korea’s gross domestic product (GDP) would grow 2% in 2025.

This is higher than the Korean government’s projection of 1.8% and other global investment banks’ GDP growth outlook ranging from 1.7% by HSBC and Nomura to 1.6% by Citi to JP Morgan’s 1.3%.

In November, the Bank of Korea also cut its forecast for 2025 to 1.9% from the previous 2.1%.

The downside risks on the Korean economy have risen since November, said Kuijs, adding that S&P Global Ratings, however, sees no need “to change the outlook significantly.”

But he warned of a fall in Korea’s potential growth rate in the mid to long term.

“We expect South Korea’s potential GDP growth to average 2% in 2023-2026 and to edge down to 1.9% in 2026-2030,” said Kuijs.

He projected the BOK’s three cuts of 25 basis points in its base policy rate this year to shore up Korea's weakening growth drive.

Write to Sang-Yong Park and Se-Min Huh at yourpencil@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Business & PoliticsKorea sharply cuts 2025 growth forecast, opens door for extra budget

Business & PoliticsKorea sharply cuts 2025 growth forecast, opens door for extra budgetJan 02, 2025 (Gmt+09:00)

4 Min read -

Business & PoliticsKorea’s new acting president assures economy resilient, security tight

Business & PoliticsKorea’s new acting president assures economy resilient, security tightDec 27, 2024 (Gmt+09:00)

1 Min read -

Business & PoliticsSouth Korea’s Acting President Han impeached; Stocks, won plummet

Business & PoliticsSouth Korea’s Acting President Han impeached; Stocks, won plummetDec 27, 2024 (Gmt+09:00)

4 Min read -

Business & PoliticsSouth Korea’s sovereign credit rating stable: S&P, Moody's, Fitch

Business & PoliticsSouth Korea’s sovereign credit rating stable: S&P, Moody's, FitchDec 13, 2024 (Gmt+09:00)

2 Min read -

Central bankBOK makes 1st back-to-back rate cut since 2009 global crisis

Central bankBOK makes 1st back-to-back rate cut since 2009 global crisisNov 28, 2024 (Gmt+09:00)

3 Min read

Comment 0

LOG IN