Energy

Hanwha to exit from polysilicon business in US

REC Silicon, in which Hanwha Group is the largest stakeholder, will shut down its last polysilicon plant in the US

By Jan 03, 2025 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Hanwha Solutions Corp., the energy unit of South Korea’s chemicals-to-financial conglomerate Hanwha Group, will likely withdraw from the polysilicon production business in the US by pulling the plug on the last polysilicon plant in the US, run by Norwegian firm REC Silicon ASA.

According to sources on Friday, REC Silicon, in which Hanwha Solutions and its affiliate have the biggest 33% stake, recently suspended operation of its polysilicon-production plant in Moses Lake, Washington, and is expected to cut the plant’s employees and eventually shutter the facilities.

It was REC Silicon’s last polysilicon-manufacturing plant in the US after the company shut down its electronic-grade polysilicon-manufacturing plant in Butte, Montana, last year.

The factory operation halt comes after REC Silicon failed to pass Hanwha Q Cells Co.’s final quality test of its solar-grade polysilicon, a move expected to lead to termination of a 4 trillion won ($2.7 billion) deal signed in 2023 to supply REC Silicon’s polysilicon to Hanwha Q Cells, the solar power unit of Hanwha Solutions known as Qcells in overseas markets.

REC Silicon’s polysilicon plant closure would also thwart Hanwha Group’s ambitious plan to build a complete photovoltaic (PV) manufacturing value chain in the US, spanning polysilicon, ingot, wafer, cell and module production.

Polysilicon or polycrystalline silicon is a raw material used by the solar PV and electronics industry.

LARGEST US SILICON SOLAR MODULE PROVIDER

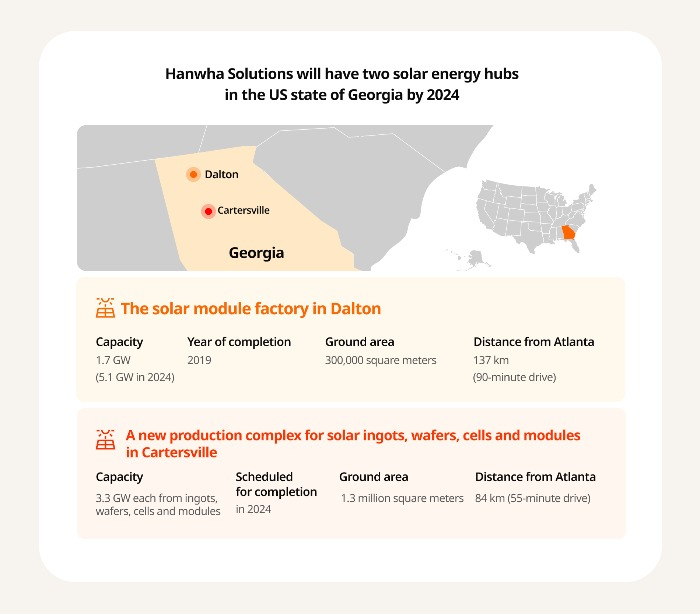

Hanwha Q Cells operates two solar energy hubs in the US state of Georgia, where the Korean solar PV leader churns out ingots, wafers, cells and modules.

Hanwha has made a huge investment to build a solar PV manufacturing value chain in the US to capitalize on the US government’s push for renewable energy.

Its manufacturing facilities in Dalton, Georgia, completed in 2019, mainly produce solar modules, while the newer one built in 2024 for 3 trillion won manufactures solar ingots, wafers, cells and modules.

With the two factories, Hanwha became the first company to offer production lines for the four major phases of the solar value chain in North America, boasting the capacity to generate 8.4 GW of electricity from sunlight as of 2024.

The Korean energy company acquired REC Silicon, renowned for its electronic-grade polysilicon production, for 249 billion won to become its largest shareholder in 2022.

Built in 2014, its solar-grade polysilicon-manufacturing facility in Moses Lake, Washington, can produce 16,000 tons a year, enough to build 8 GW of PV modules.

Its operation was temporarily suspended in 2019 due to a decline in orders amid fierce competition from a cheaper Chinese version. Then Hanwha took it over and resumed operation after refurbishing the plant in late 2023.

But seasoned employees and engineers left REC Silicon during the temporary closure before Hanwha’s acquisition and after the permanent shutdown of the factory in Butte, hampering the development of high-grade, highly purified solar-grade polysilicon that meets Hanwha Q Cells’ standards, said an industry source.

The equipment and machines were also old and worn, costing too much to replace, said an official from Hanwha Q Cells.

The Korean company is even mulling the sale of its stake in REC Silicon, added the official.

Following the closure of REC Silicon’s polysilicon-manufacturing facilities, Hanwha Q Cells plans to use polysilicon provided by OCIM Sdn. (OCIM), a Malaysian polysilicon-manufacturing unit of Korean solar cell major OCI Holdings Co.

OCIM’s polysilicon sells for $22 per kilogram, three times as much as Chinese polysilicon.

But considering that the US may impose up to 250% anti-dumping duties on China-made polysilicon, Hanwha could obtain polysilicon from OCIM at lower cost.

Write to Hyeon-woo Oh at ohw@hankyung.com

Sookyung Seo edited this article.

More to Read

-

EnergyQcells launches commercial operations at new plant in Georgia, US

EnergyQcells launches commercial operations at new plant in Georgia, USMay 07, 2024 (Gmt+09:00)

2 Min read -

EnergyHanwha’s REC Silicon plant restarts as US-China tension eases

EnergyHanwha’s REC Silicon plant restarts as US-China tension easesNov 16, 2023 (Gmt+09:00)

3 Min read -

-

EnergyHanwha Q Cells holds No.1 position in US solar module market

EnergyHanwha Q Cells holds No.1 position in US solar module marketMay 10, 2023 (Gmt+09:00)

1 Min read -

-

EnergyHanwha Solutions, OCI to benefit from US push for solar energy

EnergyHanwha Solutions, OCI to benefit from US push for solar energyAug 04, 2022 (Gmt+09:00)

3 Min read -

EnergyHanwha acquires 16.67% of REC Silicon for $160 mn for US solar projects

EnergyHanwha acquires 16.67% of REC Silicon for $160 mn for US solar projectsNov 19, 2021 (Gmt+09:00)

1 Min read

Comment 0

LOG IN