Corporate strategy

Kia vows to drastically raise shareholder returns, hike EV, hybrid sales

Its proposed annual total shareholder return rate of 35% is the highest among major global automakers

By Dec 04, 2024 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Kia Corp., South Korea’s second-largest automaker, plans to drastically raise its shareholder return rates to bolster shareholder value. The company also plans to sell more eco-friendly vehicles, including electric cars and hybrid models.

Kia – a sister firm of Hyundai Motor Co. and an affiliate of Hyundai Motor Group – said in a regulatory filing on Tuesday that It plans to return 35% of its net profit annually to shareholders over the next three years, starting in 2025.

The company said its aggressive total shareholder return (TSR) goal will be achieved through higher dividends and other initiatives such as share buybacks and cancellations.

Kia approved the three-year TSR goal, part of its 2024 mid-to-long-term corporate value enhancement plan, at a board meeting earlier on Tuesday.

Kia’s proposed 35% TSR rate compares with the 25–30% range between 2019 and 2023. The company’s TSR for this year is estimated at 30–35%.

TSR is a measure of financial performance, indicating the total amount an investor reaps from an investment – specifically, equities or shares of stock.

It is calculated by combining the amount spent on dividends and share buybacks and cancellations, divided by net income. TSR is a critical metric for stock investors.

INCREASED DIVIDEND PAYOUT RATIO

In line with its bolstered shareholder return policy, Kia said it will increase its minimum dividend payout ratio – the percentage of net income distributed as dividends – to 25% from 20%, starting next year.

The automaker said it has committed to paying at least 5,000 won ($3.5) per common share in annual dividends.

The frequency of share buybacks will also increase from once a year to multiple times to help stabilize its stock price.

To succeed in its three-year TSR plan, Kia has set an annual return on equity (ROE) target of 15% over the next three years – the highest among major global automakers. The average ROE of the top eight global automakers is 10.6%.

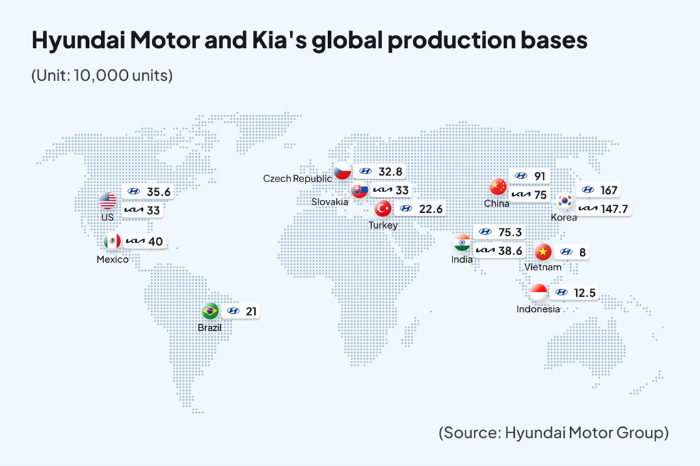

At Tuesday’s board meeting, Kia also presented its growth strategy, targeting annual global vehicle sales of 4.3 million units by 2030.

It plans to increase the global sales share of eco-friendly vehicles, including electric and hybrid cars, from the current 24% to 58% by 2030, capitalizing on their higher profitability compared to internal combustion engine vehicles.

Kia said it will strengthen its purpose-built vehicle (PBV) business by launching new models such as the PV5 and PV7 early for a steady new revenue stream.

Write to Jin-Won Kim at jin1@hankyung.com

In-Soo Nam edited this article.

More to Read

-

AutomobilesHyundai, Kia’s September US sales fall; hybrids buck weak sales trend

AutomobilesHyundai, Kia’s September US sales fall; hybrids buck weak sales trendOct 02, 2024 (Gmt+09:00)

2 Min read -

AutomobilesThe new Kia K8: A high-tech, modern and innovative sedan

AutomobilesThe new Kia K8: A high-tech, modern and innovative sedanAug 09, 2024 (Gmt+09:00)

1 Min read -

ESGHyundai, Kia to require stricter ESG compliance from subcontractors

ESGHyundai, Kia to require stricter ESG compliance from subcontractorsJun 10, 2024 (Gmt+09:00)

3 Min read -

Korean innovators at CES 2024Kia, Uber to jointly develop custom-tailored electric ride-hailing PBV

Korean innovators at CES 2024Kia, Uber to jointly develop custom-tailored electric ride-hailing PBVJan 11, 2024 (Gmt+09:00)

2 Min read -

Chief ExecutivesKia aims to become purpose-built vehicle market leader: CEO

Chief ExecutivesKia aims to become purpose-built vehicle market leader: CEOFeb 02, 2021 (Gmt+09:00)

4 Min read

Comment 0

LOG IN