Economy

State-run think tank KDI slashes GDP forecast, urges BOK to cut rates

The economic institute says the central bank’s monetary policy shift toward easing has come later than expected

By Nov 12, 2024 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

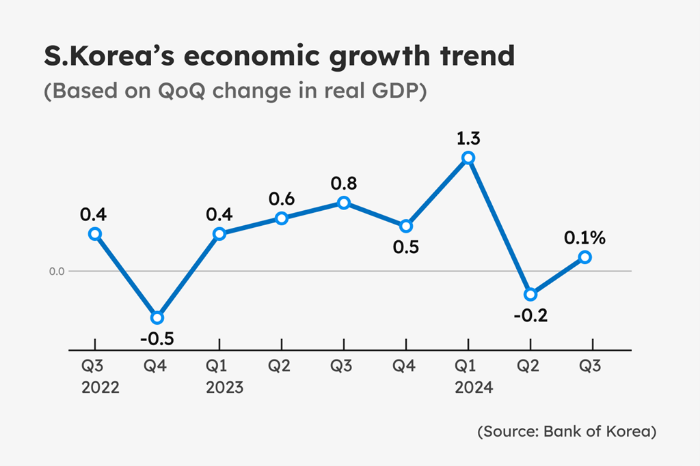

The Korea Development Institute (KDI), South Korea’s state-run think tank, has slashed its forecasts for the country’s economic growth for this year and 2025, citing growing uncertainty surrounding the new Trump administration’s trade policy.

In its second-half 2024 economic outlook report on Tuesday, the KDI said it is lowering its outlook for Korea’s 2024 economic growth rate to 2.2%, down from its August projection of 2.5% growth.

The institute cut its growth outlook for the second half of this year to 1.7% from 2.2% earlier, citing slower-than-expected domestic consumption pickup and weak construction investment.

For next year, the KDI said Asia’s fourth-largest economy will grow 2.0%, 0.1 percentage point lower than its earlier forecast. It attributed its downward revision to Korea’s expected worsening export conditions in the wake of Donald Trump’s presidential election victory.

The US president-elect emphasized his "America First" policy during his campaign, which poses challenges to Korea's trade-dependent economy.

The state-run think tank said the Bank of Korea’s monetary easing has been slow and urged the central bank to cut its policy interest rate further to bolster Korea’s economic growth.

"The central bank’s rate cut has come later than expected. High market interest rates are hurting construction investment, the key reason for the KDI to cut its growth outlook for the country,” said Jung Kyu-chul, head of KDI's Economic Outlook Division.

The KDI’s downward revision follows similar moves by global investment banks.

Eight major IBs, including Goldman Sachs and JPMorgan Chase, predicted Korea's 2024 growth rate at 2.3% on average as of the end of October, 0.2 percentage point lower than their earlier forecasts.

2025 GROWTH COULD FALL BELOW 2% IF TRUMP MOVES FASTER

The KDI said it assumes a possible US tariff hike by the new Trump administration will come in 2026.

But if President Trump moves faster and implements a tariff hike next year, Korea's economic growth rate could fall into the 1% range, below its potential growth rate of 2%.

An accelerated tariff increase would significantly impact Korea’s exports, its main growth engine, as companies worldwide tend to reduce investments at times of trade uncertainty, according to the KDI.

Korea’s export growth, in terms of volume, will stand at 2.1% in 2025, down sharply from an estimated 7.0% rise this year, led by a slowdown in the semiconductors, automobiles and petrochemicals industries, it said.

Tariff barriers are also expected to cut Korea’s exports.

According to the Korea Institute for International Economic Policy (KIEP), Korea’s total exports would decrease by $44.8 billion if the US imposes a blanket 20% tariff on the country.

The KDI expects Korea’s current account surplus to expand to $93 billion next year from $87.5 billion this year, largely due to lower import prices in line with falling international oil prices.

‘FURTHER BOK RATE CUTS NEEDED’

Korea’s consumer price inflation will slow to 1.6% next year from an estimated 2.3% gain this year, according to the KDI.

Core inflation, which excludes food and energy prices to gauge the underlying price trends, is forecast to drop to 1.5% in 2025 from 2.1% this year – falling below the BOK’s inflation target of 2%.

“We’re not concerned about deflation. But if a slowdown in consumer price hikes continues, it could lead to a sluggish domestic recovery and widen the gap between inflation and inflation targets. So, the BOK should cut its policy rates further,” said Jung.

The KDI forecasts that private consumption will grow 1.8% in 2025, up from an estimated 1.3% increase this year, supported by the BOK’s rate cut in October.

Last month, the central bank slashed its benchmark interest rate by a quarter percentage point to 3.25% — the central bank’s first rate cut in more than four years.

The KDI said facility investment is forecast to rise 2.1% next year after a rise of 1.6% in 2024.

Construction investment is projected to continue declining, with a 0.7% decrease in 2025 following a 1.8% drop this year.

Job growth is forecast to slow to 140,000 next year from 180,000 this year due to sluggish domestic demand and a declining population.

The KDI called for urgent corporate structural reforms to discover new growth drivers.

"The potential growth rate of our economy is projected to drop to the mid-1% range by 2025-2030. Establishing a fair competitive environment and lowering entry barriers in key sectors to encourage innovative startups is essential for the Korean economy,” said the KDI.

Write to Se-Min Huh at semin@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Business & PoliticsKorean chipmakers, battery makers face new risks with Trump’s comeback

Business & PoliticsKorean chipmakers, battery makers face new risks with Trump’s comebackNov 07, 2024 (Gmt+09:00)

4 Min read -

-

Central bankBOK flags more rate cuts but in gradual, small steps

Central bankBOK flags more rate cuts but in gradual, small stepsOct 11, 2024 (Gmt+09:00)

3 Min read -

Central bankAugust inflation puts BOK under fire for delayed pivot

Central bankAugust inflation puts BOK under fire for delayed pivotSep 04, 2024 (Gmt+09:00)

2 Min read -

Shipping & ShipbuildingKorean shipbuilding shares surge on supercycle hope, Trump Trade

Shipping & ShipbuildingKorean shipbuilding shares surge on supercycle hope, Trump TradeJul 28, 2024 (Gmt+09:00)

3 Min read

Comment 0

LOG IN