Corporate bonds

Korean brokerages flock to debt market with securities bonds on bull run

Eased real estate project financing concerns and improved earnings at brokerage houses are whetting debt appetite

By Oct 22, 2024 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s leading brokerage houses are flocking to the debt market as bonds issued by securities companies are in growing demand, industry data showed on Tuesday.

With concerns over real estate project financing loan delinquencies subsiding and expectations for improved business performance at brokerage houses on the rise, big investors are tapping into the corporate bond market.

According to investment banking industry officials, Hana Securities Co. plans to conduct bookbuilding on Oct. 28 to gauge demand for its bond issue worth up to 300 billion won ($217 million) for two-year and three-year notes.

The lead managers are KB Securities Co., NH Investment & Securities Co., Korea Investment & Securities Co., and Shinhan Securities Co.

HIGH DEMAND FOR SECURITIES BONDS

With rising demand for securities bonds, major securities firms are rushing into the corporate bond market.

Large securities firms such as Korea Investment, NH Investment and Samsung Securities Co. have each seen over 2 trillion won in bids for their planned bond sales since September.

Korea Investment & Securities saw its 200 billion won bond issue 12 times oversubscribed, attracting 2.53 trillion won in bids from investors.

NH Investment and Samsung Securities attracted 2.18 trillion won and 2.29 trillion won in bids, respectively, for their bond sales.

REPLACE SHORT-TERM DEBT WITH LONGER-DATED BONDS

Industry officials said brokerage firms are ramping up sales of longer-term bonds to repay their shorter-dated debt.

Taking advantage of ample liquidity and improved investor sentiment, brokerages such as Korea Investment, NH Investment and Samsung plan to replace short-term financial instruments like commercial papers (CPs) with long-term debt.

Analysts said securities firms' record-breaking earnings offer bond buyers a safety net to buy into their debt.

Their earnings growth is expected to continue into the rest of the year.

According to financial market information provider FnGuide Inc., the combined operating profit of six major Korean brokerage houses – Mirae Asset Securities Co., Korea Investment Holdings Co., NH Investment, Samsung Securities, Kiwoom Securities Co. and Meritz Financial Group Inc. – is estimated at 2.12 trillion won in the third quarter, up 18.9% from a year earlier.

The risks associated with real estate project financing, which previously weighed on securities firms, are also diminishing.

Major firms have built up enough loan-loss provisioning to endure any project financing delinquencies, a move that helped them regain investor interest, according to industry officials.

Write to Hyun-Ju Jang at blacksea@hankyung.com

In-Soo Nam edited this article.

More to Read

-

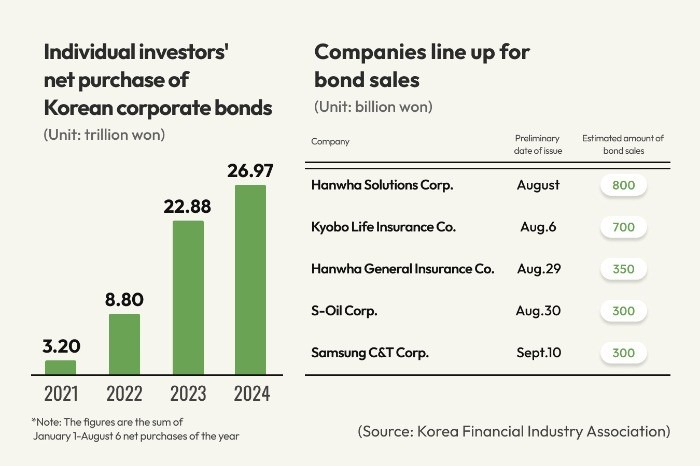

Debt financingKorean firms rush to sell bonds with yields at over 2-yr low

Debt financingKorean firms rush to sell bonds with yields at over 2-yr lowAug 08, 2024 (Gmt+09:00)

3 Min read -

Corporate bondsBrokerage firms' bonds draw investors amid rate cut hopes

Corporate bondsBrokerage firms' bonds draw investors amid rate cut hopesApr 16, 2024 (Gmt+09:00)

1 Min read -

Corporate bondsKorean brokerages expand bond issues to repay short-term debts

Corporate bondsKorean brokerages expand bond issues to repay short-term debtsFeb 20, 2024 (Gmt+09:00)

1 Min read -

EconomyKorea’s treasury yields climb on hopes of vaccines, more bond issues

EconomyKorea’s treasury yields climb on hopes of vaccines, more bond issuesDec 20, 2020 (Gmt+09:00)

3 Min read

Comment 0

LOG IN