LVMH, OpenAI, LG deepen ties with S. Korean startups

MarqVision, Asleep and Exosystems are among Korean startups tapping overseas markets with multinational companies

By Sep 04, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korean startups and established corporations are seeking to deepen their partnerships to ensure win-win outcomes, by tapping into funds and other resources to scale up and innovative new growth ideas.

MarqVision, a Korean startup developing an artificial intelligence-powered intellectual property (IP) protection platform, has been expanding its presence globally with support from the international luxury powerhouse LVMH Moët Hennessy Louis Vuitton (LVMH).

The startup joined the LVMH accelerator program, La Maison des Startups, after winning an Innovation Award from LVMH at the 2022 Viva Technology show.

The French luxury house is also MarqVision’s most influential foreign client.

Meanwhile, Korean healthcare startup Exosystems has teamed up with Swiss multinational pharmaceutical company Roche to develop medical devices to diagnose and treat musculoskeletal disorders — diseases affecting the bones, joints, muscles and connective tissues.

“The collaboration with globally renowned Roche is expected to facilitate our global advance,” said Lee Hoo-man, founder and CEO of Exosystems.

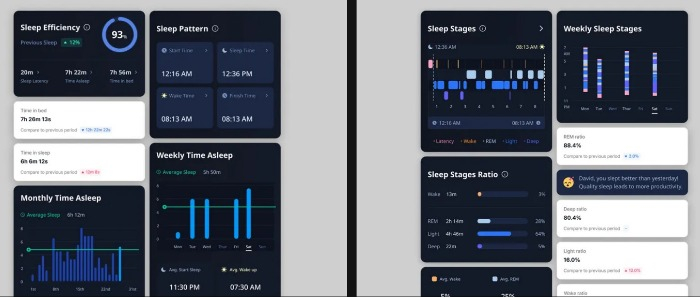

Korean software-as-a-service (SaaS) healthcare startup Asleep developing sleep tracking technology is another domestic startup pursuing partnerships with multinational companies.

It won the backing of the world’s best-known AI company, OpenAI, to develop a new sleep management service that will be available on ChatGPT, said Asleep CEO Lee Dongheon.

Startups and established companies often join hands because fledgling companies with innovative technologies or business models need funds and other resources to scale up, while corporations want to swiftly apply disruptive technologies to foster new growth engines.

Such partnerships have faced criticism for failing to bear fruit. But now they are seeking to deepen their collaboration to achieve realistic and successful outcomes.

GOVERNMENT-LED STARTUP SUPPORT PROGRAM

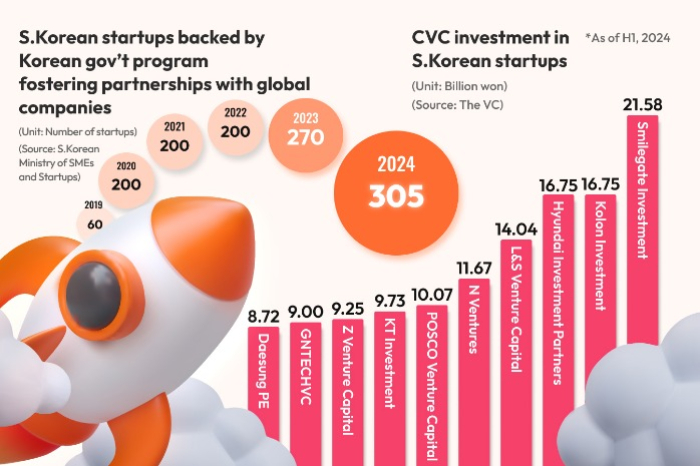

The enhanced corporate-startup partnership in Korea has been effectively promoted by the Korean government.

Korea’s Ministry of SMEs and Startups has invited 11 international tech giants including Nvidia, Microsoft, Amazone Web Services, Siemens and Intel this year to work with Korean startups via its Collaboration Program with Global Companies.

The program, with over 300 local startups participating this year, has already met with success. It has resulted in 12 mergers and acquisitions and a combined investment of over 500 billion won ($372.4 million).

Korean private businesses have also grown more active at deepening their ties with startups, going beyond joint proof of concept (POC) projects to come up with real products.

LG Electronics Inc. has been working with Korean AI startups such as Clika and Nation A to develop on-device AI technology for its flagship gram laptop series.

Late last month, D.Camp, a Korean startup accelerator backed by the Banks Foundation for Young Entrepreneurs, took Korean startups to Japan to allow them to unlock opportunities through collaboration with Tokyo Broadcasting System’s (TBS) corporate venture capital (CVC), TBS Innovation Partners LLC, to develop products and technologies tailored to the Japanese market.

The CVC selected seven Korean entertainment and content startups, including Stayge Labs, Realdraw and Inshorts, as its partners.

CVC INVESTMENT FALLS SHORT

Corporate funding, however, has fallen short of expectations, said Korean startup industry observers.

According to data from Korea’s Ministry of SMEs and Startups, private business investment stood at 4.18 trillion won, accounting for 82% of fresh venture funds formed in the first half of this year. That is less than 2022 (87.5%) and 2023 (85.6%).

A shortage of investment from conglomerates and financial firms drove the decline.

Conglomerates invested 1.02 trillion won in startup venture funds in the first half, down 42.4% from 2022 and 12.3% from 2023.

Venture investment by financial institutions, except the state-run Korea Development Bank, also nosedived 50% from 2022 and 0.9% from 2023 to 1.48 trillion won.

Korea’s strict regulations on CVC funding are blamed for declining VC investment in startups.

Under the current capital law, CVCs are allowed to borrow a maximum of 40% of each fund from external lenders to invest. They are also allowed to invest up to 20% of their assets in overseas targets to prevent money fraud by major conglomerates.

The Korean government is seeking to lift the ceiling to beef up corporate investment in startups.

Write to Joo-Wan Kim and Eun-Yi Ko at kjwan@hankyung.com

Sookyung Seo edited this article.

-

Tech, Media & TelecomLG kicks off SPARK 2024 to share AI, new tech with Big Tech, startups

Tech, Media & TelecomLG kicks off SPARK 2024 to share AI, new tech with Big Tech, startupsAug 26, 2024 (Gmt+09:00)

2 Min read -

Korean startupsS.Korea's early stage VC funding down amid dearth of targets

Korean startupsS.Korea's early stage VC funding down amid dearth of targetsJul 19, 2024 (Gmt+09:00)

4 Min read -

-

Korean startupsDigital healthcare, robot, AI chip startups among VCs’ 2024 top picks

Korean startupsDigital healthcare, robot, AI chip startups among VCs’ 2024 top picksJan 03, 2024 (Gmt+09:00)

4 Min read -

Venture capitalVCs give thumbs up to EV, parts/materials, travel tech

Venture capitalVCs give thumbs up to EV, parts/materials, travel techNov 09, 2023 (Gmt+09:00)

3 Min read -

-

Venture capitalS.Korean startups, VC seek money, business opportunities in Japan

Venture capitalS.Korean startups, VC seek money, business opportunities in JapanSep 22, 2023 (Gmt+09:00)

5 Min read -

Venture capitalS.Korea to form $6.2 bn corporate venture capital fund pool by 2025

Venture capitalS.Korea to form $6.2 bn corporate venture capital fund pool by 2025Jul 24, 2023 (Gmt+09:00)

1 Min read -

Korean startupsAsleep dreams big to help sleepless people worldwide find right treatment

Korean startupsAsleep dreams big to help sleepless people worldwide find right treatmentApr 21, 2023 (Gmt+09:00)

3 Min read -