Chemical Industry

Hyosung to sell its specialty gas unit for $943 mn to Korean PEs

IMM-STIC consortium is the preferred bidder to buy the world's third-largest maker of NF3, essential for cleaning chip equipment

By Jul 12, 2024 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s Hyosung Group is poised to sell a 100% stake in its specialty and industrial gas unit to a consortium led by IMM Private Equity Inc. and STIC Investments Inc. for 1.3 trillion won ($943.3 million) to improve the financial health of the conglomerate’s debt-ridden chemicals unit.

Hyosung Chemical Corp. said on Thursday that Swiss investment bank UBS and state-run Korea Development Bank, the sale's lead managers, have named the domestic consortium as the preferred bidder.

IMM PE and STIC will each invest 650 billion won, according to banking industry sources. IMM will leverage its experience in the 100% acquisition of Korean industrial gas supplier AirFirst Co. in 2019, in which the Seoul-based PE holds a 70% stake after selling 30% to BlackRock in June 2023.

Hyosung Chemical’s specialty and industrial gas division produces 8,000 tons of nitrogen trifluoride (NF3), making it the world’s third-largest NF3 manufacturer after Korea’s SK Specialty Co. and China’s Peric Special Gases Co. NF3 is mainly used as a cleaning agent for microchip manufacturing equipment.

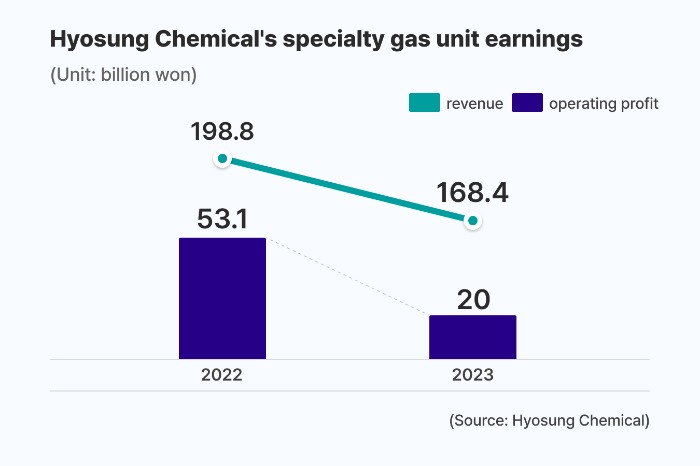

The specialty gas division posted 20 billion won in operating profit and 168.4 billion won in revenue last year, down 62.1% and 15.3% on-year, respectively.

CHALLENGES IN VIETNAMESE OPERATIONS

Hyosung Chemical logged 336.7 billion won and 188.8 billion won in operating losses in 2022 and 2023, respectively. The chemicals maker’s total debt amounted to 3.2 trillion won with a 3485.8% debt-to-equity ratio as of the end of March this year.

The company’s financial conditions have deteriorated as operation of a factory in Vietnam has been delayed.

Hyosung Chemical injected more than 1.5 trillion won to build a chemical plant in the Southeast Asian country in 2021. But the company struggled with the Vietnamese business over the factory’s equipment defects and several renovations. The plant was not fully operational until June last year, industry sources said.

Chinese chemicals makers aggressively expanded their market share with low-cost polypropylene (PP) and terephthalic acid (TPA), Hyosung Chemical’s core products, while the Korean company struggled to operate the Vietnamese plant.

The company’s financial burden has worsened due to a rise in the cost of liquefied petroleum gas (LPG), a component of PP, since the outbreak of the Ukraine-Russia war.

Hyosung Chemical will focus on normalizing its Vietnamese affiliate Hyosung Vina Chemicals Co. after improving its financial health.

In May, Hyosung Chemical and Abu Dhabi National Oil Company (ADNOC) signed an MOU to jointly invest in the Vietnamese unit and use LPG from the Emirati oil giant to produce chemicals.

Write to Jun-Ho Cha and Jong-Kwan Park at chacha@hankyung.com

Jihyun Kim edited this article.

More to Read

-

Corporate bondsHyosung Chemical receives negative credit rating outlook

Corporate bondsHyosung Chemical receives negative credit rating outlookJun 19, 2024 (Gmt+09:00)

1 Min read -

Fiber & TextileHyosung TNC to invest $1 bn in new bio-fiber plants in Vietnam

Fiber & TextileHyosung TNC to invest $1 bn in new bio-fiber plants in VietnamApr 03, 2024 (Gmt+09:00)

3 Min read -

Corporate governanceNPS to veto adding Hyosung chair, vice chair to board

Corporate governanceNPS to veto adding Hyosung chair, vice chair to boardMar 07, 2024 (Gmt+09:00)

2 Min read -

Chemical IndustryHyosung Chemical makes emergency investment in crisis-hit Vietnamese subsidiary

Chemical IndustryHyosung Chemical makes emergency investment in crisis-hit Vietnamese subsidiaryMay 22, 2023 (Gmt+09:00)

1 Min read

Comment 0

LOG IN