Korea Zinc to invest $146 mn in green business R&D hub

The S.Korean non-ferrous metal smelting giant is fostering eco-friendly materials businesses as new growth drivers

By May 13, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Korea Zinc Inc., South Korea’s and the world’s No. 1 lead and zinc smelter, will build its second research and development center, which will aid the company’s push for new growth drivers – eco-friendly and next-generation materials businesses – in Incheon, adjacent to Seoul, by 2027.

According to the company’s announcement on Sunday, its new R&D center will be located in Songdo, or Songdo International Business District, Incheon, about 40 kilometers west-southwest of Seoul, Korea’s capital city.

Korea Zinc has already begun designing the new R&D hub with multiple facilities and this year aims to gain construction plan approval for the center to sit on a total floor area of 29,444 square meters to break ground on it next year. It plans to complete the center's construction by April 2027.

The company currently runs one R&D center in Onsan, Ulsan in the southeast corner of the Korean peninsula.

While the existing center focuses on the company’s mainstay business of non-ferrous metals, the new R&D center will focus on new growth engines beyond non-ferrous metals – battery materials, new renewable energy and green hydrogen materials, material recycling and next-generation material technologies.

It plans to hire about 200 new R&D personnel, about double the staff at the Onsan R&D center, and invest about 200 billion won ($146 million) in total for the Songdo R&D hub.

The new R&D center is part of the company’s long-term plan to foster eco-friendly material businesses as its new growth driver under the direction of the company’s Chairman Choi Yun-Birm.

Choi, the third-generation leader from its founding family, has been aggressively pursuing new growth engines since he took the helm of Korea Zinc in 2019. He became chairman in 2022.

TROIKA DRIVE BEYOND NON-FERROUS METALS

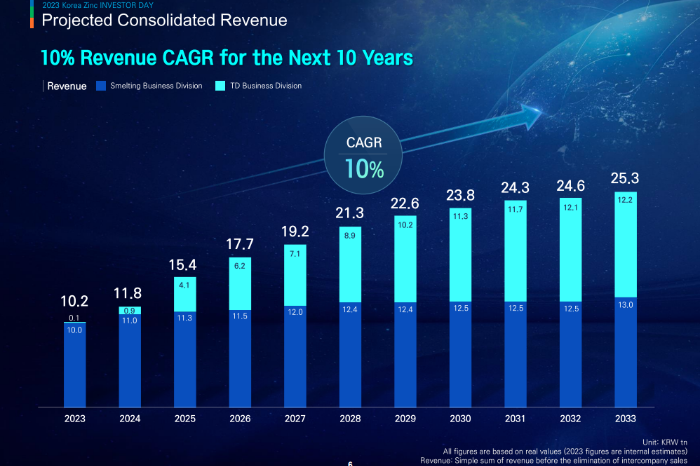

The company in December last year announced a plan to more than double its revenue to 25.3 trillion won from 2023 to 2033 by bolstering its so-called Troika Drive businesses – renewable energy and green hydrogen, battery materials and resource recycling.

Korea Zinc raked in 9.7 trillion won in consolidated sales for 2023, down 13.5% from the previous year, and its combined operating profit fell 28.3% to 659.1 billion won over the same period.

Non-ferrous metal smelting business currently accounts for nearly 99% of its entire revenue.

As part of its long-term plan to bolster Troika Drive businesses, Korea Zinc pledged to invest 12 trillion won in the new growth drivers from 2024 to 2033.

The Troika Drive aims to leverage Korea Zinc’s metal extraction know-how to bolster the company’s green energy material businesses.

The company expects the new businesses to bring in more profit than its current mainstay non-ferrous metal smelting business.

HUNT FOR TALENT AND M&A OPPORTUNITIES

To bolster the R&D capabilities of the new center, Korea Zinc plans to fill half of the new 200 staff with those holding master’s and doctorate degrees in their respective new growth areas, the company said.

The company expects the new R&D center's location near Seoul will help it easily lure skilled experts.

It will also keep looking for merger and acquisition targets abroad that are expected to create synergy with the new R&D center.

In July 2022, Korea Zinc acquired a 73.21% stake in Igneo Holdings LLC, a US-based electronic waste recycling company, for $332 million.

Last month, it took over the entire stake in Kataman Metals LLC, a US-based scrap metal trading company, for $55 million to expand its recycling business.

It also runs two Australian affiliates – Ark Energy, a sister company of Australian zinc producer Sun Metals, which is part of Korea Zinc, and the country’s largest renewable energy developer Epuron acquired in 2021. They play a key role in leading its major renewable energy and hydrogen projects.

In 2018, Korea Zinc also teamed up with Korean chemical giant LG Chem Ltd. to set up the nickel sulfate-producing joint venture Korea Energy Materials Co. (KEMCO), which also set up a precursor-producing JV, Korea Precursor Co., with LG Chem in 2022.

LG Chem is the parent company of Korea’s largest electric vehicle battery maker LG Energy Solution Ltd.

Write to Sang Hoon Sung at uphoon@hankyung.com

Sookyung Seo edited this article.

-

BatteriesLG Chem, Korea Zinc JV to mass-produce EV battery materials

BatteriesLG Chem, Korea Zinc JV to mass-produce EV battery materialsApr 17, 2024 (Gmt+09:00)

2 Min read -

Waste managementKorea Zinc buys US Kataman for $55 mn for recycling business

Waste managementKorea Zinc buys US Kataman for $55 mn for recycling businessApr 01, 2024 (Gmt+09:00)

1 Min read -

Waste managementKorea Zinc, LG Chem team up for US recycling business

Waste managementKorea Zinc, LG Chem team up for US recycling businessMar 15, 2024 (Gmt+09:00)

2 Min read -

Hydrogen economyKorea Zinc to up sales to $19 billion by 2033 with green energy

Hydrogen economyKorea Zinc to up sales to $19 billion by 2033 with green energyDec 07, 2023 (Gmt+09:00)

3 Min read -

BatteriesHyundai to invest $398 mn in Korea Zinc for battery materials

BatteriesHyundai to invest $398 mn in Korea Zinc for battery materialsAug 30, 2023 (Gmt+09:00)

2 Min read -

Private equityYoung Poong Precision to increase control over Korea Zinc

Private equityYoung Poong Precision to increase control over Korea ZincDec 28, 2022 (Gmt+09:00)

1 Min read -

Corporate investmentKorea Zinc to invest $7.5 billion in green hydrogen, battery materials

Corporate investmentKorea Zinc to invest $7.5 billion in green hydrogen, battery materialsAug 09, 2022 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsKorea Zinc buys US e-waste recycling firm for $332 mn

Mergers & AcquisitionsKorea Zinc buys US e-waste recycling firm for $332 mnJul 12, 2022 (Gmt+09:00)

2 Min read -

BatteriesLG Chem, Korea Zinc affiliate KEMCO to launch battery precursor JV

BatteriesLG Chem, Korea Zinc affiliate KEMCO to launch battery precursor JVJun 02, 2022 (Gmt+09:00)

1 Min read