Bio & Pharma

S.Korean anti-obesity drugmakers eye niche demand

S.Korean latecomers eye success in the burgeoning weight-loss drug market with different delivery systems

By May 07, 2024 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

The global weight management market has entered a new chapter following the arrival of blockbuster weight-loss medication Wegovy, and South Korean latecomers are upping the ante in the heated global race with different drug delivery technologies.

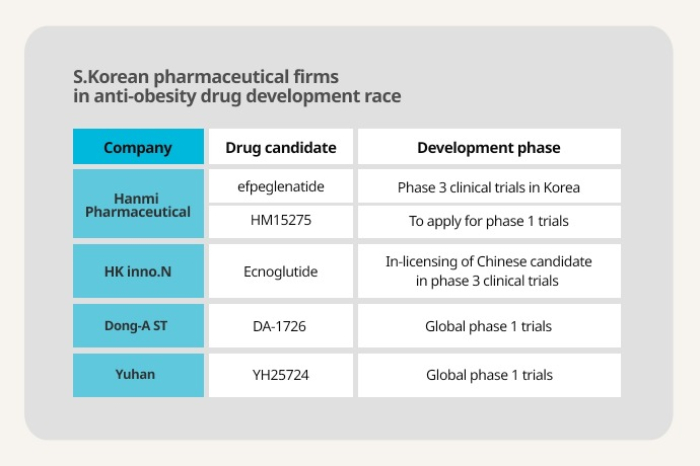

Of many Korean pharmaceutical companies, Hanmi Pharmaceutical Co. under Hanmi Science Co. is expected to be the first company to debut Korea’s first anti-obesity drug in the market.

In January, the country’s pharmaceutical giant embarked on phase 3 trials of its weight-loss drug candidate efpeglenatide, a glucagon-like peptide 1 (GLP-1) receptor agonist, with 420 adult patients suffering from obesity in Korea.

GLP-1 is a hormone that is released after eating and sends signals to the brain to suppress appetite by increasing the feeling of being sated.

It aims to commercialize the medicine in three years after completing its clinical trials by the first half of 2026.

The company with a pipeline of five obesity treatment candidates also applied for a clinical trial of another candidate HM15275 with Korea’s Ministry of Food and Drug Safety in February.

The giant pharmaceutical company, however, is contested by smaller local rivals in a race to lead the anti-obesity drug market.

HK inno.N Corp. last week announced that it signed an in-licensing agreement with Chinese biotech company Sciwind Biosciences Co. to develop and commercialize an obesity treatment using the latter’s GLP-1 analog ecnoglutide (XW003).

The Chinese candidate is currently in phase 3 clinical trials in China, meaning that the Korean latecomer will be able to speed up the commercialization of its weight-loss drug due to the partnership.

Dong-A ST Co. is currently carrying out global phase 1 clinical trials of its weight treatment candidate DA-1726 with its US subsidiary Neurobo Pharmaceuticals Inc.

Yuhan Corp. is also expected to complete global phase 1 trials of its anti-obesity candidate YH25724 this year. The candidate was out-licensed to Boehringer Ingelheim for $870 million in 2019.

FIERCE GLOBAL RACE

The Korean pharmaceutical companies are jumping on the global obesity treatment bandwagon after Wegovy by Danish multinational pharmaceutical company Novo Nordisk A/S has transformed the related market.

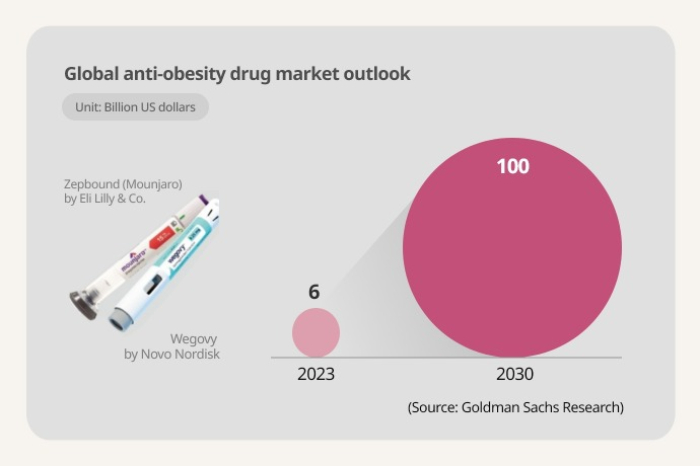

With high efficacy in treating obesity, Wegovy's sales in 2023 reached 39 trillion won ($28.8 billion), and those of Zepbound by Eli Lilly & Co., approved by the US Food and Drug Administration in November last year, hit 19 trillion won. The latter drug is already available to treat Type 2 diabetes under the brand name Mounjaro.

Due to a surge in demand, these drugs are grappling with supply shortages, indicating the global obesity management market is set to take off for a while.

Goldman Sachs Research forecast the market could grow to $100 billion in 2030 from $6 billion in 2023.

The market is currently vied for by more than 2,000 GLP-1 analogs in clinical trials across the world, including 100 candidates already in phase 3 trials.

Other multinational pharmaceutical and biotech companies such as Merck & Co. Inc., AstraZeneca plc, Roche and Amgen are also in the race, raising the bar in the obesity management market.

But the supply shortage of Wegovy and Zepbound is expected to give latecomers like Korean pharmaceutical firms a chance to share the market in its next leap, said a Korean pharmaceutical industry observer.

To crack the market, Korean obesity treatment developers should be more creative and focus on niche demand, industry experts advised.

DIFFERENT DELIVERY TECHNOLOGIES

Hence, smaller latecomers in Korea have turned their eyes to new drug delivery technologies.

Ildong Pharmaceutical Co. has been carrying out phase 1 trials of its weight-loss drug candidate, which can be taken orally in a capsule form, since last year.

Biotech startup D&D Pharmatech has joined hands with US-based multinational biopharmaceutical company Metsera to introduce anti-obesity pills.

Novo Nordisk and Eli Lilly are also carrying out clinical trials of weight-loss pills. Wegovy and Zepbound are currently available as pre-filled injection pens.

A transdermal patch, which delivers the medication into the body through the skin with micrometer needles, is another popular type of weight-loss medication under development.

Daewoong Pharmaceutical Co. is set to commence phase 1 trials of its patch-type anti-obesity drug this year with an aim to commercialize it by 2028.

Daewon Pharmaceutical Co. has partnered with local microneedle developer Raphas Co. to commercialize the weight-loss patch DW-1022. It got the nod for the patch’s phase 1 trials in Korea in March.

Write to Young- Ae Lee at 0ae@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Bio & PharmaLG Chem out-licenses obesity drug candidate to US firm

Bio & PharmaLG Chem out-licenses obesity drug candidate to US firmJan 05, 2024 (Gmt+09:00)

2 Min read -

Bio & PharmaInventage Lab, Yuhan to co-work for obesity treatment

Bio & PharmaInventage Lab, Yuhan to co-work for obesity treatmentJan 05, 2024 (Gmt+09:00)

1 Min read -

Bio & PharmaHanmi Pharma’s Phase 3 trials for anti-obesity medicine approved

Bio & PharmaHanmi Pharma’s Phase 3 trials for anti-obesity medicine approvedOct 24, 2023 (Gmt+09:00)

1 Min read -

Bio & PharmaHanmi Science joins race to develop Wegovy competitor

Bio & PharmaHanmi Science joins race to develop Wegovy competitorSep 13, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN