STIC Investments to sell Korea’s top mobile coupon platform

The PE firm will sell a 68.4% stake in Coop, which operates vouchers for mobile app Kakao Talk, for more than $218 million

By Apr 30, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

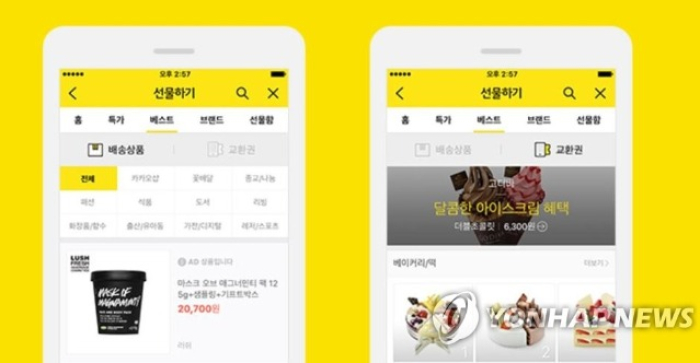

Seoul-based private equity firm STIC Investments is set to sell Coop Marketing, South Korea’s largest mobile coupon platform company that operates digital voucher systems for the country’s top online messenger Kakao Talk, shopping centers and food and beverage franchises such as Starbucks and McDonald’s.

STIC aims to sell a 68.4% stake in Coop for more than 300 billion won ($217.7 million) and is in the process of selecting a lead manager, banking sources said on Monday.

The asset manager and NH Private Equity, the PE unit of NH Investment & Securities Co., jointly bought a 70% stake in Coop for 45.5 billion won in 2017. STIC acquired a 54% stake via its 2014 Growth Engine M&A fund, while NH PE secured 15%.

STIC has raised its ownership in Coop through the mobile voucher platform’s 12 billion won rights offering in 2019 and an additional acquisition of a 12.7% stake from NH PE in 2022.

STIC’s plan to divest Coop was dropped in 2022 and 2023 due to the bid-ask spread. The PE manager is expected to see the internal rate of return (IRR) in the late 10% range if the deal is successfully closed.

Coop issues and distributes mobile coupons and authenticates redemption transactions. Users can exchange the coupons for products of 1,600 companies in the retail, insurance and F&B industries, including E-Mart Inc., Samsung Insurance Co., SPC Group and Korean operations of Pizza Hut and KFC.

The company owns five subsidiaries, fintech firm Korea Pay’s Service, book gift certificate issuer Pay’s BooknLife, overseas business operator Coop Network Asia Pacific, digital insurance platform Coop Fimaps and online marketing firm Gru Company.

Coop posted 6.7 billion won in operating profit and 131.6 billion won in revenue last year, which rose 26% and 15% on-year, respectively.

Write to Jun-Ho Cha at chacha@hankyung.com

Jihyun Kim edited this article.

-

Leadership & ManagementSindoh to tap ex-STIC Investments exec Seo as CEO, spur M&As

Leadership & ManagementSindoh to tap ex-STIC Investments exec Seo as CEO, spur M&AsFeb 15, 2024 (Gmt+09:00)

2 Min read -

Korean startupsMusic copyright trading platform Musicow attracts $46 mn from STIC

Korean startupsMusic copyright trading platform Musicow attracts $46 mn from STICMay 23, 2023 (Gmt+09:00)

2 Min read -

Private equityKorean PE firm STIC to buy stake in copper foil maker Iljin

Private equityKorean PE firm STIC to buy stake in copper foil maker IljinFeb 15, 2023 (Gmt+09:00)

1 Min read