Economy

Korea’s factory output rebounds in February on chip recovery

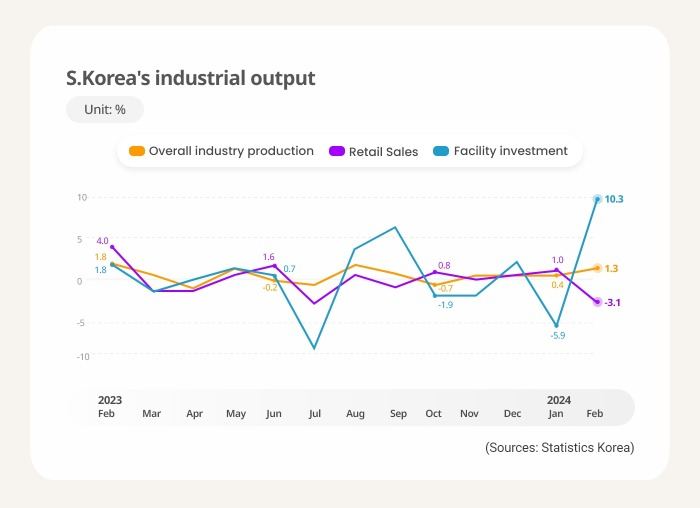

Facility investment jumped by the biggest 10.3% in more than nine years but retail sales fell by their most in the last seven months

By Mar 29, 2024 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s factory activity last month bounced back in three months thanks to strong recovery in the country’s semiconductor sector but consumption dwindled with people still tightening their belts amid stubborn inflation, which could complicate the recovery of Asia’s No. 4 economy.

According to data released on Friday by Statistics Korea, seasonally adjusted mining and manufacturing output in February rose 3.1% from the prior month, marking the first gain since November last year when it added 1.6%.

It fell 0.4% and 1.5%, respectively, in December and January.

The rebound was driven by a 3.4% increase in manufacturing output, largely propelled by an increase in microchip and machinery production, Korea’s mainstay export items.

In line with this, the country’s facility investment last month jumped 10.3% from the previous month, the biggest gain since November 2014 when it climbed 12.7%.

Thanks to the strong recovery in factory activity and facility investment, Korea’s overall industrial production extended its growth streak for the fourth straight month in February with a 1.3% on-month gain.

WEAK RETAIL SALES

While the country’s factory activity returned to the recovery track, consumption showed signs of cooling on still-high inflation.

Retail sales, a gauge of private consumption, contracted 3.1% over the same period, the largest drop since July last year when it retreated 3.1%.

Sales of non-durable goods like food and groceries, as well as cosmetics, fell 4.8% on-month in February, and those of durable goods like home appliances dropped 3.2%. Sales of semi-durables like clothing added 2.4%.

The country’s headline inflation rebounded in February from a six-month low on higher prices of oil and agricultural products, with a 3.1% rise on-year despite the government’s efforts to combat inflation.

“The overall indicator looked healthy but consumption lagged,” said Gong Mi-sook, deputy director general of Short-Term Economic Statistics at Statistics Korea.

With subdued consumption, the country’s economic growth could hit a snag despite strong global demand for Korea’s semiconductors, the main growth driver of the export-reliant country.

But Gong was more optimistic about the country’s economic recovery, citing a recuperation in the indicators of the country’s current and future economic activities last month.

The cyclical component of the composite coincident index, which measures current economic activity, climbed 0.2 point from the previous month to 99.9 in February, indicating resilience in the economy.

The cyclical component of the composite leading indicator, which predicts the turning point in the business cycle, also added 0.1 point to 100.4, suggesting improvement to come.

Write to Kyung-Min Kang at kkm1026@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Korean chipmakersSamsung set to triple HBM output in 2024 to lead AI chip era

Korean chipmakersSamsung set to triple HBM output in 2024 to lead AI chip eraMar 27, 2024 (Gmt+09:00)

3 Min read -

EconomyKorea’s inflation rebounds, BOK to keep interest rates in H1

EconomyKorea’s inflation rebounds, BOK to keep interest rates in H1Mar 06, 2024 (Gmt+09:00)

1 Min read -

EconomyS.Korea’s 2024 exports get off to strong start on China, semiconductors

EconomyS.Korea’s 2024 exports get off to strong start on China, semiconductorsFeb 01, 2024 (Gmt+09:00)

3 Min read -

EconomyS.Korea’s factory output, consumption dwindle in October

EconomyS.Korea’s factory output, consumption dwindle in OctoberNov 30, 2023 (Gmt+09:00)

3 Min read -

EconomyKorea’s July factory output slows at fastest pace since February

EconomyKorea’s July factory output slows at fastest pace since FebruaryAug 31, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN