IPOs

DN Solutions seeks IPO at $3 bn enterprise value on Korea’s main bourse

The company aims for a Kospi debut by year-end while other firms also seek IPOs to ride on the market's rise

By Jan 03, 2024 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

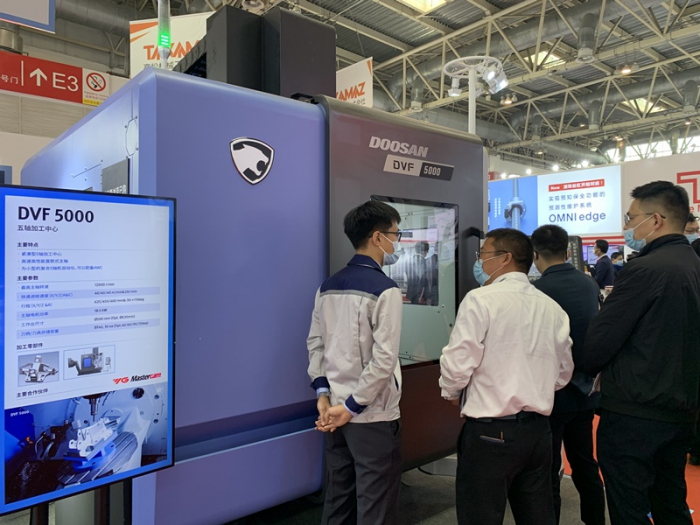

DN Solutions Co., formerly Doosan Machine Tools Co., is seeking an initial public offering on South Korea’s main bourse, aiming to make a Kospi debut by the end of this year.

The company on Wednesday sent out requests for proposals (RFPs) to major brokerages in Korea and abroad to pick a lead underwriter for its IPO plan, according to investment banking industry sources.

DN Solutions plans to receive bids by the end of February and choose the main IPO manager after a competitive session of presentations, sources said.

The company hopes its enterprise value to be between 3 trillion won and 4 trillion won ($2.3 billion-$3.1 billion) when listed on the Kospi market, they said.

Analysts said DN Solutions has begun its IPO process encouraged by a series of successful IPOs on the Korean stock market last year.

DN Solutions is the top machine tool maker in Korea and the world’s No. 3 metal-cutting machine maker.

It started as a machine tool business unit of Doosan Infracore Co., now HD Hyundai Infracore Co.

DN Solutions’ predecessor, Doosan Machine Tools, was acquired by private equity firm MBK Partners in 2016 and was sold to Kospi-listed DN Automotive for 2.12 trillion won in 2022.

Currently, GT Holdings, a special-purpose company wholly owned by DN Automotive, is the owner of DN Solutions.

AIM TO COMPLETE IPO BY END-NOVEMBER

Industry sources said DN Solutions aims to complete its IPO process by the end of November to trade on the Kospi.

When DN Automotive acquired the machine tool maker in 2022, it invested 900 billion won as equity capital in DN Solutions, while raising 220 billion won through perpetual exchangeable bonds issued to financial investors, including Korea Investment & Securities Private Equity. The remaining 1 trillion won was secured through acquisition financing.

Financial investors are expected to recover their investment through the planned IPO, sources said.

DN Solutions' earnings before interest, taxes, depreciation and amortization (EBITDA) was 241.7 billion won in the first half of 2023, up 43% from 168.9 billion won a year earlier.

The company attributed its decent earnings performance to increased orders from major global markets, including the US, Europe and China.

DN Automotive’s consolidated assets stood at 4.55 trillion won at the end of September 2023, up sharply from 1.5 trillion won at the end of 2021.

Meanwhile, other companies are also preparing for IPOs this year to take advantage of the rising stock market in the wake of an apparent end to monetary tightening by central banks around the world.

Among those preparing to go public this year include cosmetics and clothing company APR; HD Hyundai Marine Solution; SSG.COM, an e-commerce unit of Shinsegae Inc.; information technology firm LG CNS; health and beauty store chain CJ Olive Young; SK Ecoplant, a construction engineering and waste management firm under SK Group; internet-only bank K-Bank; and game development and design company Shift Up.

Write to Jun-Ho Cha and Seok-Cheol Choi at chacha@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Private equityMBK names two partners as vice chairman, vice president

Private equityMBK names two partners as vice chairman, vice presidentJan 03, 2024 (Gmt+09:00)

1 Min read -

ConstructionHD Hyundai Construction, Infracore to use integrated machinery platform

ConstructionHD Hyundai Construction, Infracore to use integrated machinery platformDec 26, 2023 (Gmt+09:00)

2 Min read -

Leadership & ManagementMBK raises Hankook bid price, asks FSS to probe Cho's stock purchase

Leadership & ManagementMBK raises Hankook bid price, asks FSS to probe Cho's stock purchaseDec 15, 2023 (Gmt+09:00)

4 Min read -

Comment 0

LOG IN