Thematic ETFs in Korea betting on India’s growth boom

Indian securities-based ETFs have fared well in South Korea thanks to India’s rosy growth outlook

By Nov 17, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korean asset managers stand hand in hand with their global peers in betting on India’s bright growth outlook by rolling out India-themed exchange-traded funds (ETF), which have been faring well this year.

The KODEX India Nifty50 ETF by Samsung Asset Management Co., which debuted on the Korean market in April, recorded a 9.65% cumulative return as of Thursday, while Mirae Asset Global Investments Co.'s TIGER India Nifty 50 ETF boasted an 8.74% return since its debut the same month.

Kiwoom Asset Management Co.'s KOSEF India Nifty50 ETF has gained 8.26% since the start of this year.

An ETF is a basket of securities whose underlying assets vary from stocks to commodities, bonds and indices and trades on an exchange like a stock.

The Nifty 50 is India’s benchmark stock index, tracking 50 blue-chip companies in India. Korean asset management firms have been active in introducing Nifty 50-based ETFs to diversify investments.

Active India-themed ETFs, which are managed by professional investors for higher returns than the general market, are also popular in Korea.

The India Active ETF (NDIA) by Global X under Mirae Asset Global Investments posted a 4.22% return since debuting in August on the New York Stock Exchange Arca. It contains mostly Indian financial, IT and consumer staples and discretionary stocks.

GLOBAL SUPPLY CHAIN RESHUFFLE

With many foreign companies seeking an alternative manufacturing base after fleeing China, the Indian government has become more aggressive at wooing foreign firms to its soil by promoting the country as the global manufacturing hub under the Make In India initiative.

Global investment banking giant Goldman Sachs Group has upgraded India to Overweight, citing the country’s strong economic growth outlook on its strong domestic demand, constant flow of money into the market from mutual funds and anticipated shift of supply chain from China.

S&P Global forecast India’s gross domestic product to grow 6.7% per year from fiscal 2024 to fiscal 2031.

Reflecting such an upbeat growth outlook, Indian stock markets have outperformed their global peers and are expected to continue their bull run next year.

According to the Bombay Stock Exchange (BSE) on Thursday, the BSE SENSEX index gained 11.39% since March.

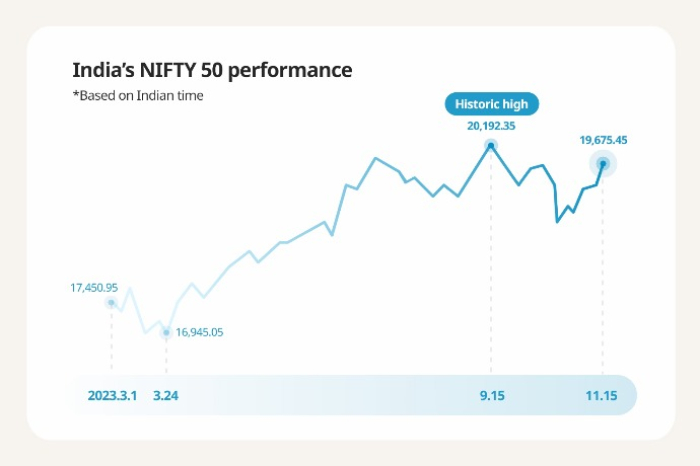

The Nifty50 index also rose 13.71% over the same period after breaking the 20,000-point milestone in September for the first time.

The BSE SENSEX and the Nifty 50 have gained 7.95% and 8.67%, respectively, so far this year.

THEMATIC ETFS BACK INDIA’S GROWTH STORY

Asset managers in other countries are also making big bets on Indian stocks by introducing a slew of Indian securities-based ETFs.

WisdomTree India Earnings Fund (EPI), which tracks profitable companies in the Indian equity market is the world’s largest ETF, managing $1.38 billion in assets. It contains India’s largest conglomerate Reliance Industries Ltd. and the Housing Development Finance Corp.

That ETF climbed 13.22% in the second half of this year. WisdomTree is a New York-based global asset manager focusing on exchange-traded products.

In September, Matthews Asia under Matthews International Capital Management LLC listed the Matthews India Active ETF, whose cumulative return as of Thursday was 3.92%.

MANUFACTURING, FINANCIAL AND CONSUMER SECTORS LOOK PROMISING

As the Indian government ups the ante in its manufacturing sector, the country's manufacturing and financial sectors are expected to post solid growth.

The VanEck India Growth Leaders ETF which tracks Indian investment banks and investment service companies has posted a 23.10% year-to-date return.

The India Internet & Ecommerce ETF with consumer staples and e-commerce stocks, including Zomato Ltd. and Freshworks Inc., as its underlying assets has also performed well.

Write to Hyo-Sung Jeon at zeon@hankyung.com

Sookyung Seo edited this article.

-

Korean foodLotte Wellfood ups Choco Pie India sales target to $60 mn with new factory

Korean foodLotte Wellfood ups Choco Pie India sales target to $60 mn with new factoryOct 10, 2023 (Gmt+09:00)

2 Min read -

AutomobilesHyundai to hike Exter SUV output to capitalize on void in India

AutomobilesHyundai to hike Exter SUV output to capitalize on void in IndiaOct 09, 2023 (Gmt+09:00)

3 Min read -

Corporate strategyKorea Inc. to focus more on India, Vietnam as biz partners

Corporate strategyKorea Inc. to focus more on India, Vietnam as biz partnersSep 08, 2023 (Gmt+09:00)

1 Min read -

ElectronicsIndia, LG’s land of promise with young, rich population

ElectronicsIndia, LG’s land of promise with young, rich populationSep 06, 2023 (Gmt+09:00)

3 Min read -

-

Asset managementMirae Asset No. 1 among overseas asset managers in India

Asset managementMirae Asset No. 1 among overseas asset managers in IndiaSep 04, 2023 (Gmt+09:00)

2 Min read -

-

Mergers & AcquisitionsMirae Asset seeks to buy India’s 9th-largest brokerage Sharekhan

Mergers & AcquisitionsMirae Asset seeks to buy India’s 9th-largest brokerage SharekhanAug 31, 2023 (Gmt+09:00)

3 Min read