E-commerce

SK Square in talks with Qoo10 for joint management of 11Street

The 11Street parent wants to merge the Korean e-tailer with the Singaporean e-commerce giant for joint management

By Oct 27, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

SK Square Co., the investment management arm of SK Group, is in talks with Qoo10 Pte. to merge its e-commerce subsidiary 11Street with the Singapore-based e-commerce giant to co-manage the Korean e-tailer as a major stakeholder, according to sources in the investment banking industry on Friday.

If they agree on the deal, the Korean e-commerce market, currently dominated by top three players Coupang Inc., Naver Shopping and Gmarket, is expected to face a big shakeup.

The IB sources said SK Square’s Chief Investment Officer Ha Hyung-il and Qoo10’s largest stakeholder and Chief Executive Officer Ku Young-bae are holding a new round of discussions on the deal to co-manage 11Street after the merger, which was initially proposed by the Korean e-commerce platform’s parent.

After the merger, SK Square is expected to own a major stake in Qoo10, according to the sources.

With the new offer, the 11Street sale negotiations, which have been stalled after the parties’ initial sale talks faltered due to differences over terms such as the sale price, are entering a new round of discussions.

Qoo10 originally proposed to buy 11Street in a stock swap deal, which would exclude SK Square from 11Street's management.

The Singapore-headquartered e-commerce giant took over other Korean e-commerce platforms TMON and WeMakePrice, respectively, in September last year and May this year in similar deals, which allowed their investors to exit without listing them.

KOREAN E-COMMERCE MARKET SHAKEUP

If SK Square and Qoo10 agree on the new deal, 11Street would have a breakthrough in its business with other e-tailers under Qoo10 operating in Korea.

The total gross merchandise value (GMV) of TMON and WeMakePrice stood at 3.8 trillion won ($2.8 billion) and 2.4 trillion won, respectively, as of the end of 2022.

Combined with their smaller sibling Interpark Commerce Corp., the total GMV of Qoo10’s Korean e-tailers fell short of 7 trillion won.

But if 11Street with a 10.5 trillion won GMV commanding 7% market share joins the Qoo10 club, they could control the third-largest share together in the Korean e-commerce market, following No. 1 Coupang with a 36.8 trillion won GMV and runner-up Naver Shopping with 35 trillion won.

The current No. 3 is GMarket with a 15.2 trillion GMV.

The strategic partnership between the world’s largest online shopping mall Amazon.com and 11Street is an important factor making the co-management option attractive, market analysts said.

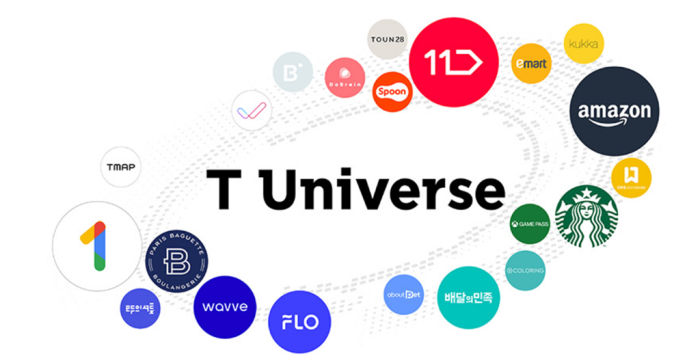

SK Group would also benefit from a bigger e-commerce network as its mobile carrier unit SK Telecom Co. and mobility unit Tmap Mobility Co. need online platforms to bolster their businesses.

“If SK Square receives stakes (from Qoo10) and succeeds in (11Street’s) initial public offering, it would be a blessing in disguise,” said a source from the IB industry.

Qoo10 has the upper hand in the negotiations with SK Square, according to market sources.

SK Square attempted to list 11Street to allow its financial investors to exit by September as agreed with the investors.

Nile Holdings Co., a special purpose vehicle founded by H&Q Korea, the National Pension Service and others, invested 500 billion won to own an 18.1% stake in 11Street in 2018. The remaining stake is held by SK Sqaure.

But the IPO failed amid the ongoing IPO winter.

IMM Investment plans to additionally inject 500 billion won in Qoo10, suggesting the Southeast Asian e-commerce giant has enormous growth potential.

Write to Dong-Hui Park at donghuip@hankyung.com

Sookyung Seo edited this article.

More to Read

-

E-commerceSingapore-based Qoo10 acquires South Korean e-tailer WeMakePrice

E-commerceSingapore-based Qoo10 acquires South Korean e-tailer WeMakePriceApr 07, 2023 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsQoo10 to buy another Korean rival for unit’s Nasdaq listing

Mergers & AcquisitionsQoo10 to buy another Korean rival for unit’s Nasdaq listingMar 14, 2023 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsKKR, Anchor Equity tipped to exit from TMON in 7 yrs

Mergers & AcquisitionsKKR, Anchor Equity tipped to exit from TMON in 7 yrsAug 26, 2022 (Gmt+09:00)

3 Min read -

E-commerceAmazon teams up with SK’s 11Street to offer Global Store for Koreans

E-commerceAmazon teams up with SK’s 11Street to offer Global Store for KoreansAug 26, 2021 (Gmt+09:00)

2 Min read -

E-commerceKorea's first-generation retail platform Interpark up for sale

E-commerceKorea's first-generation retail platform Interpark up for saleJul 12, 2021 (Gmt+09:00)

4 Min read

Comment 0

LOG IN