Automobiles

Hyundai, Kia aim for 20% share in Middle East with EVs by 2030

S.Korea's top two carmakers target 550,000 combined unit sales annually in the region by 2030, 70% more than in 2022

By Oct 20, 2023 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Hyundai Motor Co. and its sibling Kia Corp. together target selling 550,000 cars annually in the Middle East by 2030 to control about 20% of the regional market with their expanded electric vehicle lineup, Hyundai Motor Group announced on Friday.

South Korea’s top two automakers have set their sights on the Middle East on expectations that the region’s auto market will top 3 million units by 2030 from 2.3 million in 2022.

By brand, Hyundai Motor plans to sell 350,000 units in the market by 2032 and Kia 210,000 units by 2030.

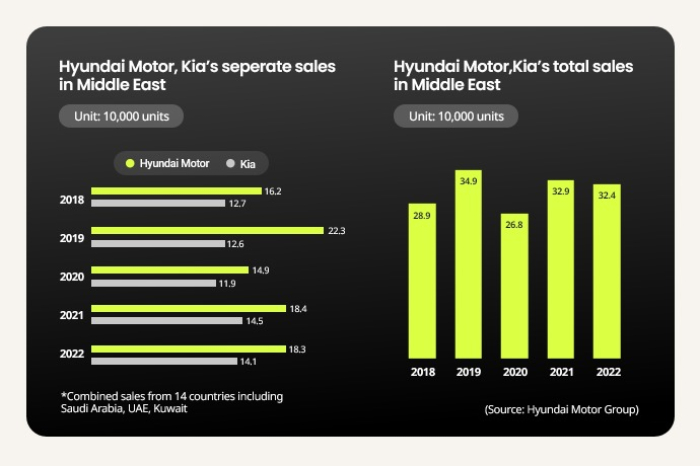

Hyundai Motor and Kia’s car sales should grow at a compound annual growth rate of 6.8% by 2030 to meet the sales target, which is 70% higher than 2022.

The Korean siblings’ total car sales in the Middle East dropped to 268,311 units in 2020 due to COVID-19 outbreaks but bounced back to 324,439 units in 2022 – Hyundai Motor with an 8.0% share after selling 182,934 units and Kia with 6.2% after selling 141,505.

In the first three quarters of this year, they sold 281,097 units – Hyundai Motor with 162,655 and Kia with 118,442. Total shipments were 14.2% higher than the same period last year.

EV-DRIVEN GROWTH

Hyundai Motor will double its EV lineup from the current six models by 2027 to up its EV sales to over 15% of its total car sales in the Middle East in 2032.

Kia plans to expand its EV lineup in the market from its current four models to 11.

Kia last week introduced more affordable EV models to bolster its eco-friendly car sales under a long-term goal to sell 1.6 million EVs across the globe by 2030. To meet the goal, it plans to release 15 EV models in the price range between $30,000 and $80,000 by 2027.

Hyundai Motor has set a target to sell 2 million EVs by 2030 around the world.

“Considering the high growth potential of the Middle Eastern auto market and diverse cultures across nations in the region, Hyundai Motor and Kia will offer different market-specific products and services to build premium brand images and increase their sales and market shares,” said the company.

SAUDI ARABIA, NO.1 AUTO MARKET IN MIDDLE EAST

They also pin high hopes on Saudi Arabia, the biggest car market in the region.

The Saudi Arabian auto market expanded 52% to 640,000 units in 2022 from 2018. Over the same period, the whole Middle Eastern auto market contracted.

Hyundai Motor and Kia project the Saudi auto market in 2030 would recover to about 800,000 units, the level last seen in 2014.

In the first six months of this year, Hyundai Motor and Kia ranked second and fourth, respectively, in terms of sales volume in Saudi Arabia.

Hyundai Motor delivered about 52,000 units over the period, trailing behind market No. 1 Toyota Motor Corp. with shipments of 114,000 units.

Kia sold about 21,000 units, falling behind Nissan Motor Corp. with 23,000.

The best-selling cars of Hyundai Motor in the country were compact sedans the Avante and the Accent, as well as compact sport utility vehicle the Creta, while Kia’s Pegas, K5 and Sportage were the most popular models.

The Korean auto giant’s Chairman Chung Euisun will depart to Saudi Arabia tomorrow as a member of the business delegation accompanying South Korean President Yoon Suk Yeol for his state visit to the country.

Chung is expected to come up with a more detailed plan for Hyundai Motor’s EV assembly plant in Saudi Arabia during his trip. The Korean auto giant earlier this year signed a memorandum of understanding with the Saudi trade ministry to build an EV assembly factory in the Middle Eastern country.

MARKET ENTRY 50 YEARS AGO

The two Korean carmakers first entered the Middle Eastern auro market in the 1970s.

Their sales, however, faltered during the pandemic but recently started recovering.

To improve their brand awareness and sales in the Middle East, Hyundai Motor plans to roll out a new segment vehicle such as pickup trucks, introduce the connected car service Bluelink, enhance the dealer network and reinforce its corporate social impact movement.

Kia plans to develop new strategic models catering to local drivers’ demands, build EV infrastructure and diversify its dealer channels.

Their main markets in the Middle East are 14 countries, including Saudi Arabia, the United Arab Emirates, Kuwait, Oman, Qatar, Bahrain, Jordan, Iraq, Lebanon and Syria.

Write to Nan-Sae Bin at binthere@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Electric vehiclesKia unveils low-cost EV models to reboot sales growth

Electric vehiclesKia unveils low-cost EV models to reboot sales growthOct 12, 2023 (Gmt+09:00)

4 Min read -

Corporate strategyFrom fast follower to first mover under Hyundai Motor's Chung

Corporate strategyFrom fast follower to first mover under Hyundai Motor's ChungOct 04, 2023 (Gmt+09:00)

3 Min read -

Business & PoliticsHyundai eyes Saudi EV plant as Korea bets on Middle East boom

Business & PoliticsHyundai eyes Saudi EV plant as Korea bets on Middle East boomSep 18, 2023 (Gmt+09:00)

3 Min read -

AutomobilesHyundai Motor set to exit Russia with St. Petersburg plant sale to AGR

AutomobilesHyundai Motor set to exit Russia with St. Petersburg plant sale to AGRSep 14, 2023 (Gmt+09:00)

2 Min read -

Business & PoliticsSaudi prince’s Seoul trip brings $30 billion in business deals

Business & PoliticsSaudi prince’s Seoul trip brings $30 billion in business dealsNov 17, 2022 (Gmt+09:00)

4 Min read

Comment 0

LOG IN