Automobiles

Korean cars' gap vs. Japanese to narrow in UAE under CEPA

Japanese auto brands currently dominate the UAE auto market, with less than 10% of it controlled by Hyundai Motor and Kia

By Oct 16, 2023 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korean carmakers are expected to rapidly catch up to their Japanese rivals in the United Arab Emirates (UAE) after their home country and the UAE agreed on a free trade deal which will lift 5% tariffs on Korean cars in the UAE within 10 years.

Korean Trade Minister Ahn Deok-geun and UAE Minister of State for Foreign Trade Thani bin Ahmed Al Zeyoudi signed a bilateral Comprehensive Economic Partnership Agreement (CEPA) in Seoul on Saturday, the Korean trade ministry announced the same day.

A CEPA is a free trade deal that opens each country’s market through lower or zero tariffs on imports to the other country while covering a broader scope of economic cooperation and exchange measures than a free trade agreement.

Korean cars are expected to enjoy a boon from the deal, which will remove 5% tariffs on Korean car imports in the UAE in phases over 10 years. Cars are Korea’s No. 1 export item to the UAE, the Middle East's second-largest auto market after Saudi Arabia.

CARS, KOREA’S NO.1 EXPORT TO THE UAE

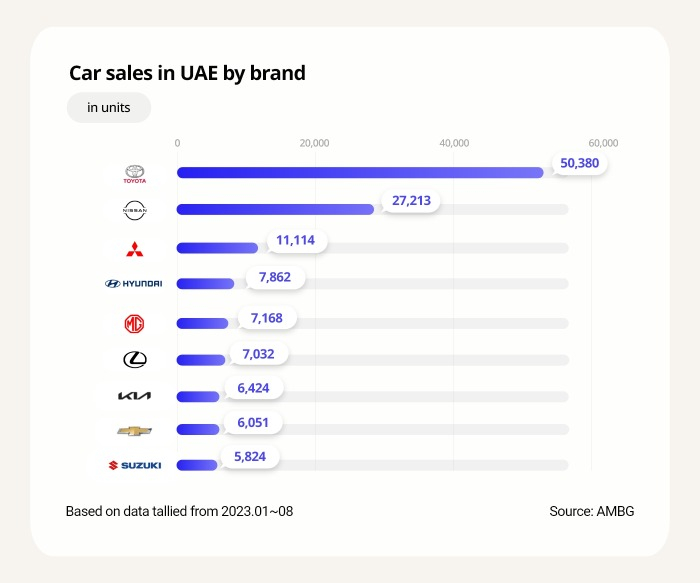

The Middle Eastern nation's auto market is now dominated by Japanese carmakers, with top seller Toyota Motor Corp. commanding a 29.6% share and runner-up Nissan Motor Co. with 16%, based on total auto sales from January to August this year, according to data from the Automotive Manufacturers Business Group (AMBG) under the Dubai Chamber on Monday.

Hyundai Motor and Kia together sold 14,286 units in the country over the same period, ranking No. 3 with an 8.4% share and outperforming Mitsubishi Motors Corp.'s 6.5%. Compared with a year ago, the Koreans' share increased from 7.2%, while their Japanese peer’s share fell from 14.9%.

Hyundai Motor and Kia's combined sales volume also surged 39.4% over the same period, marking the fastest pace of growth in the UAE.

Under the Korea-UAE CEPA, Korean auto brands are expected to speed up their expanded presence in the Middle Eastern country, as the deal should bolster Korean cars’ price competitiveness versus their rivals from Japan, the US and the EU that do not have a free trade deal with the UAE.

Once the deal takes effect, about half of Hyundai Motor and Kia’s cars in the UAE would benefit from zero tariffs, considering that about 50% of their total exports to the country are shipped from Korea while the remainder come from India and Indonesia, according to a Korean auto industry source.

PAVING THE WAY FOR EV MARKET LEAD

The free trade deal with the UAE is also expected to lay the groundwork for deeper inroads into the Middle East by Korean electric vehicles.

The UAE has announced it will replace all taxis in its capital Dubai with green cars — hybrids and EVs — by 2027 to achieve net zero transport emissions by 2050. The UAE EV market is forecast to grow from $250 million in 2022 to $660 million in 2026, according to Statista.

Hyundai Motor has already been supplying its Sonata hybrid taxis to Dubai. The brand's vehicles account for two-thirds of the city’s green taxi market.

While Hyundai Motor and Kia are ahead of their Japanese peers in the EV sector thanks to their many high-quality models, Korean EVs are expected to gain even more traction under the Korea-UAE trade deal.

Korea-made EV parts like batteries and electric motors, as well as EV charging technology are also expected to benefit from the deal.

KOREA’S FIRST CEPA WITH A MIDDLE EASTERN COUNTRY

The Korea-UAE CEPA is Korea’s first free trade deal with a Middle Eastern nation and its 24th free trade agreement. The UAE is Korea's 16th major trading partner, with bilateral trade estimated at $19.5 billion in 2022, according to Korean government data.

Under the CEPA, the two countries have agreed to remove duties on 92.8% of all items exported from the UAE to Korea and 91.2% of all products shipped from Korea to the UAE within 10 years.

Besides the abolition of the car tariff, Korean electronics, weapons and fresh foods are also poised to benefit from the deal.

The UAE will also lift a 3% tariff on crude oil over the next 10 years in phases, a move expected to bolster not only Korean refiners’ price competitiveness abroad but also Korea’s energy security.

The UAE is Korea’s third-largest crude importer, accounting for about 10% of the Asian country’s total crude imports. Of UAE’s total exports to Korea, about 60% is oil by value.

Under the deal, the two countries will also bolster their economic ties in energy, biotechnology, smart farms, healthcare and advanced industries.

Korea and the UAE plan to sign a formal CEPA agreement in the first half of next year after legal review and parliamentary approval.

Write to Nan-Sae Bin and Il-Gue Kim at binthere@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Business & PoliticsUAE to find $2 bn investment opportunities in S.Korea

Business & PoliticsUAE to find $2 bn investment opportunities in S.KoreaMay 22, 2023 (Gmt+09:00)

1 Min read -

Business & PoliticsUAE state funds gear up for $30 bn S.Korean investment

Business & PoliticsUAE state funds gear up for $30 bn S.Korean investmentMay 19, 2023 (Gmt+09:00)

3 Min read -

AutomobilesHyundai, Kia post record US car sales as Japanese firms struggle

AutomobilesHyundai, Kia post record US car sales as Japanese firms struggleFeb 03, 2022 (Gmt+09:00)

3 Min read

Comment 0

LOG IN