Supply chain

Korea’s heavy dependence on China for raw materials deepens

If China tightens its grip on key materials again, it could deal a heavy blow to Korea’s major industries, analysts warn

By Sep 12, 2023 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

While the urea crisis in 2021 laid bare South Korea’s heavy dependence on China for basic raw materials, concerns are growing that Korea’s fragile supply chain puts many of its key industries in a precarious situation.

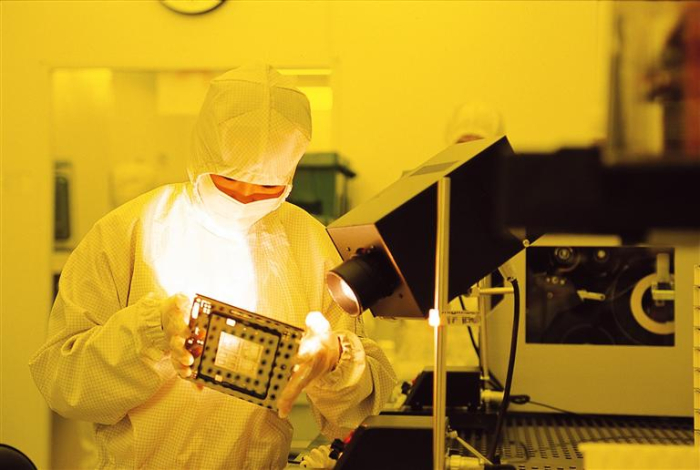

According to the Korea International Trade Association (KITA) and the Korea Customs Service, the supply chain vulnerability of Korea’s key industries, including semiconductors, batteries, automobiles, petrochemicals and steel, has increased alongside the steady rise in imports from China over the years.

Imports of three key rare gases – krypton, neon and xenon – used in chipmaking processes, reached $135.4 million in the first seven months of this year, data showed.

Of the imports, 68.1% or $92.2 million worth of the materials came from China. That percentage is much higher than the 16.7% at the end of 2021.

Korea’s reliance on China for xenon, in particular, used in the wafer-cutting etching process, has increased to 67.1% from 9.2% over the same period.

Analysts said minor disruptions in the supply chain could deal a heavy blow to Korea – home to the world’s two largest memory chipmakers, Samsung Electronics Co. and SK Hynix Inc.

Korea’s heavier reliance on China for the three chip-processing gases has been due to the protracted war between Russia and Ukraine, two major producers of such gases.

SAME FOR BATTERIES, CARS & PETROCHEMICALS

The situation isn’t much different for other Korean industries.

Korea’s imports of precursors – an ingredient of cathodes, the positive end of a lithium-ion battery – from China reached $2.48 billion in the January-July period. China accounted for 96.6% of Korea’s precursor imports, up from 93.1% at the end of 2021.

China-made synthetic graphite, used for the negative end of a lithium-ion battery, known as the anode, accounted for 93.7% of Korea’s total imports of such material.

Chinese imports of two other battery-making materials – lithium hydroxide and cobalt oxide – accounted for 80.4% and 69.5%, respectively, during the January-July period.

While China is not the primary producer of battery materials, it is the primary processor, controlling the processing of nearly 60% of the world’s lithium, 35% of its nickel and 65% of its cobalt, according to industry data.

In the past, supply-chain disruptions arising from China often led to higher prices in the global battery parts market.

Soaring prices of metals for rechargeable batteries are particularly worrisome for Korea, home to some of the world’s leading battery makers such as LG Energy Solution Ltd., Samsung SDI Co. and SK On Co.

UREA CRISIS AGAIN?

In the petrochemical industry, Korea’s dependence on China for ethyl acetate, used as a solvent, reached 98.8% while imports of material magnesium ingots, used to make lightweight aluminum alloys for automotive bodies, stood at 99.7% in the January-July period.

Korean steelmaker POSCO established a magnesium ingot plant in Gangneung, Gangwon Province in 2012, but domestic production was soon suspended after an environmental pollution controversy flared.

When a Chinese fertilizer company last week restricted the export of urea, used in diesel cars, Koreans rushed to online shopping malls to buy it, fearing another urea crisis.

In October 2021, China banned exports of urea solution, normally a cheap and easy-to-purchase substance used to reduce carbon emissions in diesel vehicles such as trucks.

The ban created chaos among diesel car owners, including truck drivers, who were desperate to secure the diesel exhaust fluid (DEF) amid rapid price gains. Korea imports almost all its DEF needs from China.

GROWING VULNERABILITY

The Korean economy’s growth strategy has long been based on value-added, high-end products, taking advantage of China’s cheap labor and readily available raw materials.

However, Korea stands to lose the most if the China-US trade dispute or China-Taiwan relations worsen, analysts warn.

On Aug. 1, the Chinese government imposed export restrictions on gallium and germanium, key raw materials used to make chip wafers. China accounts for 90% of the global production of the two materials.

Industry officials said there is little chance that China will resort to resource weaponization akin to its suspension of rare earth supply in the early 2010s as such a move could backfire, hitting its own economy. Nevertheless, China could use export bans as political leverage to wield its clout over the global supply chain.

“China cutting off its raw material supplies entirely would be tantamount to declaring war on the international community, but it could tighten its control over certain raw materials, like rare gases, anytime. Korea needs to be prepared,” said Kim Kyung-hoon, head of KITA’s supply chain analysis team.

Write to Kyung-Min Kang at Kkm1026@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Korean chipmakersSK Hynix hikes use of locally produced neon gas for chip manufacture

Korean chipmakersSK Hynix hikes use of locally produced neon gas for chip manufactureOct 05, 2022 (Gmt+09:00)

1 Min read -

BatteriesChina’s tighter grip on minerals boosts costs for Korean battery makers

BatteriesChina’s tighter grip on minerals boosts costs for Korean battery makersApr 12, 2022 (Gmt+09:00)

4 Min read -

War in UkraineKorea jittery over oil, gas, commodity weaponization

War in UkraineKorea jittery over oil, gas, commodity weaponizationMar 13, 2022 (Gmt+09:00)

4 Min read -

Supply chainUrea crisis lays bare South Korea’s heavy dependence on China

Supply chainUrea crisis lays bare South Korea’s heavy dependence on ChinaNov 14, 2021 (Gmt+09:00)

4 Min read

Comment 0

LOG IN