S.Korea files to revoke PCA ruling in favor of Elliott

S.Korea's justice ministry refutes the $53.6 million arbitration award to the US hedge fund, citing jurisdiction violation

By Jul 18, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea has decided to challenge an international arbitration tribunal’s decision a month ago ordering the Korean government to compensate Elliott Investment Management Corp. for a financial loss from the 2015 merger of two Samsung affiliates, Korea’s Ministry of Justice said on Tuesday.

The justice ministry said it concluded that filing a request to revoke the ruling in favor of the US activist fund is “a must,” considering that it is very rare that a government is ordered to pay damages in an investor-state dispute settlement (ISDS) case for a voting right exercised by a public agency.

If it does not correct the errors now, the Korean government could face similar "unfair" ISDS suits in the future, it argued.

“We will go all out to correct judicial errors in the adjudication of this case,” the justice ministry said in a statement.

A tribunal at the Permanent Court of Arbitration (PCA) at The Hague last month ordered the Korean government to pay Elliott $53.6 million in damages in an ISDS case over the $8 billion merger in 2015 of Cheil Industries Inc. and Samsung C&T Corp., both Samsung Group affiliates.

The tribunal’s arbitration panel accepted only 7% of what Elliott asked but also ordered Seoul to pay an accrued 5% compound interest on the compensation over the past five years and $28.9 million in legal costs to the US fund.

The Korean government estimates the amount it must pay Elliott at 130 billion won ($103 million).

Today was the last day that the Korean government could raise an issue with the arbitration tribunal's ruling.

REASONABLY ARGUABLE

The justice department filed revocation litigation with a court in England, the place of arbitration, citing a violation of jurisdiction.

The ministry said that an international tribunal is given the right to arbitrate an ISDS case when a government’s or authorities’ measures are directly involved in damages and are related to an investor’s investment.

But the NPS was one of Samsung C&T's shareholders, and its decision to approve the merger between the two Samsung companies was not aimed directly at Elliott, a peer shareholder, the justice ministry said.

The NPS held an 11.21% stake in Samsung C&T in 2015 when it approved its merger with Cheil Industries, while Elliott held 7.12% — a reason that the US activist fund viewed the state-run Korean pension fund as a casting vote.

Korea's justice ministry also noted that it is unreasonable to hold the Korean government responsible for the NPS’s decision by identifying the pension service as a “de facto state agency,” as the term does not exist in the Korea-US free trade agreement.

In regard to the Korean Supreme Court’s 2022 decision to uphold a jail sentence for Moon Hyung-pho, a former health minister, for exerting pressure on the NPS to approve the merger, Justice Minister Han Dong-hoon said the highest court’s ruling does not mean that the NPS must consider other minority shareholders when it exercises its voting right.

Elliott opposed the merger in 2015 because it viewed the terms as unfavorable to Samsung C&T and argued that it suffered huge losses from its investment in the company due to the NPS-approved merger.

An international arbitration lawyer who declined to be named said it is worth pursuing revocation litigation concerning ambiguous decisions but there is no guarantee that the Korean government would win.

In 2018, the Korean government requested an England court to revoke an arbitration award in an ISDS case that ruled in favor of Iran’s Dayyani family. In that case, England's High Court of Justice upheld the PCA ruling ordering the Korean government to pay the Iranian family a $53.2 million award in 2019.

The family had filed suit against Korea after claiming that the Korean government violated bilateral investment agreements between Korea and Iran when Entekhab, of which the Iranian family was the largest shareholder, acquired Daewoo Electronics in 2011.

Write to Jin-Seong Kim and Yong-Hoon Kwon at jskim1028@hankyung.com

Sookyung Seo edited this article.

-

Shareholder activismTribunal partially accepts Elliott’s claims over Samsung merger

Shareholder activismTribunal partially accepts Elliott’s claims over Samsung mergerJun 20, 2023 (Gmt+09:00)

2 Min read -

Elliott sells off over $1 bn shares in Hyundai Motor, two affiliates in two yrs

Elliott sells off over $1 bn shares in Hyundai Motor, two affiliates in two yrsJan 23, 2020 (Gmt+09:00)

2 Min read -

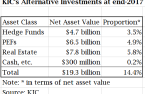

KIC may cancel $50 mn contract with Elliott over US fund’s disputes with Korean govt

KIC may cancel $50 mn contract with Elliott over US fund’s disputes with Korean govtMay 17, 2018 (Gmt+09:00)

2 Min read -

Hyundai Motor hires Goldman, top law firm to fend off Elliott’s reform call

Hyundai Motor hires Goldman, top law firm to fend off Elliott’s reform callApr 25, 2018 (Gmt+09:00)

2 Min read