Bio & Pharma

Huons sees tripling of lidocaine vial output in 3 years

The Kosdaq-listed anesthetics producer expects US lidocaine sales to jump eightfold in 5 years

By May 09, 2023 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

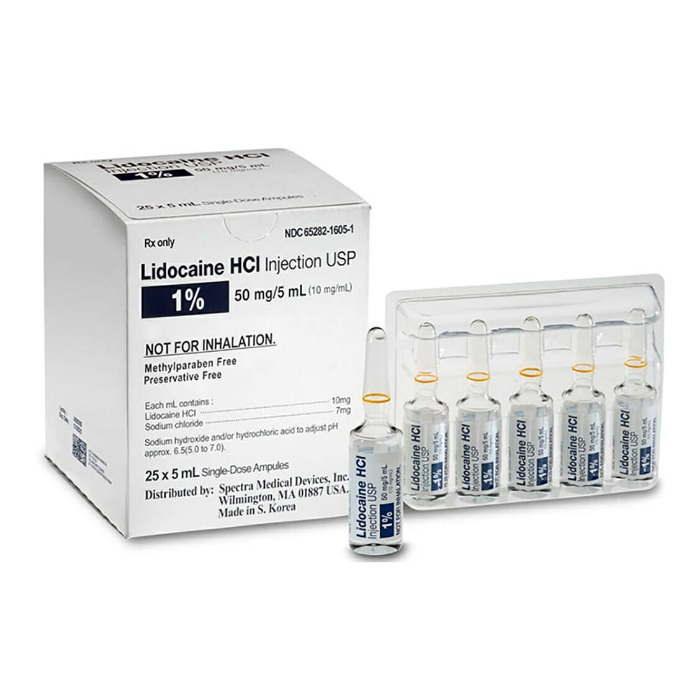

South Korea’s Huons Co., an anesthetics vial producer, aims to triple its lidocaine output from 2026, targeting the US market, where it fills the void left by multinational pharmaceutical firms, said its chief executive.

“Once our second plant under construction in Jecheon is up and running in three years' time, our output will rise to 100 million vials from the current 34 million per year,” Huons CEO Yoon Sangbae told The Korea Economic Daily on Monday.

“In five years’ time, our anesthetics sales in the US may reach 100 billion won ($76 million).”

Lidocaine is a local anesthetic commonly used in dermatology procedures and cosmetic surgery.

Jecheon is some 120 km south of Seoul in North Chungcheong Province.

Lidocaine sees steady demand in the US. But it has faced severe supply shortages in the aftermath of Hurricane Fiona, which in 2022 devastated Puerto Rico, where multinational drug companies operate plants that ship products to the US.

Moreover, Pfizer Inc., a major lidocaine producer, switched its production lines to those for COVID-19 vaccines after the pandemic struck.

In 2022, Huons’ US sales climbed to 12.3 billion won versus 7.3 billion won the previous year. This year, its US sales are expected to double to 24 billion won, Yoon said.

“US sales will lead Huons’ growth going forward,” said Yoon in an interview. “Huons’ lidocaine is the only generic sold by a Korean company in the US, aside from biosimilars.”

It also has won approval from Canada to sell lidocaine injections there.

“We are looking for an investment target in the US to source new medical technologies,” he said. “We will expand drug candidates through open innovation.”

Open innovation refers to sharing information and R&D with other companies, including competitors.

Yoon took over as CEO of Huons in March 2022. Before joining the company, he worked at GlaxoSmithKline’s Korea operations and at Boryung Corp., a leading Korean pharmaceuticals company.

DIVERSIFICATION

Beyond North America, Huons has set its eyes on China and Southeast Asia, with a focus on eye drops. It runs the bulk of eye drop production in Korea, where most eye drops are produced by contract manufacturers.

It is now in a phase 3 clinical trial of a new dry eye treatment, which it expects to win approval for as a new medication by 2025.

Huons has also been building its presence in the nutritional supplements market. It aims to win approval next year for a new therapy to improve cognitive function.

But its aggressive push into the supplements market pulled down its operating profit 10% to 40.9 billion won in 2022 from a year earlier.

Last year, Huons’ sales were up 12.7% on-year to 492.4 billion won.

Write to Ji-Hyun Lee at bluesky@hankyung.com

Yeonhee Kim edited this article

More to Read

-

Bio & PharmaDaewoong Pharma, UK firm to jointly develop autoimmune disease drug

Bio & PharmaDaewoong Pharma, UK firm to jointly develop autoimmune disease drugApr 18, 2023 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsDongwon backs out of Boryung Biopharma buyout deal

Mergers & AcquisitionsDongwon backs out of Boryung Biopharma buyout dealMar 23, 2023 (Gmt+09:00)

1 Min read -

Bio & PharmaS.Korea's Huons gets approval to supply anesthetics to Canada

Bio & PharmaS.Korea's Huons gets approval to supply anesthetics to CanadaFeb 28, 2023 (Gmt+09:00)

1 Min read -

Bio & PharmaDaewoong Pharma, Neurolive to jointly develop new antidepressant drug

Bio & PharmaDaewoong Pharma, Neurolive to jointly develop new antidepressant drugDec 28, 2022 (Gmt+09:00)

1 Min read -

Bio & PharmaS.Korean biopharmaceutical sector to see brisk M&As in H1, 2023

Bio & PharmaS.Korean biopharmaceutical sector to see brisk M&As in H1, 2023Dec 21, 2022 (Gmt+09:00)

1 Min read

Comment 0

LOG IN