LS Group' corporate value soars as EV battery market grows

LS Materials prepares for a Kosdaq listing as part of the group's efforts to boost its assets to nearly $40 billion by 2030

By Apr 11, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

LS Corp., a holding company of South Korea's LS Group, has seen its enterprise value swell by nearly 1 trillion won ($760 million) over the past year, driven by steady sales growth across the group and its rapid penetration into the electric vehicle materials and components market.

LS Corp.’s market capitalization reached 2.7 trillion won ($2 billion) by the local market’s close on Tuesday. The figure represents a 55% surge from a year earlier.

On Tuesday, shares in LS Corp. jumped 8.55% to close at 83,800 won, outperforming the benchmark Kospi's 1.42% gain to end at 2,547.86.

Since its Chairman Koo Ja-eun took the reins of the business group in January of last year, the combined market value of its units has been on an upward trend.

In 2022, the holding company posted a 19.45% increase on-year in consolidated operating profit to 561.6 billion won.

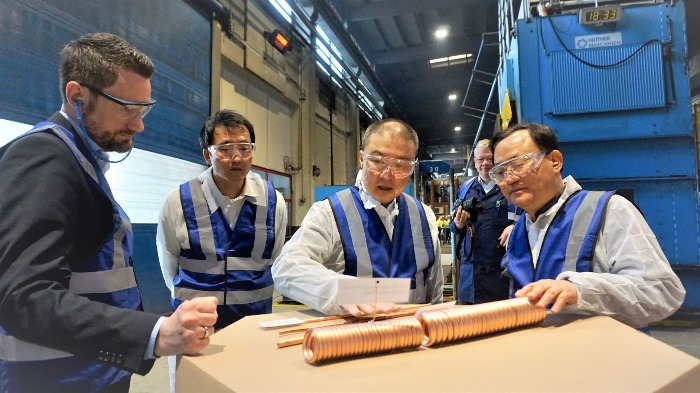

Particularly, LS MnM Inc., formerly known as LS-Nikko Copper Inc. and LS Electric Co. led the group's sales sharply higher.

LS MnM is the world’s second-largest electrolytic copper maker. LS Electric manufactures electrical equipment and automation systems.

Both companies are seen as the group’s main beneficiaries of the growing EV market.

LS e-Mobility Solutions Co., hived off from LS Electric in March 2022, produces power transmission components.

LS MnM’s subsidiary Torecom Corp. has grabbed investor attention after it broke ground on a nickel sulphate plant with an annual capacity of 5,000 tons in March of this year.

Nickel sulphate is a key mineral used to make precursors, a core ingredient in rechargeable batteries’ cathode materials.

LS Materials Ltd. under LS Cable & System Ltd. is seeking to list on the junior Kosdaq market within the year. It is a leading manufacturer of ultracapacitors, or energy storage systems.

LS Materials' corporate value is estimated between 400 billion won and 500 billion won.

LS Alsco Co., wholly owned by LS Materials, supplies refined aluminum for use in EV batteries.

It earned 8.6 billion won in operating profit on sales of 120.7 billion won in 2022.

Under the group’s Vision 2030 unveiled early this year, LS Group aims to lift its assets to 50 trillion won ($38 billion) by 2030 with a focus on materials and parts of batteries, EVs and semiconductor chips.

It was spun off from LG Group in 2003.

Write to Ik-Hwan Kim at lovepen@hankyung.com

Yeonhee Kim edited this article

-

IPOsEnergy storage devices firm LS Materials launches IPO process

IPOsEnergy storage devices firm LS Materials launches IPO processApr 03, 2023 (Gmt+09:00)

2 Min read -

BatteriesLS Group completes nickel sulfate plant for EV batteries

BatteriesLS Group completes nickel sulfate plant for EV batteriesMar 27, 2023 (Gmt+09:00)

1 Min read -

ElectronicsLS Cable wins $86 mn contract to supply submarine cables to Taiwan

ElectronicsLS Cable wins $86 mn contract to supply submarine cables to TaiwanMar 23, 2023 (Gmt+09:00)

1 Min read -

Electric vehiclesLS E-Link partners with Logen to boost EV charging

Electric vehiclesLS E-Link partners with Logen to boost EV chargingMar 21, 2023 (Gmt+09:00)

1 Min read -

-

Electric vehiclesLS Cable to inject $53.3 million to set up EV parts JV with HAI

Electric vehiclesLS Cable to inject $53.3 million to set up EV parts JV with HAIFeb 10, 2023 (Gmt+09:00)

1 Min read -

Leadership & ManagementKoo Ja-eun takes helm of Korea’s cable, machinery conglomerate LS Group

Leadership & ManagementKoo Ja-eun takes helm of Korea’s cable, machinery conglomerate LS GroupNov 26, 2021 (Gmt+09:00)

2 Min read