EcoPro taps mines in the Americas to secure cathode materials: EcoPro CEO

The Korean battery materials maker and global NCM cathode market leader eyes complete vertical integration of cathode production

By Mar 22, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

EcoPro Group, South Korea’s leading battery materials producer, is mulling investments in mines in the Americas to source cathode materials, a move that will complete the vertical integration of the company’s cathode production process, the company chief said.

“We will expedite the vertical integration of our cathode production with investments in overseas mines,” EcoPro Co.’s Chief Executive Officer Song Ho-jun said in an interview with The Korea Economic Daily last week.

“We are considering either a direct investment in a mine or partnership ... We are tapping (ones in) North America or South America.”

The company will seek approval from shareholders during a general meeting on March 30 for a change in its articles to add mineral resource exploration, extraction and development as a new business, which is expected to pave the way for the company’s mine investment.

The vertical integration is a must for EcoPro, the top global nickel-cobalt-manganese (NCM) cathode supplier, to further widen the gap with its rivals, said Song. With the mines, EcoPro would be the world’s sole secondary battery materials maker with full control of the cathode materials value chain.

Its Chinese peers have an advantage because they already own mines. But EcoPro is confident that it can benefit from its investment in the mines, said Song.

The investment will give EcoPro more control over raw materials.

The company in November last year agreed with SK On Co. and China’s cathode precursor manufacturer GEM to produce 30,000 tons of nickel and cobalt hydroxide (MHP) from their three-way joint factory in Indonesia, the world’s largest nickel-producing country, next year.

MHP is a key material for nickel sulfate, used in producing precursors, and its demand is set to rise as it is more stable and costs less than other intermediate materials.

A precursor is a material made from a mixture of nickel, cobalt and manganese, and is added to lithium to make cathode, the positive end of a lithium-ion battery.

BATTERY RECYCLING, ANOTHER PILLAR

“EcoPro is the only company in the world that controls the entire cathode production cycle, encompassing cathode production (EcoPro BM Co.), precursor production (EcoPro Materials Co.), waste battery recycling (EcoPro CnG) and lithium compounds production (EcoPro Innovation),” said Song.

EcoPro’s battery recycling is considered another key to the company’s vertical integration while demand for battery recycling is growing in line with a surge in mineral prices.

Battery recycling can help cut production costs nearly by half, said Song, adding that it would be a win-win for EcoPro and its client if it gives a big discount to the client that purchases cathodes from EcoPro after returning its waste batteries for free.

EcoPro produces precursors with recycled waste batteries, using metals recovered from waste batteries or scrap batteries. Demand for such recovered metals is expected to rise as many countries around the world are tightening regulations on key raw materials required for the energy transition.

The EU recently unveiled the Critical Raw Materials Act (CRMA) that aims to ensure the bloc’s access to critical minerals necessary to meet its target of moving to net zero greenhouse gas emissions by 2050 with its reduced reliance on China’s supplies.

“Our clients are demanding for us to boost battery recycling, and we are fully ready for it,” said Song.

EcoPro BM's overseas plants to be built in Hungary and Canada will also be able to cover the entire cathode production cycle, including battery recycling, like at its main factory in Pohang, Korea, added the chief.

EcoPro is expected to announce a detailed plan for the second factory in Europe later this year, and the new factory is expected to be built in another European country, not Hungary, Song said.

DIVERSIFICATION

The leading NCM cathode maker will develop new battery materials to meet growing demand for lithium-iron-phosphate (LFP) batteries and high-manganese batteries, Song said.

Chinese battery makers are leading the global LFP battery market. Because it is cheaper and uses more environmentally friendly technology, its demand is increasing -- and why EcoPro is eyeing a jump into the LFP cathode market, Song said.

The Korean battery material supplier will also diversify its client base, which is currently centered around SK On and Samsung SDI Co.

Song hinted that it may win an order for batteries to be churned out from the Samsung SDI-GM joint factory in the US. EcoPro is also seeking to win orders from LG Energy Solution Ltd, he added.

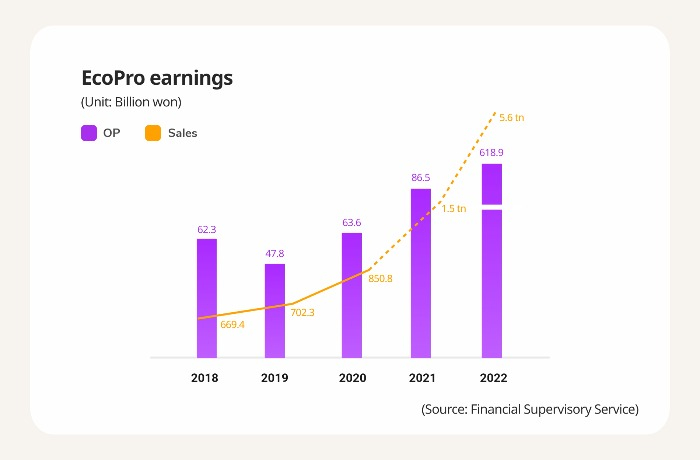

After its sales jumped nearly five times on-year to 5.4 trillion won ($4.1 billion) last year, EcoPro’s cathode sales are expected to rise more this year to help the company’s earnings for this year remain upbeat, Song said.

Cheering the company’s stellar earnings last year, investors have gobbled up the EcoPro trio’s shares, lifting EcoPro shares more than 300% this year.

Kosdaq-listed EcoPro, EcoPro BM and EcoPro HN Co. shares on Wednesday closed up 7.8% at 453,000 won, 4.4% at 213,500 won and 0.7% at 70,300 won, respectively.

The company is preparing to list EcoPro Materials in the Korean market later this year.

Write to Seo-Woo Jang at suwu@hankyung.com

Sookyung Seo edited this article.

-

BatteriesS.Korea's EcoPro boosts raw material plant for cathode materials

BatteriesS.Korea's EcoPro boosts raw material plant for cathode materialsFeb 15, 2023 (Gmt+09:00)

1 Min read -

BatteriesEcoPro Group nearly doubles sales target to $7.8 billion this year

BatteriesEcoPro Group nearly doubles sales target to $7.8 billion this yearJan 05, 2023 (Gmt+09:00)

2 Min read -

BatteriesSK On, EcoPro, China’s GEM to build battery materials plant in Indonesia

BatteriesSK On, EcoPro, China’s GEM to build battery materials plant in IndonesiaNov 25, 2022 (Gmt+09:00)

1 Min read -

-

Korean stock marketEV materials maker EcoPro tops the buy list of Korean stocks

Korean stock marketEV materials maker EcoPro tops the buy list of Korean stocksSep 14, 2022 (Gmt+09:00)

2 Min read